Credit Report Repairing: What a Credit (FICO) Score Is & Factors That Determine It

Understanding Your FICO Score

When I was a mortgage consultant, I got a first-hand lesson in credit report repairing because many of my clients didn’t qualify for conventional home loans. They only qualified for subprime mortgages.

If you want to raise your FICO score, one of the first things you need to do before undergoing the credit report repairing process to do it is to learn how credit scoring works. Here, I will explain exactly what a credit score is, so that you will know what to look for when you start to fix bad credit items that show up on your credit report.

Credit Report Repairing: FICO Score Explained

Many consumers who want to fix their credit start with the elementary question, “What is a FICO score?” It’s an understandable question to ask, especially if you’ve never been taught how to handle money effectively.

The credit score that lenders use is called a FICO score. This score helps those you want to borrow money from determine whether you are credit worthy or not. It also helps them decide what interest rate you’ll pay for any loans you get. You see, your FICO score is very important; for it tells lenders how likely you are to pay a loan back.

Credit Report Repairing: The Highs and Lows of a Credit Score

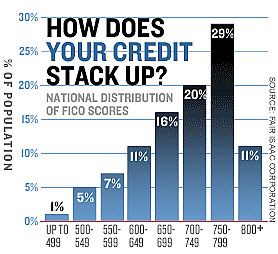

FICO scores range from a low of 300 or 400 to a high of 800 or 900, depending on which source you consult. The higher your credit score is, the lower your rate will be on any money you borrow/loans you take out (eg, car loans, home loans, department store credit cards, etc.).

Conversely, the lower your credit score is, the higher your interest rate will be on any loans you take out.

Credit Report Repairing: Why It Pays to Fix Bad Credit

As the discussion on interest rates above spell out, bad credit costs – a lot. Just how much can having bad credit cost you in money over time?

Consider this: A credit score of 720-750 is needed nowadays to prime home loan (mortgage) at conventional rates. Before the foreclosure crisis of 2007 hit, all your FICO score needed to be to qualify for this type of home loan was a mere 620.

As a side note, see how much impact the foreclosure crisis has had on how lenders look at your credit score?

Consumers with lower FICO scores are charged a higher interest rate, or denied a home loan altogether.

Falling below the 720-750 cut-off point can costs home loan applicants thousands more over time For example, over the life of a 30-year, $150,000 mortgage for example, a borrower paying a sub-prime rate of 9.84%, instead of a prime rate of 6.56% (at the time of this writing), would pay a whopping $317,517 in interest. This compared to $193,450 for someone with good credit who qualifies for a prime home loan. That’s a difference of $124,067 in interest payments over the life of the loan.

As these numbers clearly illustrate, it literally pays to repair bad credit.

Credit Repair Tips: Factors that Impact Your FICO Score

There are several factors that go into determining your FICO store. Following are four of the most important. Realize that there are several more.

On-Time Payments: This is the number one thing you can do to raise your FICO score - make your payments on time. Late payments signal instability, carelessness and immaturity with your money to lenders. Hence, they look at you as a higher credit risk.

So, if you don’t do anything else, remember to always, always, always make your payments on time. Not one day late; pay on time.

Length of Credit History: The longer you have open credit accounts, the higher your FICO score (if you've paid on time and if the accounts are of a certain kind).

Type of Credit Lines: Certain types of credit can actually work against you.

Credit Available to You: Having too much credit available to you - even if you don't use it - can lower your score. Why? Because it’s there for you to use IF you want to use it. Hence, there’s a chance for you to over extend yourself.

Note: It's tidbits like this that most don't know when trying to repair their credit that can have you going about it the wrong way.

Repair Your Credit and Have the Life You Deserve

Learn everything you need to know about how to how to repair your credit and get the free report, 6 Credit Repair Myths and 6 Specific Ways to Raise Your Credit Score at Repair-Credit-Easily.INFO.