Do It Yourself Credit Repair

Maybe you find yourself pursuing a home loan or a new car? What will you do if your credit doesn't meet the requirements . There is no need to hire a professional. Do it yourself credit repair is an option. Life is full of challenges and obstacles and a healthy credit profile is one of them. Throughout life our need for credit, loans and mortgages only seems to increase.

What do you do if you have no credit history? What can you do if you defaulted on a small loan or even a small credit card? Will you be able to bounce back? Yes you can repair or build your credit. There are no expensive courses to take and no need to hire a professional to help you. Good credit is one of the most important things we can have as an adult. Good income alone will not get you a home loan or into a new car. A good credit history and score are a must.

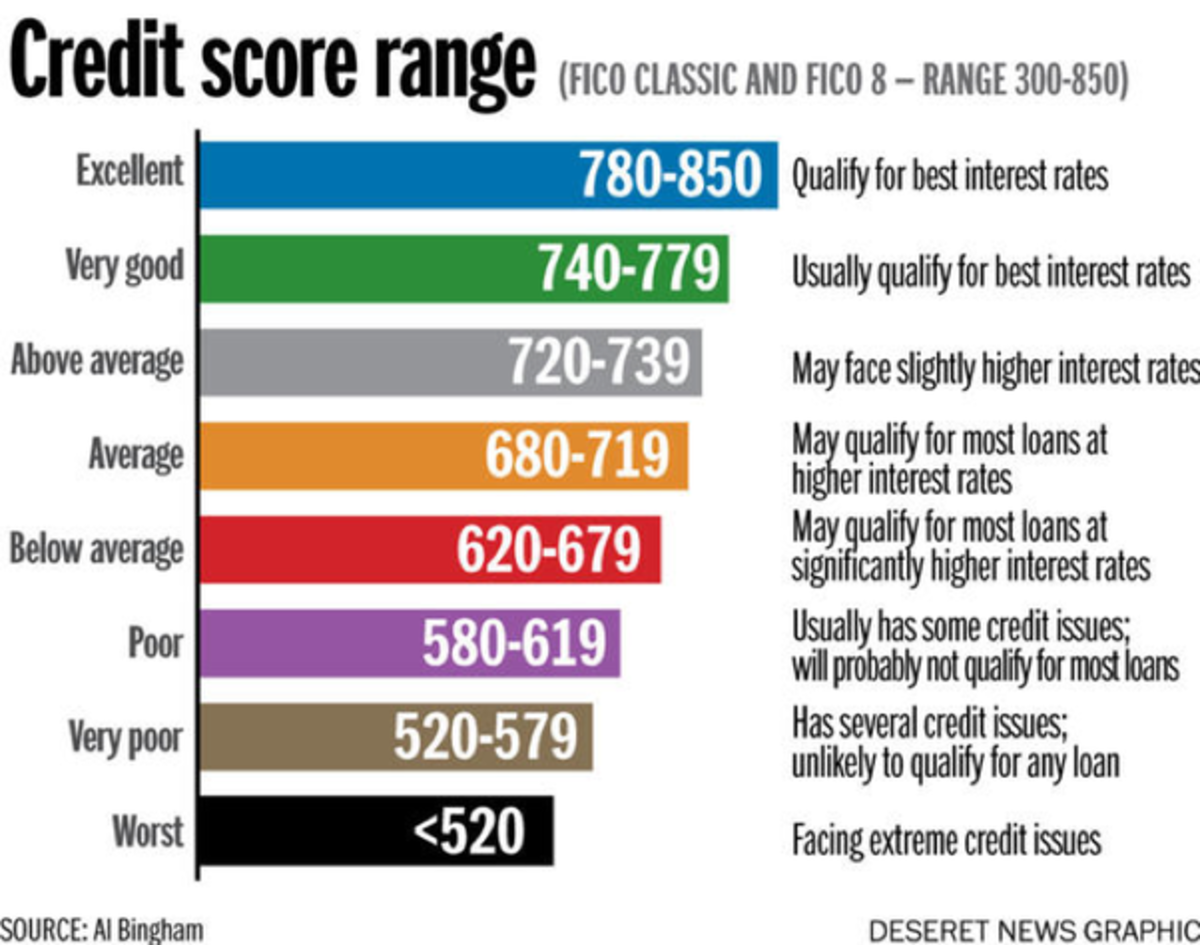

Credit

I consider my credit

Debt Repair Specialists

I can't imagine anyone not having at least heard of or seen an ad for a debt repair specialist these days. Just in case you somehow missed out let me explain what a debt repair specialist does:

- Negotiate with your creditors

- Pays your debts with your money

- Charges nominal fees for the service

Seems so simple, while they will charge you monthly for the services you can do all these things yourself. Along with the fee you will me making monthly payments to them that they accumulate until they have the balance for any given debt. Meanwhile you still get dinged with late payments on your credit reports. The only reason to you should consider using this type of service to repair your credit is if you:

- Money to waste on their fees.

- No free time to dedicate to working on your credit yourself.

