Curious About The Value of Silver? Five Easy Ways to Determine True Silver Value.

What Is Silver Value?

How Can We Calculate The Value of Silver?

It is said that the stock market is full of people who know the price of everything and value of nothing. When silver prices rose from $10.00 in 2008 to almost $50.00 in 2010, did the value of silver increase five-fold? Is it possible for the value of anything like silver to change that much in so short a time? How can we calculate the value of silver?

In this article, I’ll discuss the important differences between silver price and silver value, go over five easy ways to calculate the value of silver and suggest some ways to invest in silver.

What Is The Difference Between Silver Value and Silver Price? Why Is It Important?

Although words silver price and silver value are often used interchangeably, they have very different meanings, especially when applied to a precious metal like silver which acts as both a commodity and a monetary instrument. Silver price refers specifically to the number of currency units you would be willing to trade for silver. Silver value is a measure of the benefit derived from silver.

Take the water in the fire hydrant down the road for example. Even when your house is on fire, the price of the water doesn’t change, but the value of that same water skyrockets as your house burns. Conversely, to the plants in your garden, the value of water remains the same whether the water is free rainwater or expensive French bottled water.

While it is important to know the price of something when making an investment decision, it is arguably far more important to know the value of that same thing. This is the whole basis of value investing, to buy undervalued assets and sell overvalued assets.

A final point on the difference between silver price and silver value is that price is set at the margin. This means that while there may be many millions of individuals holding any asset, price is set by only those very few who are willing to trade on any given day. So even though 99.95% of holders might value their silver far higher than others, the 0.05% who are currently willing to sell will set the price. The price of silver is a fickle thing; the value of silver is much more constant.

With this in mind, lets look at five different methods we can use to help us determine the value of silver.

How Much Silver Value Is In The Earth's Crust?

What Are The Five Ways We Can Determine The Value Of Silver?

#1 - Let's Compare The Existence Of Other Metals To Silver To Determine Value

Lets begin with the physical composition of the earth’s crust and look at the ratio of silver in comparison to other metals in general and precious metals in particular.

The chart below is a comparison of the four precious metals and two common base metals. The first column shows the natural abundance in the earth’s crust of each metal; the second column shows the ratio of that abundance to silver. Next is the indicator of relative value, the fourth column is the rounded price and the last column is the indicator of Silver's undervaluation.

Element

| Natural Abundance

| Abundance Ratio to Silver

| Relative Silver Value

| Price / Ounce

| Relativer Silver Under Valuation

|

|---|---|---|---|---|---|

Silver

| 0.0000079%

| 1

| $19

| $19

| |

Gold

| 0.00000031%

| 1/20

| $62.50

| $1,250

| 3.3

|

Platinum

| 0.0000037%

| 1/15

| $96

| $1,450

| 5

|

Palladium

| 0.00000063%

| 1/5

| $170

| $850

| 9

|

Copper

| 0.0068%

| 800

| $171

| $0.214

| 9

|

Lead

| 0.00099%

| 185

| $132

| $0.715

| 7

|

With silver naturally occurring in the earth’s crust about 20 times more than gold, we can take the price of gold ($1,250) and divide it by the abundance ratio of silver (20) to give us a relative price of $62.50. Contrast this with silver’s current price of $19 and the model suggests that the value of silver should be 3.3 times higher. Using the same calculation for platinum ($1,450 / 15 = 96 / 19 = 5) suggests silver value should be five times higher. For palladium, ($850 / 5 = 170 / 19 = 9) our calculation suggests the value of silver should be nine times higher.

For the base metals, we can relate natural abundance to current prices using the same calculation with one small difference. As the base metals are more abundant than silver, we take copper’s price per ounce ($0.214) and multiply it by its abundance ratio (800) to give us a relative price of 171. Divide this by silver’s price ($19) and the model suggests silver value should be nine times higher. For Lead (0.715 x 185 = 132 / 19 = 7) implies that the value of silver should be 7 times higher.

With each of these “in-ground inventories” suggesting the value of silver should be vastly higher, we might wonder how can this be and how could such an undervaluation have existed for such a long time? The answer can be found in the change in above ground inventories described below.

#2 - We Can Compare Above Ground Inventories As An Indicator Of Silver Value

Above ground inventories is defined as silver that has been mined and is in a usable or recoverable state such as coins, bars, jewelry, tableware and art. It does not include silver that has been “consumed” in fabrication and is in such minute quantities it is not recoverable. Examples of this are silver in batteries, electronics, and medical dressings & equipment.

