Credit Debt Management - Understanding Your Free Credit Report

A credit report is a detailed financial record of all dealings with credit bureau member credit lenders over the last six or more years.

Consumers have the habit of wanting things immediately, before being able to pay for them. This want has created significant credit issues, a credit reporting niche, and the vital need to pay attention to one's credit report in order to stay on top of one's credit scores, credit ratings, private information and money matters. Though reviewing a credit report may seem daunting and even frightening, what with all its numbers and financial lingo, at its simplest level, it really is just an accounting by lenders of your credit activity and financial responsibilities. Understanding Your Free Credit Report is a smart start to taking care of your financial affairs and setting yourself on track to good credit rating.

At the end of this article, hopefully the tangle of perplexing data within your credit report will have been clarified, and you'll have grasped the basics of credit reporting to enable you to confidently move forward to Correct and Repair Your Credit Report Yourself.

What is credit?

For this discussion, I've created a mini list of credit terms here, that you'll need to understand when talking about credit and credit reporting.

Now, your could say that credit is the one-time revolving or installment payments that you owe to a lender who gave you funds to immediately purchase something or for your use personally.

Credit can be SECURED against an asset you own (such as a house) as security, which is usually considered to be low risk credit, or credit can be UNSECURED based on your good credit history (credit cards are usually unsecured credit), usually considered as high risk credit, because there is no asset (such as a house) which can be sold, lien-ed or repossessed to retrieve the creditors funds should you default (not pay) on the loan.

So, in return for providing you with a loan, creditors usually demand interests and other charges on top of the principal (original) amount you borrowed. Creditors call these interests and charges the cost of lending or the cost of extending you credit to cover their risks, but really it's just profit.

Credit can be defined as something of value (ie a loan) that you receive now from a lender without having made immediate payment for it, and for which you agree to repay with conditions (terms, interest, charges, etc.) to the lender at a later time.

Who are creditors?

Creditors (also called lenders), are the individual and or companies to whom you apply for credit, insurance, etc, and who are also the customers of the credit reporting agencies. Creditors pay credit reporting agencies a membership fee to access your credit report.

Creditors assess your loan application, and calculate whether you deserve credit and whether they should extend credit to you (ie approve or deny a loan) based on what they find in your credit report and any other information that you provide them.

On a monthly basis, creditors convey information to the credit reporting agency about your loan applications, payment arrangements, payment patterns in R# or I#-ratings, any defaults on a loan, and any changes to your loan and personal information that they've collected. Every time you make an application for credit or even if credit is declined to you, it is reported monthly to the credit reporting agencies by the creditor.

What Is A Credit Reporting Agency?

Credit reports are owned and maintained by credit reporting agencies (also called credit bureaus and consumer reporting agencies (CRAs)).

Credit reporting agencies are private organizations that collect, keep and continuously update your personal information and financial dealings in their database. They then sell access to your information (compiled into your credit report) to their paying members: lenders, insurers, employers, rental managers, banks, store creditors and so on. In theory, anyone who is considering giving you credit or seeks information about you relating to a credit application, residential rental, employment application, insurance application, debt collection can become a member of the credit bureaus and obtain personal and financial information about you.

Canada’s two major credit reporting agencies are Equifax and TransUnion, but there is also a third credit reporting agency called Experian. Keep in mind, that credit bureaus are NOT controlled by the government, thereby allowing them to do as they wish with the information that they gather about you. Furthermore, as they align themselves with their members (your creditors) first, any requests that you make to them for changes to your credit report will not outweigh those of their members without solid, conclusive proof of being right on your part.

- Consumer Reporting Act

This Ontario Canada Act sets out the type of information a credit reporting agency can store, who can view the report, and the right to correct inaccurate information in it.

As of January 1, 2008, if a consumer believes he/she is at risk of fraud and asks the credit reporting agency to place a warning/alert on his/her report pertaining to this risk, the credit reporting agency must do so.

What is Credit Reporting

Credit reporting allows creditors to know how you've handled debt in the past with other lenders, and your possible repayment conduct should they loan you funds. Using the credit reporting agencies, creditors access your information from the two major agencies and update monthly their dealing with you.