It is possible to repair your credit by yourself. Sure, you could pay someone to do it but why? If you landed here, you are likely already in debt or with a limited credit profile. Why waste hundreds if not thousands on a service that does something that you can do yourself?

Monthly fees paid to a debt repair specialist can used for paying down your debts yourself. Some of the monthly fees can be hundreds of dollars a month, and that could amount could easily help you pay your debts faster.

The Starting Point

If you are still with me here, you are probably hoping I get to the point. While repairing your credit sounds complicated, long run if you have determination it won't be. But where do you start, and what are the steps?

You need to do a few things before you even begin to negotiate debts or consider paying anything.

- Print a copy of credit reports

- Using credit reports order debts from newest to oldest starting with the lowest dollar amount first

- ·Create a monthly budget including current debts

Once you have printed a copy of your credit reports from all three major credit bureaus you need to sort the debts. Sort the debts as follows:

- ·Newest and current debts first

- ·Smallest deficiency balance to largest

You maybe wondering why you would sort the newest debts to the top of your list. This is because the older dates could be close to the statute of limitations for your state. Any current revolving accounts are in your best interest to clear up or attempt to keep in good standing.

By sorting the lowest balance due, you have a starting point. Take care of anything you may have with a low balance first. Clearing these debts and paying them will have a faster impact on your credit score. Plus, coming up with 50 dollars to cover an old cable bill is much easier than covering a credit card or possible loan you may have defaulted on. Creating a monthly budget, you should include:·

- Monthly income

Monthly income is any wages or income from other sources you get each month. Include anything that brings in dependable income each month. ·

- Life expenses

Life expenses should include any utility bills, groceries. Add anything you must pay each month even including car insurance and rent.

Once you have a basic budget down you can see what if any remaining funds you have each month. Compare this to your debt list. Creating a budget or a plan will help you stay on track with paying expenses as well as covering any debt collections you have.

Statute of Limitations for Debt Reporting

The Statute of limitations for debt reporting varies by state. It is easy to look up for whatever state you live in. Having this information is essential, you do not want to inquire about a debt that is very close to falling off. Inquiring about debts and deficient balances that appear on reports can start the statute of limitations over. Meaning a debt that was a few months away from coming off your report now starts over and can remain for years again.

People in some states enjoy a much smaller window of 3 years for debt reporting. While other states have a much longer window and certain debts can remain on your credit files for up to 10 years.

Remember I said earlier to list debts and deficiencies newest to oldest. This is because some of your debts maybe close to the window that they will fall off or be removed from your credit reports. If you find anything on your credit reports that is outside of the statute of limitations. Dispute these with the 3 major credit bureaus stating that under your state statutes these debts are past the threshold for reporting.

Debt Collectors

The next step is dealing with the debt collectors for the debts on your credit reports. If you have small debts around 50-100 dollars or items still with the original creditors. Paying off debts that sit with the original creditor is better than allowing them to hit collections. Pay them, get them taken care of and they will show closed on your reports.

There are a few things you should know about debt collectors:

- Debts are purchased for pennies on the dollar

- They often lack ethics and often lie

- Use caution when dealing with them

- It is possible to negotiate payment for less than the deficient balances due

- Get everything in writing before paying anything

Negotiating to settle debts with a collection agency is possible. Remember they paid pennies on the dollar for your debt from the original creditor. So, you can negotiate in most cases to pay less than owed. Ever notice that your debt owed seems larger than what you remember it being when it was with the original company? It usually is, there are interest and penalties tacked onto the balances once you default.

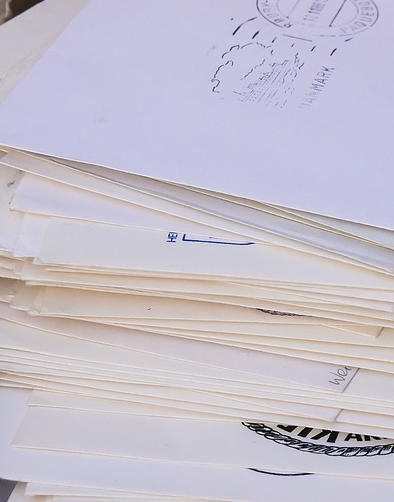

You can call the collection agents on your report, though sending certified mail is best. What happens with old debts is often these agencies have purchased so much debt, that they cannot always validate them. Nor do they bother with validating the debts if it’s requested. A win win for the deficient party if they choose to send a validation request. Failing to produce the validation request makes it rather easy to remove these of credit reports.

Before you deal with debt collectors there are a few Tips:

- Never deal with debt collectors by phone

- Send everything via certified mail with signature and return receipt

- Send validation letters for any unrecognized collections

- Be clear and to the point in communications, while staying polite

- Never sign by hand, always type your signature

Validation Letters

Over the years I have had my information included in data breaches. So at times there have been debts that I cannot validate on my credit reports. I remember one specifically as it is what started my journey with debt collections, and clearing up credit.

In this case I sent an email as it was the only contact for the collection agency I was able to find. I know more now than I did then my initial email was really short and left me no course of action should they have been unable to validate the debt but left it on my report.