The value of silver - or any commodity - is closely tied to availability or scarcity. The price of water anywhere in the world is zero - when it falls from the sky. But, rainfall is not constant around the world and the value of water corresponds directly with this scarcity. The same applies to any commodity. Up to 1967 when silver was the main component in circulating coinage, central banks around the world stored vast amounts of silver as a reserve asset and for minting purposes. Since 1967, when the western world substituted the silver in its coins for other cheaper metals like copper and nickel, these western central banks have been selling off their silver hoard. Silver has been in a significant production deficit for the majority of the last century but the difference has been filled by central bank sales. These sales have depleted the above ground inventory of silver from over 10 billion ounces at the start of the 20th century to just over one billion presently.

In 1959, there were 9 billion ounces of silver bullion in above ground inventories. With a population of 3 billion people, that equated to three ounces per every person in the world at that time. Today, with just over one billion ounces and a population of over 7 billion, there are only about 0.15 ounces per person: a drop of more than 95% in the amount of silver per person in the world.

When comparing this to silver’s cousin gold, it is important to remember that gold is not “consumed” in industrial fabrication like silver. Almost all of the 5.5 billion ounces ever mined is still available in various forms. Spread over the world’s population, this is just under one ounce of gold per person.

Silver value can be deduced by comparing the dollar amount of gold to the dollar amount of silver available per person in the world. In 2014, 5.5 billion ounces of gold at $1,250 divided by 7 billion people yields just under $1,000 of gold per person. 1.3 billion ounces of silver at $19 divided by the same population yields just $3.50 worth of silver per person. Comparing $1,000 of gold to $3.50 of silver shows us that, in dollar terms, there is 285 times more gold than silver in above ground inventories. Conversely, we can say that silver is 285 times more scarce than gold and use this as an solid indicator of the value of silver.

#3 - Comparing Supply And Demand Are Key To Calculating The Value Of Silver

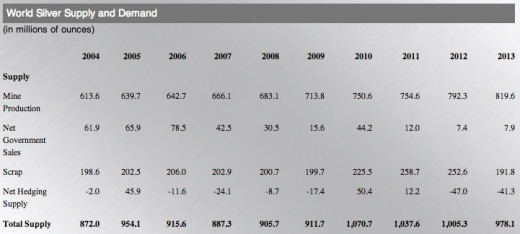

When determining the value of silver, or anything that is mined, manufactured or grown, knowing and comparing supply and demand is key. The following chart shows silver’s supply and demand components over the last decade.

Total Annual World Net Supply of Selected Metals, Tonnes

2005

| 2006

| 2007

| 2008

| 2009

| 2010

| 2011

| 2012

| 2013

| |

|---|---|---|---|---|---|---|---|---|---|

Gold

| 225

| 67

| -33

| -381

| 418

| 100

| -182

| -129

| 277

|

Platinum

| 115

| 477

| -132

| 210

| 1,167

| 65

| 593

| -288

| -756

|

Palladium

| 1,824

| 1,802

| 301

| 338

| 492

| -939

| 1,045

| -1,202

| -979

|

Source: GFMS Thompson Reuters Annual Survey, 2014

As can be seen in the above tables, while gold, platinum, and palladium have had fairly balanced supply and demand, silver’s demand has significantly outstripped its supply every year in the last decade. Silver value can be determined by taking these figures and relating them to each other as an indicator of relative supply. We can see that silver’s chronic supply/demand deficit strongly suggests that silver value should be much higher than prices indicate.

The persistence of silver's supply deficit can be explained by decades of central bank sales coupled with another of silver’s unique characteristics: the majority (70%) of its production is a by-product of the mining of other metals, usually copper, gold, lead and zinc. This is an important point because it renders the production of silver very inelastic to changes in either demand or price.

As for the comparative base metals, copper’s production has been in surplus four of the last six years and deficit in the other two, while lead has been in near balance each of the last five years. Contrasting this again with the unusually large and continuous supply deficit that exists in silver, we can use this as a strong indicator of silver value.

