Credit Cards, Debit Cards, and Money

There are differences between these different forms of payment. You might want to think of your credit cards as a part of your stock of money because you use them to make purchases. This kind of makes them a means of exchange. Money is, in fact, a medium of exchange—an item buyers give to sellers when they want to purchase goods or services. So, aren’t credit cards a medium of exchange?

Credit cards aren’t considered the same as money because they aren’t truly a method of payment, but a method of deferring payment. If you use your credit card to pay for something, the bank that issued the card actually makes the payment for that charge. In turn, you pay the bank. So, when you buy a meal using a credit card, the bank pays the restaurant, not you. Later you pay the bank back by paying your credit card bill. Chances are that you will pay the bank for the cost you charged, plus interest.

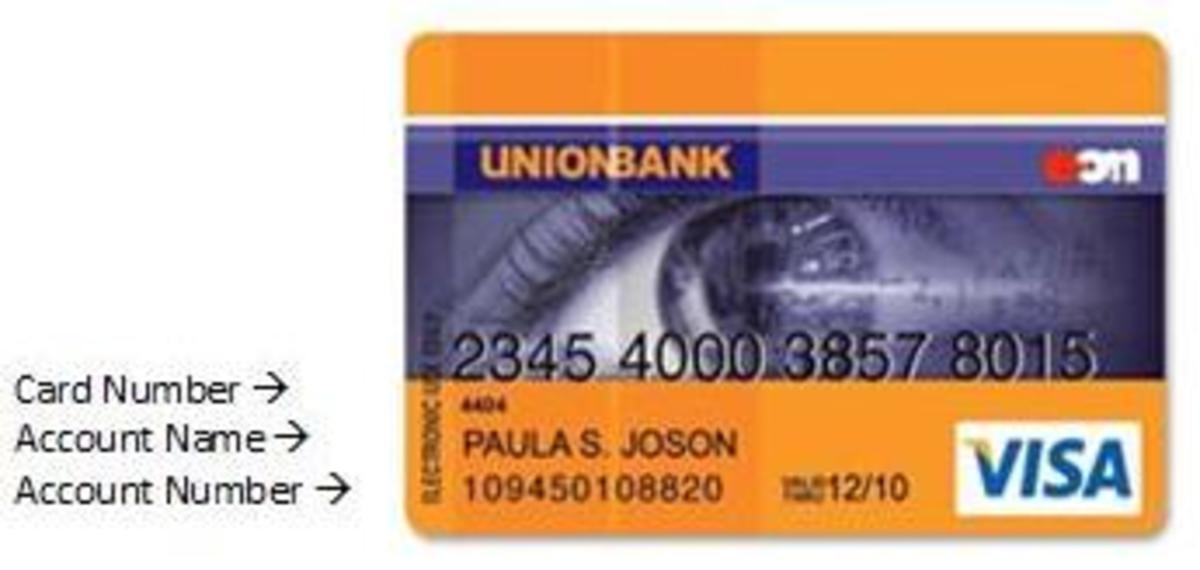

Debit cards are different from credit cards because funds are automatically withdrawn from your bank account when you use a debit card. Rather than postponing payment for a purchase, a debit card lets the user automatically access deposits in a bank account. A debit card is actually more like a check than a credit card.

When you use good old cash, you cut all of the middle men out. You are simply exchanging money for your purchase, and this money will go on to be exchanged elsewhere or deposited into a bank.

Are Credit Cards Worth Using?

Credit cards are not considered a form of money, but they are worthwhile—as long as you don’t abuse them and go into debt. People can use credit cards to pay many of their bills all at once at the end of the month, instead of paying sporadically as you make purchases. This makes balancing your budget a bit easier. For example, we primarily use our credit cards for all of our purchases, from groceries to coffee to the electric bill. At the end of the month, we only have to pay the credit card bill, so there aren’t a ton of transactions going on in our bank account. We still have to track all of our purchases and spending, but as long as we stay within our budget there aren’t any problems. This is especially useful when we spend a bit more during the first half of the month than we do during the end of the month because we don’t have to wait until the next payday to have money in our account.

The key to making credit cards work for you is to pay them off every month. When you don’t, you end up paying interest, which means you end up spending more money on your purchases than they are worth.