I sent:

To whom it may concern,

I noticed a debt appearing on my credit report that I cannot validate as a debt I owe. My personal information has been included in several data breaches. I am reaching out to see if you could please provide additional details as to what this debt is supposed to be for, services rendered and dates.

Account # listed on report

Sincerely,

Cynthia

That is above and beyond a simple correspondence, and does not include a few things you should ask for. First let me tell you what happened with my email. I got an email back the following week that was exciting to say the least. They could not produce any validation for the collection, and removed the debt off of my credit report. Just asking for validation to support that the debt was mine resulted in the removal.

If you do not recognize an account send a validation letter. Validation letters are simple letters asking for proof that you owe the debt. Sending a validation letter can start the statute of limitations over. That is why newer debts are the best starting point. Be sure to state you give 30 days for the collection agency 'validate' the debt.

If they fail to prove the debt is yours, you can submit a dispute with the bureaus for its removal. Always keep a copy of the validation letter as well as your returned receipt for verification. Send copies along with certified letters, and signature receipts with your dispute to all three credit bureaus.

If the debt is yours, start negotiating. I suggest never paying off anything without getting a 'pay for delete' agreement if possible. Even a collection marked as 'paid' is still a derogatory mark on credit reports if it went to collections. Often, they will decline your request, keep trying as they want the debt settled as much as you. If they decline your first offer, you can always increase the amount you are willing to pay in small increments. Keep your letter simple and polite. There are many sample letters on the web for pay for deletion and validating debts.

Corresponding with Debt Collectors

I know there are loads of us on the internet that give advice about dealing with debt collections and clearing up reports. Though I find a lot of people that write in this niche will tell you to call debt collectors. This is not something I advise, though you can absolutely do so if you choose. Why? Because calling can often get the statue starting over by drawing attention to a collection the agency was not actively pursuing. And you are skipping the step of asking for validation if you choose. Writing a validation letter can often get the debt removed without negotiating payment.

So, choose the contact method that fits you and your needs best. All debt and collections are as unique as those of us who get a credit report.

Debt collection agencies can be sneaky and sometimes borderline unethical in their pursuit of collecting debts. When you begin to start writing letters to debt collections there are some do's and don'ts to consider. I prefer not to call debt collectors, they lie, and they manipulate. It is easy to get caught up on the phone and confused. Writing letters, you can go over them and be sure you are concise.

Be sure to include the following details in correspondence:

- The date of the collection, any applicable account numbers that show on your credit report.

- How much of the deficient balance you are willing to settle the debt for in exchange for the debts removal.

- If you agree to accept my offer, please send a legal document agreeing to my terms and bound by my state laws on company letterhead

- Optional: If I receive no respond in 15-30 days (timeline is up to you) that you will retract any offer made to settle the debt.

Never include any of the following in letters to debt collectors:

- Birth date

- Social security number

- Date of services

- For validation letters: Never acknowledge the debt as yours or mention the type of debt/services

Any reputable debt collector that is reporting a valid debt, should already have access to your details. Assuming they indeed purchased your debt legally. There is no need to provide them with any further details than the account number for said collection and your name and address that will be on the letter. Only provide minimal details when sending validation letters or pay for deletion. Be sure to include what percentage, or flat rate you are attempting to prepared to pay to negotiate the debt removal.

Credit Monitoring

Monitoring your credit is easy each year you can request a free copy of your credit report from all credit bureaus. The three major credit bureaus are:

- Experian

- TransUnion

- Equifax

Many websites offer free credit monitoring and some credit cards include monitoring services too. Keep in mind the scores they show are for educational purposes and more than likely are not 100% accurate.

These sites are a good asset. They will update any knew activity that has been added to your reports. This is essential in catching possible identity theft or catching inaccurate information. Any inaccurate information can be disputed for removal. Many credit cards will also offer a monitoring service for free.

Take advantage of free monitoring services an easy tool to reference credit report and any changes. It helps seeing what has changed and you can see improvements to your reports without having to wait.

What did you learn

view quiz statisticsTake Action and See Results

Removing even the small debts off your credit reports will help to improve your overall score. If you are dealing with poor credit do not open any new accounts until you take control of the accounts, you have defaulted on. If you have a current credit card and pay it off do not close it. Even closing a credit card that you are not carrying a balance on can have a negative impact on your score. If you are afraid you will not use it responsibly, cut the card up but allow the account to remain open.

Nothing good happens overnight, and that is the same with your credit scores. It will take time to see them improve by leaps and bounds. When I removed the small debt, I did not recognize I mentioned earlier, I noticed an immediate uptick to my score. You will never improve your score if you do nothing with your debts. How fast you can see an improvement remains solely up to you and how determined you are to put forth the effort in dealing with debts.

Don’t spend outside your means or income stick within your monthly budget. If you find ways to cut down on expenses for your monthly budget, use any overage you accumulate towards paying down your debts. Try to avoid payments when paying debts, a collection debt reporting monthly payments can ding your scores and start the statute over again. Try to save a lump sum before negotiating with the debt collectors to pay the debt.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2015 Cynthia Hoover