Date of Last Activity: Credit Report Secrets

DOLA: Date of Last Activity

Hopefully you've gotten a free copy of your credit report and are aware of the different sections on your credit report and what they entail.

Today we are going to talk about the date of last activity(DOLA).

The DOLA is exactly as it states, this is the last date that there was activity on the account. The activity on the account could be as simple as a phone call to company XYZ to discuss a balance. Or it could be something else such as:

- when you closed the account

- when you added an authorized user

- when you made your last payment

- when the debt went to collections

- etc.

Basically ANY activity CAN be recorded as the DOLA: date of last activity.

The Problem with DOLA

The problem with the DOLA, when trying to fix your credit, is that any activity can be reported here thus updating the DOLA. When it comes to seriously overdue accounts you want the DOLA to be dated as long ago as possible to have as little negative impact as possible.

Let's come back to this, let's talk about the magical 7 years first....

**Important Note**

**As time lapses the "bruises" that you put on your credit start to heal themselves. They no longer look as bad as they did when they were first put there. Don't get me wrong a late payment, a collection or a charge off will always look bad on your credit file (until it "falls off") however the DOLA tells creditors or potential creditors how long ago the negative mark was made.

Algorithm

algorithm n

1. Compare - a logical arithmetical or computational procedure that if correctly applied ensures the solution of a problem

2. logic - maths a recursive procedure whereby an infinite sequence of terms can be generated

