Current Ratio

The Current ratio, also known as cash ratio, or cash asset ratio, or liquidity ratio, is a liquidity type of ratio. Liquidity ratios measure how quickly and easily a company can convert its assets into cash. Obviously the easier it is to convert, the cheaper it is also. Companies that have a high Current ratio figure tend to have a high cash flow, although, this tendency is by no means a rule (ie.: there are exceptions).

The primary use of the ratio is to tell investors and analysts how easy it is for the company to pay back its due, short-term credits and loans. It is advisable for all companies to have short-term assets (which is predominantly, but not exclusively cash), so it won't run into such difficulties, as they may result in lawsuits filed against the company, and also higher interest on newly issued credits and loans. On the other hand having a high Current ratio figure, that is having lots of short-term assets (cash at hand), can hurt the performance of the company, since its money not invested in anything, thus not earning any interest or yield (in other words; income) for the company.

The Formula

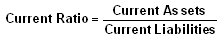

Current ratio is calculated by dividing the Current assets of the company with the current liabilities. The formula is the following:

Another advantage to the use of the Current Ratio is its ease of use, and that it is easy to calculate and understand. As current assets and liabilities tend to be summed up in the account of a company, they are easy to add to the formula, thus requiring very short time to calculate, which in turn enables investors, analyst to find the Current Ratio for many companies, thus by being able to compare a larger amount of companies they can make educated guesses.

In general the higher the figure is, the better. When the ratio is below 1, the company is unable to pay its obligations either on time, or completely, or both. When the resulting number of the calculation of the current ratio is 1, then the company is able to repay its current liabilities (short-term debts), however, by doing so, the company is left with no short-term assets after the payment of current liabilities. When the result for the formula is above 1, the company is not only able to repay its liabilities according to the terms of the credit/loan, but also has short term assets left over after the payment. When we use the Current ratio, please remember, that it only the current, that is short-term, assets, (as well as liabilities), are taken into consideration; assets such as plants and other illiquid assets still remain unassessed by this formula.

In case of a company with many, diversified product portfolio, this formula doesn't perform very well either. Some of its product might meet the short term income requirements of the company, whereas other product may deeply underperform in this respect. The Current ratio only shows their combined performance. In such a case this ratio is inadequate, and, if possible (when detailed reports for each-, or a narrow group of products are available), the company should narrow down the calculation of the Current ratio for fewer products.

Conclusion

The Current ratio is a very easy to use, and useful ratio, but should be used with caution, as with all other financial analysis ratios, and those who use it have to be very clear about the limitations of it too, to be able to correctly use it, and correctly interpret what it indicates to its user.

Advantages of the Current Ratio

One advantage of using this formula is that it often tells how fast the products sell, thus the company can optimize its production. Companies with fast selling products, that is, one with a high Current ratio figure, can utilize the just-in-time production system, when parts and raw materials required for the manufacturing of the product can be ordered so that they arrive just before they are needed, thus decreasing production inventory (storage rooms), thus also decreasing overhead costs.

Disadvantages of the Current Ratio

A drawback of the Current Ratio is that it tells nothing about the profitability of the company or of the product. A product may sell fast, but it may generate large losses to the company. It does not tell whether the production cost are to high, or sales prices are too low, or possibly a combination of the two.

Still, another advantage is that companies that have a current ratio above 2, this may indicate to the company that maybe it sell the product at a too low price, as the demand for it is very high. In such a case, the company, when the product is highly standardized (for example; bread), the company could examine the product and price of its direct competitors, and may increase its prices if they are too low below that of the direct competitor.

Another problem with the Current ratio is the seasonality of products. If the formula is applied for a whole accounting/business year period, that is not very indicative of the real performance of the product. For example, ice creams sales sharply rise at the beginning of summer, and sharply decreases at the end of summer. During winters people tend not to buy ice cream at all. Another factor that influences the sales ice creams is the number of hot days. If for example, in one year the number of days about 30C is 90 days, whereas in the next year it is 100 days, all other factors remaining equal, the companies sales go up by more than 10 per cent. This obviously does not reflect the performance of either the company or of the product.