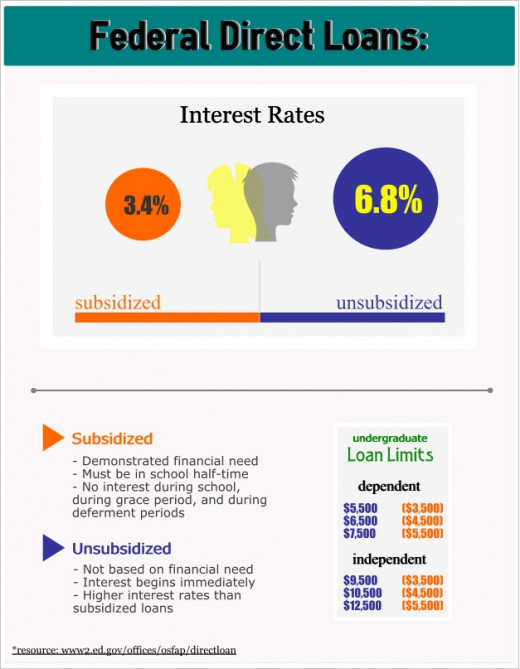

Federal Student Loans: Subsidized and Unsubsidized Direct Loans

Federal direct loans are offered through the United States Department of Education to eligible American students to cover the cost of public and private universities. Depending on financial aid qualifications, students and their parents may be eligible for loans with deferred interest accumulation and repayment plans. The different options – subsidized and unsubsidized student loans – have different associated costs, so it is important to discuss the financial implications with a financial aid adviser at the college of your choice.

To apply for federal direct loans, students will need to submit an application for financial aid with the government and the college(s) of their choice. An award package will be offered to the student with details on financial assistance, including grants, scholarships, and loan qualification amounts. Remember that student loans are financial obligations and must be repaid. The cost of these loans will vary depending on interest rates, loan amounts, and length of time until the loans are paid off. This article will provide information on the differences between subsidized and unsubsidized student loans which may lead to smarter financial decisions in the future.

Subsidized Loans

With subsidized student loans, interest on the loans does not begin accumulating until a student has graduated from college. During this time, the loans are in deferment and repayment will begin after graduation. There are a few benefits to the subsidized loan option for U.S. college students:

- Save money on interest – because the loans are not accumulating interest, any payments made to them before graduation will reduce the amount of interest charged after repayment begins.

- Avoid immediate fees – interest charges begin after disbursement of the loan with unsubsidized options.

Financial Aid Resources

- Home | Federal Student Aid

Get ready for college or career school, learn about federal student aid and how to apply using the FAFSA, and get information on repaying student loans. - Direct Loan Page for Students

This page provides information for college students about the U.S. Department of Education's Direct Loan Program.

Unsubsidized Loans

The loan approval amounts are usually lower for subsidized options so many students rely on unsubsidized loans to make up the difference in rising tuition costs and living expenses. Unsubsidized loans will start accumulating interest when they are disbursed to the school’s financial aid department or the student. While they may ultimately cost more, there are some steps you can take to reduce their financial burden:

- Reduce interest expenses – payments can be made to accruing interest while students are in school; this can reduce interest charges during the length of the outstanding balance.

- Decrease total loan cost – because these loans start charging interest immediately, any payments made to it will reduce the entire loan cost.

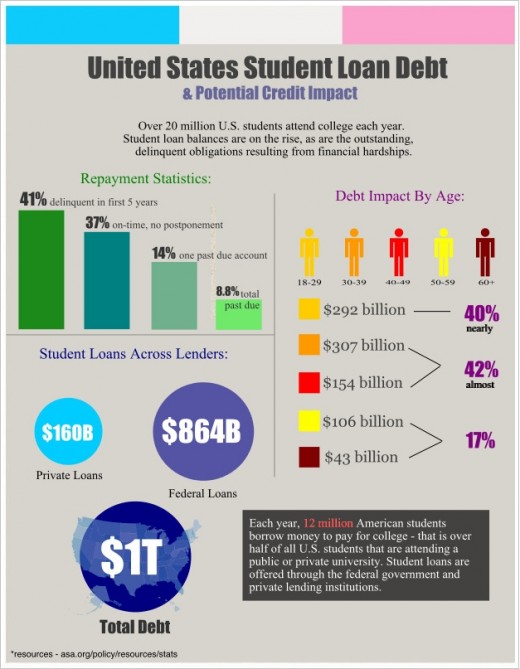

Responsible student loan management is an important consideration for future financial decisions. Missed payments or default can negatively impact a person’s credit report and credit score, which are necessary for lower interest rates or insurance premiums. Better credit puts people in a position to qualify for mortgages or small business financing.