It's important to know that under the Consumer Reporting Act, R.S.O. 1990, CHAPTER C.33, when dealing with credit reporting agencies, the consumer is entitled to:

- expect credit reporting agencies to act responsibly collecting and storing information

- know what information is in the credit report

- have disputed information investigated by the credit bureaus

- have damaging credit/loan information removed after 7 years

- know who has viewed the credit report in the last 12 months

- have disputed, unverified information removed immediately

- have a warning/alert added to the credit report for identity theft risk

- have a short, written statement included as part of the credit report

- receive a free copy of the credit report when requested in writing

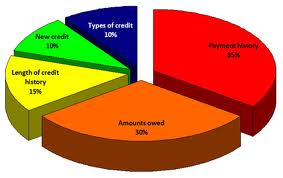

What Is Credit Rating

Your credit rating details your borrowing and repayment habits and activity on a monthly basis (creditors reports your payments to the credit bureau on a monthly basis.)

Credit Report "R" Ratings

Credit bureaus have an R or I letters and number rating:

R0 - Approved but too new to rate

R1 -Paid in 30 days - as agreed

R2 -Paid past 30 days, under 60

R3 -Paid past 60 days, under 90

R4 -Paid past 90 days, under 120

R5 -Overdue 120 days or more

R6 -Undetermined

R7 -Payment arrangement

R8 -Repossession

R9 -In collection- bad debt

Good credit rating can mean the difference between a low interest rate and a high rate of interest with poor credit. It can also make the difference to getting a loan, being hired or even getting into housing rental.

Credit reporting agencies' rate loan repayment activity using letters and numbers. The letter "R" refers to revolving credit (continuous open end term credit) such as credit cards. The letter "I" means the loan is an installment loan (fixed term with regular payment) such as a car loan. The R or I is followed by a number from 1-9 . The best rating is of course an R1 rating.

What Is A Credit Report?

Your credit report is your credit /loan history trail over the last six years (or more years dependent upon the province in which you live) recorded in files

which are part of a database in a credit reporting agency. These database files are also called credit files, a credit profile, a consumer disclosure, consumer report, a credit file disclosure, or a credit report. Your credit report reveals detailed information about you and your personal finances such as your:

- any overdue loan payments

- your credit card limits

- how many credit cards you have

- the balance on credit cards

- how much credit you have with lenders

- any actions taken against you (court judgments), and more.

- present and prior addresses

- marital status

- your bank accounts

- any declined loans

- how old your loans

- type of loans you have

- how many loans you have

3 Important Sections In Your Credit Report You Should Pay Attention To

Taking a look at your credit report shows you that it's divided into several sections. While all areas of your credit report should be looked at carefully for accuracy, there are three (3) sections in your credit report that you may want to go over with a fine tooth comb and pay particular attention to the information found there. These sections are the -Personal Identification- , the -Credit Account History-, and the -Credit Inquiries On File- sections.

1 - The -Personal Identification- section lists all the personal information the credit bureau has on you and your spouse in their database. This includes your full name, any aliases you may have, your previous and current address(es), past and current phone number(s), date of birth, marital status, your driver’s licence, SIN, health card number, past and present job and related work information, your spouse’s full name, any information on your spouse, the date a credit report was first opened about you, the dates the files were updated by creditors/credit reporting agency, and any comments about the loan by the creditor.

Pay attention to this section to watch for identity theft or any superfluous information being collected by the credit reporting agencies. The credit reporting agencies want to get as much information as possible on you and your spouse to easily be able to track you (should you default), but there is no need for them to have an overly amount of information to "identify" you. There may be cause for you to request that they remove some of that excess information. As well, past and present addresses that do not match up to places where you've lived before or having a different spouse listed may signal identity theft and incorrect information about you.

2- The -Credit Account History- section reveals details about each creditor who has given you credit, and the status of the loans that you have with them.

The account history information includes the dates your loans began, the loan account number, whether it is a joint loan with someone else, if the account is open or has been closed, the balance owing on the loan, your payment habits (paying on time or paying late) listed as an "R" or "I" followed by a number (ie. R0 to R9), a credit limit if any, collection or bankruptcy activity, the date the creditor last reported an update to the credit reporting agency, and the last date of activity you had with the creditor.