The 7 Year Rule and What Happens to Bad Debt

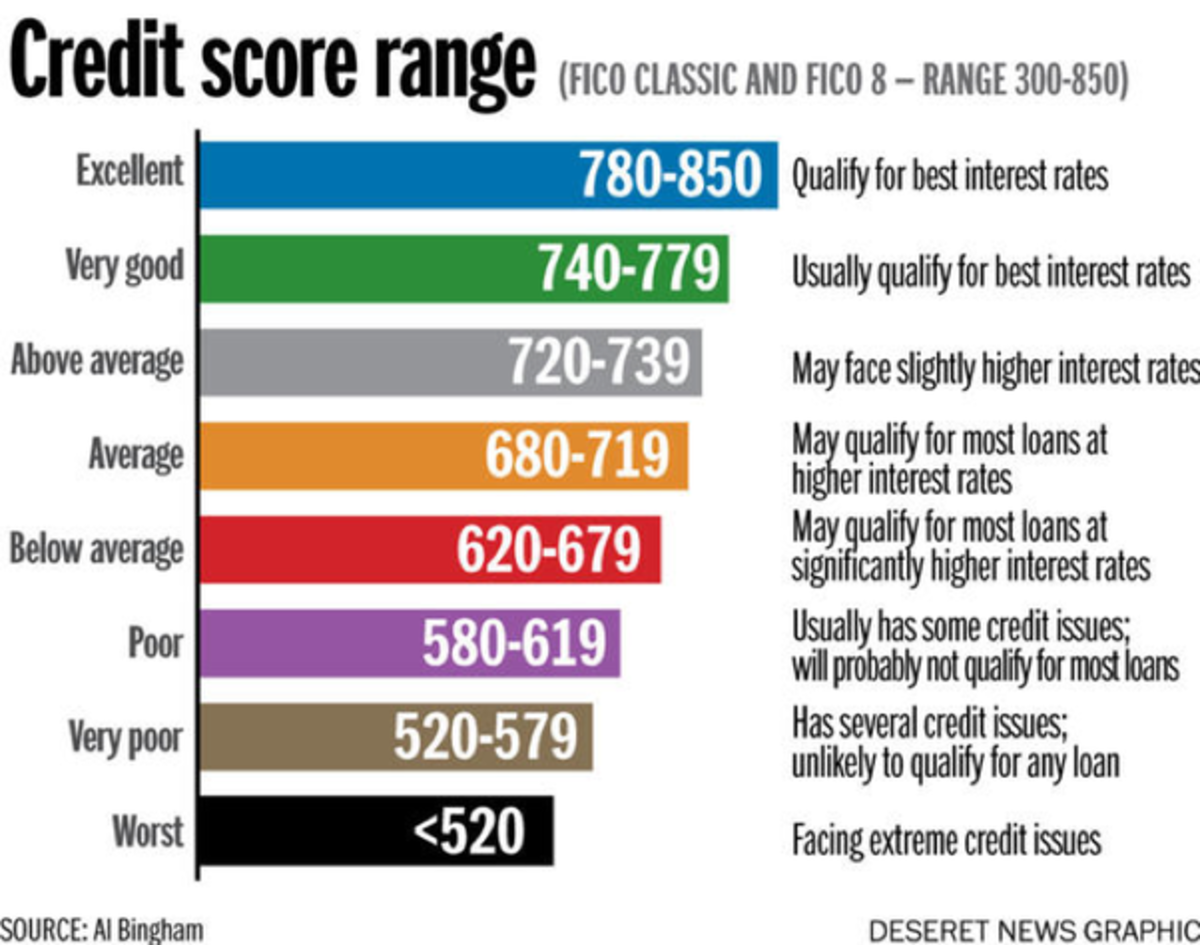

Basically 7 is your magic number when it comes to healing your credit (in the case of bankruptcy this can be up to 10 years).

For example, if you stopped paying your bills tomorrow and made no further contact with the companies you owe, your credit report in 7(ish) years would likely no longer reflect this.

The companies regard this as bad debt, write it off, and sell it to collection agencies who then turn around and try to collect. After 7 years the "bad debt" trail has gone cold. Unless of course you contact these companies to make arrangements. If you do your reset the 7 year clock...

Now let's say you fall onto hard financial times and you have no choice but to stop paying your credit cards. As time passes your financial picture gets better and you decide it's time to fix your credit. Not so fast, first thing you want to figure out is how much time has lapsed since the DOLA on EACH account?

**READ IMPORTANT NOTE ------>

That said back to our story....

So your going to fix your credit since you now have the financial means to do so. Here is where the DOLA comes into play. If you start contacting all the creditors on your credit report who have past due balances from years ago they are going to update your DOLA.

So what?

Well now the trusty algorithm we talked about in part one is going to see that "old" negative account as a "new" negative account and your credit score is going to feel the wrath all over again. Contacting the creditors to "fix" old debts is not always the best idea, since you may "reset" the DOLA to your most recent contact date.

Now you start the whole 7 year process over again, that negative information (whatever it is/was) has been updated with the most recent DOLA, and the negative information stays until 7 years from the most recent contact.

*************************************

So where does the debt "go"?

The bad debt is written off and sold by the original debt holder; this is where collection companies come into play. Colelction companies will try very hard to collect however eventually the debt is no longer collectible or enforceable and it "vanishes". Rest assured the debt is paid for by higher interest rates from creditors.

**********************************************

So What Should I Do?

Well this all depends on your individual situation. However if the "bad debt" is relatively old it is best to "wait it off". What I mean by that is when a debt gets old it no longer effects your credit score as bad as it once did (remember the Important note up there ^^^^). When the magical 7 years rolls around(according to the DOLA) it falls off like it was never there before if it does not "fall off" you must dispute the negative information with the company reporting it (Equifax, Transunion or Experian - sometimes all three).

If the bad debt is less than 3 years old you have a few choices to make.

Ask yourself:

- Can I pay off the debt in full?

Most debt collection agencies, while in the business of collecting debts are not looking to collect on debts that are very old and they definitely are not looking to work out a payment plan. They have in fact "given up" on ever collecting on some older debts.

- Why do I need to pay off this debt now?

Can you wait for this debt to fall off? Are you in the process of obtaining a mortgage and this is the best course of action? What does the lender say? Is it a requirement?

By paying of the debt now you are going to update the DOLA. Which will make the debt look recent and you will feel the pain when looking at your score. However if you are applying for a mortgage and the only debt you have is one collection account this is often mandatory for approval regardless of the "hit" on your score.

Whew, That was A Lot of Information.

Yes, yes it was. Hopefully you have somewhat of an understanding on how the DOLA (date of last activity) factors into calculating your credit score. The DOLA is not as important if your accounts are all up to date, when this happens the DOLA is actually a friend rather then a foe.

However, if you've been caught up in a financial crisis and are looking to fix your credit, rebuild your credit or anything that pertains to raising your credit score the DOLA is an important "player" in the process. By knowing the way the DOLA effects your credit score calculations you can potentially avoid the headaches associated with "fixing" your credit. Good luck!

Summary

In case your head is spinning or your unsure of what was written let him sum it up for you again!

Don't Forget! Knowledge is power in the financial world!

Copyright Notice

©Rebecca Fiskaali-Fordin 2012

All Text Rights Reserved