#4 - By Comparing Historical Prices, We Can Discover The Value Of Silver

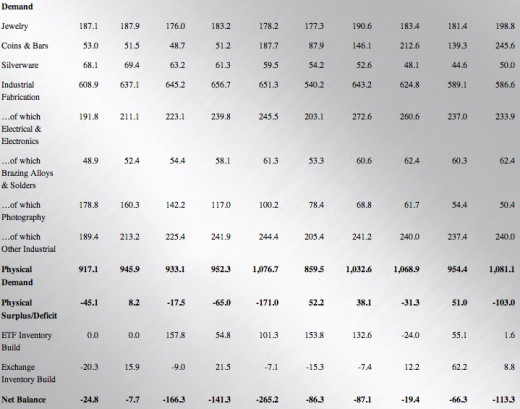

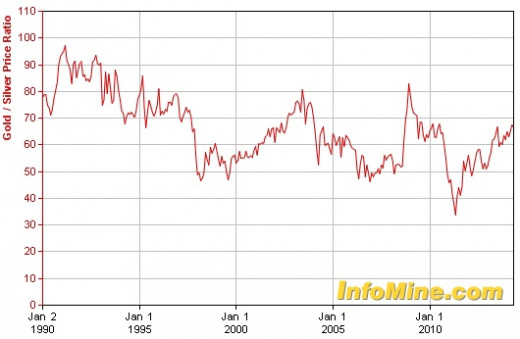

A fourth avenue to determine silver value is historical price comparisons. We can compare historical price ratios of similar commodities to current price ratios and look for variations that indicate the value of silver. This first chart below compares gold to silver prices over the last 300 years. When current price ratios are above the long term average, we can deduce the value of silver to be underestimated, and when they are below, we can deduce the value of silver to be overestimated.

The chart above shows that the price ratio of gold to silver over the last 300 years has averaged about 16:1. Over the last 100 or so years, the ratio has averaged about 50:1 with spikes up to 100:1. To help us discover silver value we can compare the historical price ratio to the current ratio. As can be seen in the chart below, recent gold to silver price ratios have been between 50-100:1, well above the average suggesting the value of silver could be much higher.

The chart below shows the price ratio of platinum to silver has averaged about 75:1 over the last 40 years, and as of the summer of 2014, is right in that range:

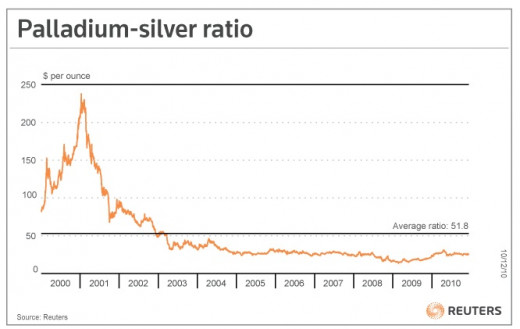

The following chart shows that the price ratio of palladium to silver over the last decade has been consistently around 25:1. Currently the ratio is about 45:1.

Using these historical price ratio comparisons, we can see that current silver prices, compared to gold and palladium, show that the value of silver might be substantially underestimated.

#5 - What Are The Value Of The Benefits And Uses Of Silver?

The fifth method of determining silver value is to examine its benefits and uses. Silver is a unique and remarkable element. To begin with, the value of silver is derived from its dual role, being both an industrially consumed commodity while also being a monetary instrument.

Silver as Money

For more than 6000 years, silver - along with gold - have been money: the preferred medium of exchange and store of wealth. Other commodities have been used as money such as diamonds, art, property, oil, salt, tobacco, and even seashells, but people have always reverted back to precious metals because of their unique and specific properties. These include:

- Divisibility: Silver bars and coins can be cut or divided and still retain their value. Try cutting your art or diamonds for payment and see what happens to their value.

- Portability: You can carry silver in your pocket, car or on an airplane. Not so much with land, oil, or beaver pelts.

- Inertness: Silver is inert, in that it does not rust, burn, rot or decay. Try preserving your wealth by burying art, salt, grains or paper currency in your backyard for a few years and see if they survive.

- Intrinsic value: Silver has value in and of itself. It represents the labour and capital expended to remove it from the ground, whereas paper currencies only have value due to confidence placed in them. Once that confidence is lost, the currency is just paper and reverts back to its intrinsic value of nothing.