You want to pay special attention to this section, because any errors or omissions here will greatly affect your credit score and credit rating. Plus this information is what you will most of the time request the credit reporting agencies correct and update.

If all or most of the list of creditors have rated your loan repayments as R1, your credit is in very good standing. When you have R3s to R9s, you will need to do something to improve your credit report rating.

3 - The -Credit Inquiries- section of your credit report lists all the new and existing creditors, insurers and collection agencies who have requested and received a copy of your file from the credit bureau.

Pay attention to the amount of requests, which creditors or collection agencies made the requests, and the dates they asked for your file. For example, too many requests by you for credit (shown by the amount of creditors looking at your credit report) may negatively impact your credit rating. On the other hand, if you did not contact these creditors asking for credit, it may be a sign of identity theft. You may want to also make sure that the creditors asking for your file have gotten written permission from you to access your credit report: a legal requirement some creditors like to overlook.

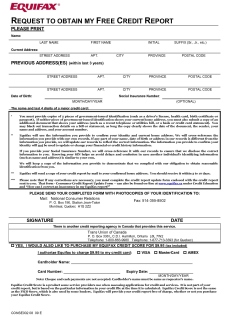

Requesting Your Free Credit Report

In Canada, so that you can know what is in your credit report, you are legally entitled to receive a free credit report by mail or in person from each of the credit reporting agencies, but only when you request it. The free report does not include your credit score (FICO), just the basic credit report (credit activity occurring with your loans).

All of the credit bureaus offer, for a fee, immediate, online access to your credit report with extra services included such as your credit score and or credit monitoring. Unless you need instant access (free by mail takes about 7-21 days) for identity theft, or an unexpected lien or some such purpose, consider waiting for the mailed report or go there in person.

It's a good idea to request your free credit report yearly to monitor your credit, check that the information in your credit report portrays your credit history correctly, and to protect yourself from possible identity theft. By the way, you can also make the request by telephone and have your credit report mailed to you.

To request your credit report from Equifax Canada, they require that you fill out their REQUEST TO OBTAIN MY FREE CREDIT REPORT form found on their website, and send it along with a copy of 2 pieces of government-issued identification (health card, driver's license, passport or birth certificate) or other household statements (telephone bill, utility bill, credit statement, or bank statement) that has your current home address.

To request your free credit report from TransUnion Canada, you'll have to fill out their CONSUMER REQUEST form and include copies of both sides of two pieces government-issued/ utility/ or bank identification containing your name, current address, signature and date of birth.

Once TransUnion and Equifax receives your information, they will use the information you supplied them to update your SIN and identity information, confirm your home address and will then send you your free report.

Once you've received and reviewed your credit report, you'll see that understanding your credit report and checking it yearly is a necessity. Creditors make mistakes often on your credit report which could lower your credit rating, and credit bureaus often fail to remove old trade lines. Knowing what is on your credit report before you apply for any loans or credit cards can safeguard against unpleasant surprises. Furthermore credit reporting agencies are not going to check to see if the information found there is correct. Therefore the burden of having an error-free credit report rests with you.

If your credit rating is not very good, remember that over time (6 or more years: each province dictates the exact number of years), all negative information is removed from your credit report leaving you ample chances to improve your future credit rating with good financial behaviour. During the time that your credit rating is poor, take the steps and time necessary to correct errors and keep it updated. If your credit rating is good or even excellent, keep it that way by staying vigilant about the credit activity passing through it yearly.

___________________________________

callmefoxxy.com, my pen is a mighty sword!

Like this article?

Then you may also like:

Collection Agency Debt Collection - Know Your Rights To Stop The Harassment by callmefoxxy

Is a collection agency hounding you for a debt? Realize that at some point, everyone incurs debt. In this article, you'll find out what you need to know about your rights when dealing with a collection agency, and how to stop them from...

Collection Agency Debt Sample Letters To Send To Collection Agents by callmefoxxy

Want to send a letter to a collection agency to tell them to stop harassing you, but don’t know what to write? In this article, you'll find some sample letters that you can use as...

I enjoy getting feedback and comments, so please let me know if you liked this article by:

- Clicking the useful/ funny/ awesome/ beautiful buttons below

- "Vote it up" below by clicking on the olive green button

- Share it with friends on Facebook, Twitter, Google etc.

Thanks for your feedback...