The Fall of Community Banks - The Fall of Financial Freedom and the Loss of Accountability

Community banks were the cornerstone of every city and town in America. After the 1980s, with the advent of the item called banking de-regulation, gradually the community bank died. Gone are the days of seeing the person, driving past the brick and mortar location of the financial institution who holds the mortgage of your home or your business.

The lack of community banks is a grave concern for Americans. However, it is also appearing as a financial crisis for a community known overseas as Greece. For you see, Germany holds the majority of the debt of Greek people.

What can we learn about community banks? Listen to a top financial expert state that regulations are lacking. For the next generation we must put in place regulations that are actively managed. Directors must understand what they are doing. A stronger measure of financial management is needed not just here in America but world wide.

Recognizing the protection of community banks is a pivotal management tool for government is needed now.

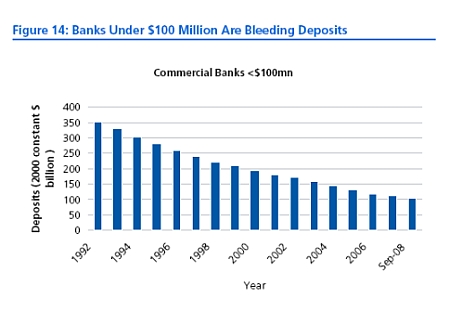

Demise of the Community Bank 1992-2008

Community Bank Assets Failing Dramatically

As the graph to the right so clearly depicts, the assets of the community banks have dropped off dramatically.

The amount of assets of a financial institution runs parallel to lending power. If assets are not on hand, loans cannot be made.

What this chart really shows is the shift of money from local control to regional or in some cases national control.

This shift that occurred in the United States is now being felt overseas by our friends in Greece. Their debt is held by Germany.

Sad Truth About Mortgage Debt

The sad truth about mortgage debt is the holders of this paper barely know the location. Yes, they can look up the location. When I ran the pension fund that invested in mortgage back securities, it was not uncommon for the trade ticket to hit my desk with no information about the security that I had just purchased other than the dollars and cents.

But you see, mortgages are more than dollars and cents and rates of return, they are also about location.

Buying a mortgage that resides in Illinois, Wisconsin or the Midwest is completely different from anticipating a return on investment from a loan that originated in California or Arizona or Florida.

Sad Truth About Land Owners

The other sad truth is the large parcels of land that once were owned locally are now owned by "outsiders". For many communities in Illinois, the owners of land reside in the suburbs of Chicago not in their community.

It doesn't end in Illinois, however, if you were to pull the land owners of the major hotels in the top cities of the United States, the real sad story is the owners of the premier commercial properties are most likely foreign residing beyond the borders of the United States.

This land ownership crisis has not been mentioned and not detailed in the media.

Disclosure of Ownership Needed to the American People

I have felt for decades that the large urban cities have a duty to report to the American citizens who owns their top assets. Who owns the shopping centers - who owns the hotels? The truth will shock you.

Banking Exec Rothschild Shares His Views of the Banking Industry

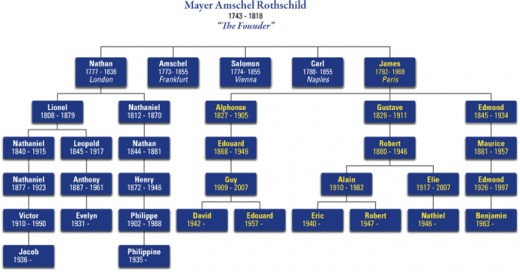

Rothschild Family Tree

Rothschild Family Tree

Sir de Rothschild is more than a banking executive, he is the great grandson of the largest banking family in the world. His pedigree is detailed in the family tree above.

Sir de Rothschild Speaks About the Global Markets

CNBC Exclusive with Sir Evelyn De Rothschild, a British Banking Giant, - what is right and what is wrong with our financial systems. A group of 20 meeting was pivotal because it showcases we are all in this together.

Many people worry that capitalism is being threatened. Is this something Sir De Rothschild is concern about? Sir Rothschild details that regulations are needed for the banking industry to be supervised.

Rothschild is amazed that the United States has not put more supervision in financial systems.

What is important, we must move ahead for the future for the next generation and for the next generation. We must make sure that directors are well versed....Directors must understand what they are doing.

In 2007, he took the view that this is going to go wrong.

He feels sorry for what will happen to the pensioners. We must face up to the fact that many families have lost all of their savings.

What signs save your own personal money? What red flags do you look for? Look for very sound investment. Look for companies that have not done this "stupidity". Go back to the basics. Obviously the market will determine whether it will go up or down.

Economic fundamentals around the world are diversely affected. Problems with the work force, in the UK, unfortunately, unemployment is a high concern. It will have to be major to encourage people to reinvest. It is the backbone of the small businesses that make up the economy.

What about the unions? Rothschild details that he could not judge upon the United States. He goes on to state that.....Margarate.. Thatcher....

Rothschild Famous Quote on Banking

"Capitalism depends upon the stability of the banking industry."

- One Penny Sheet.com

Bailouts and bonuses have many Americans frustrated with big banks. Some consumers think these giant institutions have lost touch with customers and basic good business practices. They're so fed up that they're holding these behemoths accountable by

Where are the Antitrust Laws for Banks

The demise of the community bank showcases the lack of antitrust laws for banks. The lack of community banks means the lack of competition. This oligopoly of the financial institutions is what we the American people and citizens of the world must stand up and speak out about to our neighbors, to our representatives to our children.

Understanding economics and finance is mandatory for an educated decision.

Great Quote on Competition

"Diversity in commerce is called competition."

American Choices

Share Your Thoughts on Community Banks

Is the demise of the community banks also the demise of accountability and stability?

Each Country Has Different Circumstances

The only item I take exception with in this video is each country has different circumstances. The root of the demise of the financial foundation for the world is the "arms length" banking. From the crisis in Greece (Germany holding the debt) to American (China holding the debt). Communities know the valuation and the locals cannot be oversold. Communities can take care of themselves and manage the community debt best.

Community banks were protected and encouraged prior to the banking de-regulations of the 1980s here in America.

The combination of the European nations together into one currency sounded good but has now brought about a concern with the debt that Greece is carrying.

Diversity is a great thing and must be protected in order to protect our freedoms. The power of diversity is not just race, skin color, it also extends to commerce. Diversity in commerce is called competition.

On a global basis, across all continents of the world, I contend the demise of the community bank is the demise of accountability.

© 2012 Ken Kline