Across the Spanish/Portuguese speaking world, the everyday word for money is silver. Silver coins continue to be produced as money and still circulate as such in many parts of the world. Up to 1967, silver constituted 90% of all coinage produced and circulated by western mints, and all of the world’s major mints continue to produce silver coins in a wide range of denominations as both a store of wealth and as face-value money. Beyond coins, silver bars ranging from 1 to 1,000 ounces are produced as stores of wealth and are widely held all over the world.

Silver as a Commodity

As previously seen in silver's production/consumption chart, about 90% of all silver supply is consumed by industrial fabrication - “consumed” being defined as used in manufacturing process rendering it unrecoverable.

An example of this is the computer or mobile device with which you may be viewing this article. The value of silver as an electrical conductor is unparalleled - allowing for optimum connectivity, minimizing power loss resulting in smaller, lighter, more efficient devices. There is about 1/10th of an ounce of silver in every mobile phone in the world, and up to 1/4 of an ounce in every computer, laptop, and tablet, with new devices employing the value of silver as a conductor everyday. Once the device has passed its useful life and gets recycled or ends up in land fill, the silver value will always be there, but probably in an unrecoverable state.

Silver is the most reflective substance known, making it the the main reflective component in the manufacturing of mirrors. It is also the main reflective ingredient in insulted glazing of windows to reflect heat and light, keeping glass enclosed buildings from trapping heat like a greenhouse.

The value of silver in medical applications has exploded in the last decade. Silver is a highly effective natural biocide. It is used in the manufacturing of medical tools and equipment as an antibiotic coating. It is also woven into wound dressings because of its natural anti-bacterial and anti-fungal properties.

Silver is highly used in very small lightweight silver-oxide-batteries. These types of batteries are used in the production of hearing aids, watches, and pace-makers due to their very high energy-to-weight ratio.

The value of silver is also derived from its traditional uses - silverware and jewelry. For centuries, tableware of all varieties has had a very high silver content. Whether in forks and knives, platters, goblets, or candelabras, the world has always adorned its dining rooms with silver. Due to its historically lower price per ounce, there is more silver jewelry than any other form in the world. In places like India and China, silver value is driven by its demand as a wedding and celebration gift, and because silver jewelry is commonly used as wealth preservation.

Putting It All Together - Determining The Value Of Silver

While it is important to know the price of silver, knowing the value of silver - and how to calculate it - is far more essential. We can do this by considering each of our estimates of the value of silver and comparing them to current prices to see if a trend of over- or under-valuation appears. We can then evaluate that trend when making our investment decisions.

As of the summer of 2014 when silver was trading around US$19.00 per troy ounce, our comparison of the natural abundance ratios to prices showed that silver value was vastly underestimated compared to the other three precious metals and some common base metals.

Our look at above ground inventories showed that since the 1960’s, silver reserves have dropped from from 10 billion ounces to just over 1 billion. In relation to the world’s population, the number ounces per person has dropped from about three ounces per person to less than 0.15, a noise dive of 95%. Expressed in dollar terms, silver is about 285 times more scarce than gold.

Looking at production and consumption rates showed silver’s mining and scrap supplies trailing well behind investment and fabrication demand. Keeping prices capped, the deficit has be filled with central bank sales since the removal of silver form coinage in 1967. With the exception of a spike in the late 1970’s and in the last five years, these sales have kept the price of silver - in contrast to the value of silver - below $5.00 over the last century even in the face of such a primary supply deficit.

To determine the value of silver, next, we looked at historical price ratios between silver and the other precious metals. The chart showed that the very long term average of gold to silver prices is about 16:1 with that ratio increasing to about 50:1 over that last hundred years. Over the last decade, that ratio has been as high as 100:1 and is currently at about 65:1 suggesting that the value of silver is higher than current prices reflect.

Lastly, we saw how the many diverse uses and benefits of silver drive its value. Silver has the unique quality of being both an industrial metal used in fabrication and a monetary metal used as money in circulation and a store of wealth.

Some of its more recent uses include the value of silver as an indispensable electrical connector in modern devices, and as a natural biocide in medical equipment. Silver also enjoys a long history with traditional uses such as jewelry, tableware, as well as monetary uses as a medium of exchange and a store of value.

Coupling silver’s traditional, monetary, and modern applications with its long term demand/supply deficit and inventory depletion, we can make an educated, intelligent determination that the value of silver is potentially far higher than current prices suggest. Now is probably a good time to invest in some of the physical silver bars and coins shown above.