Cryptocurrencies Based on Precious Metals Is Now a Thing—Here’s Why It’s Worth a Look

When bitcoin value surged last year, almost equaling that of gold’s value, not a few expected that a gold-backed cryptocurrency would be possible. A company called E-Gold had this vision in 1995, but the gold digital currency was not sustainable that time after enjoying a few years of relevance. Now, with blockchain technologies, such platforms can exist, lessening the risks and worries of investors.

What happens is a gold’s value (a gram) is being made equal to a token or a coin. A third party secures the gold’s possession, and it can be traded to other coins. In this way, if the token or coin surges and its value increases more than the value of gold, then this means good news to investors who took the risk and put their gold in cryptocurrency. At the very least, when tokens or coins fail to take off, the value remains the same with the gold’s value.

When initial coin offerings (ICO) are offered by companies, that is the best time to grab them since the price remains at base value. Once the platform takes off, eventually, the price of ICO will skyrocket, making it a lot harder to avail of them because of high prices.

Companies that use gold- and silver-based cryptocurrency

Among the companies that have ventured into gold-based cryptocurrency are GoldCrypto (AUX) and XGold Coin (XGC). XGold values a single coin equal to that of a gram of gold while GoldCrypto’s ratio of gold-to-token is one ounce: 750 AUX coins. Also worth mentioning are PureGold (PGT and PGG), Reales (RLS), Darico (DRC), Gold Bits Coin (GBeez), Flashmoni (OZT) and Sudan Gold Coin (SGC), among others.

Nevertheless, individual investors are not the only ones who are set to benefit from this setup but miners, mining companies and gold-producing nations as well. One of them is Mansfield-Martin Exploration Mining, Inc. (OTC Pink: MCPI), which started mining precious metals in Arizona in the 1870s.

Recently, Mansfield-Martin Exploration Mining signed a deal to acquire rich mines in central Idaho and Arizona. President and Chairman John T. Bauska expressed his excitement over the new venture as the company looks for partners in the new endeavor.

“This will be a great deal for us. These properties are special, and we’ll involve several excellent partners with experience funding developmental mining properties and claims,” Bauska said in a statement.

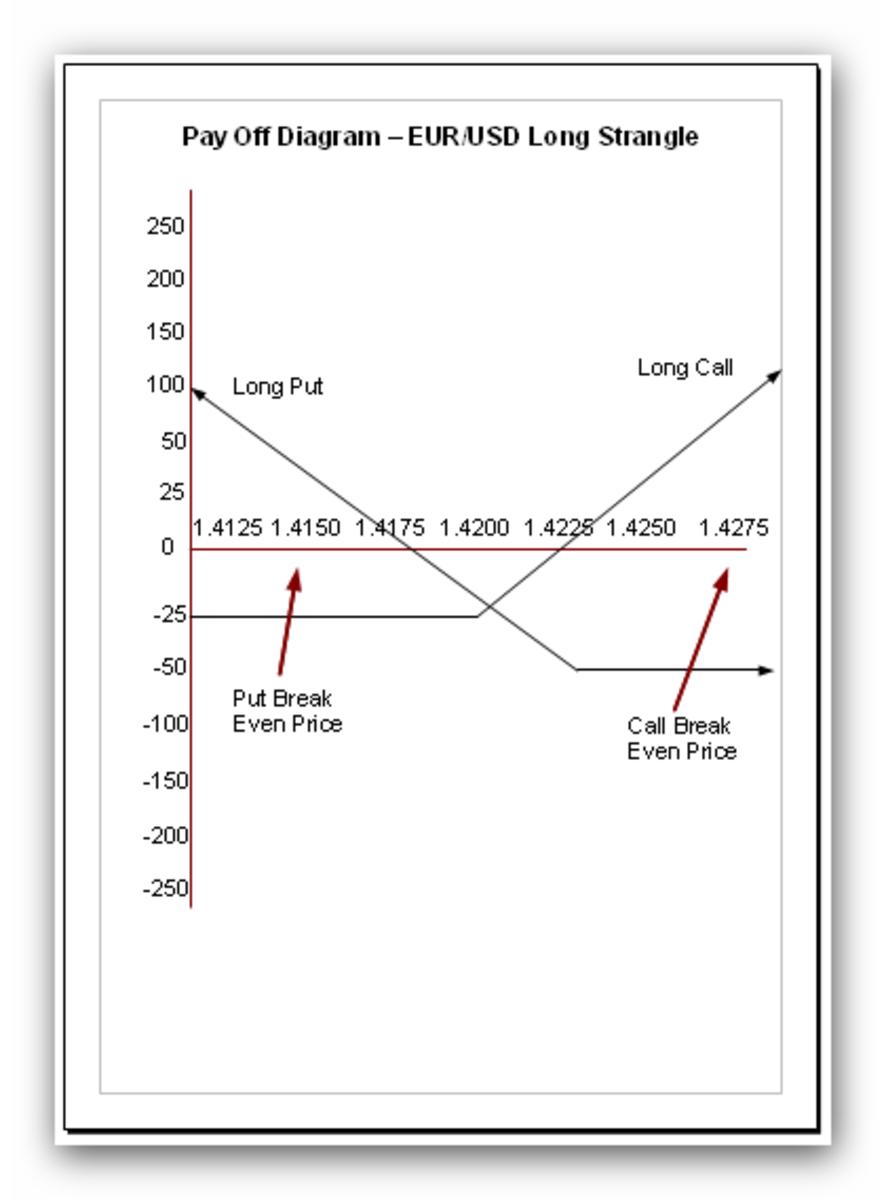

The company has also invested in cryptocurrency with the latest collaboration with Qu, Ltd. Under the new agreement, Mansfield-Martin will supply 5 million ounces of silver doré to Qu, Ltd. as part of investments to Silverback ICO, which runs on the Ethereum blockchain.

The lucrative Tombstone Mining District deal of Mansfield-Martin is expected to rake in $55 million in silver, gold, and other metals. This will boost the company’s cryptocurrency platform. Qu, Ltd. plans to offer 5 million coins, each backed by 1 ounce of .999 silver. With $55 million in projected assets from Tombstone mines, the future looks robust for Mansfield-Martin.