Daily Expenses Tracking 101

The eagerness to break this vicious "paycheck-to-paycheck" cycle is definitely strong. However, the majority of people just do not know where and/or how to begin. Managing finances could certainly be tricky and overwhelming if you skip from 101 to 901! In order to manage finances effectively, you would first need to acknowledge and understand what are your expenses. Once you can grasp this, you would need to track them. This is what we will be zooming into in this article: understanding and tracking your daily expenses 101.

What is your identified financial goal in the immediate-term?

Understanding Expenses

We can’t really run away from expenses as they are one of the main engines of a functioning society. In an efficient society, people pay rent, spend on food, shop for daily necessities, pay various bills etc. Expenses are essential but they could also create stress if we do not understand and manage them well. As such, we will first learn how to track expenses here, hence, Daily Expenses Tracking 101.

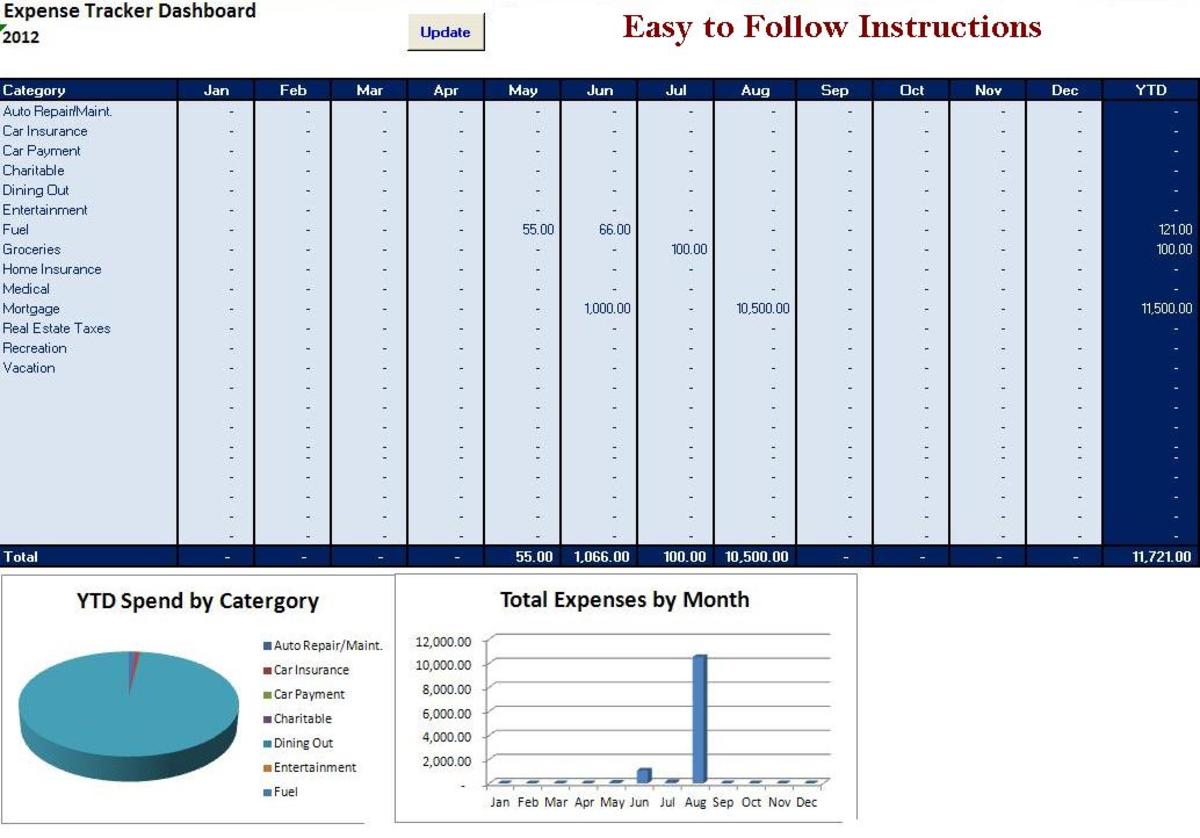

7 Steps in Building your Expenses Tracking Tool (ETT)

The essence of this exercise is to collect your expenses data, clean up your expenses data, and interpret your expenses data. Yes, Collect, Clean, and Interpret. Ultimately, we aim to make informed financial decisions by leveraging on the interpretation of the data. It will be most effective for you to update the spreadsheet daily after you have built it. This is how you accumulate your data accurately. Do not worry, it will not take up much time at all.

Note: This spreadsheet aims to track your basic "daily living expenses" - what you would spend on regularly. Therefore, it would be advisable to exclude any extraordinary items that you would only spend on if you have the extra. A common example would be traveling expenses. This is to ensure that you will have a cleaner and undistorted data.

Tool needed: Excel spreadsheet

Skill needed: Basic Excel

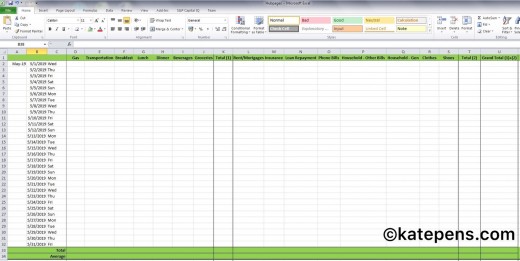

[Pictures of the 7 Steps to follow after this]

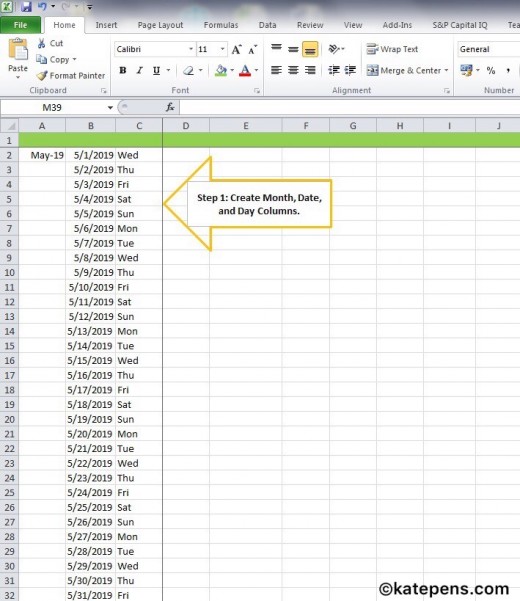

Step 1: Create “Month”, “Date”, and “Day” columns on the second row of your spreadsheet.

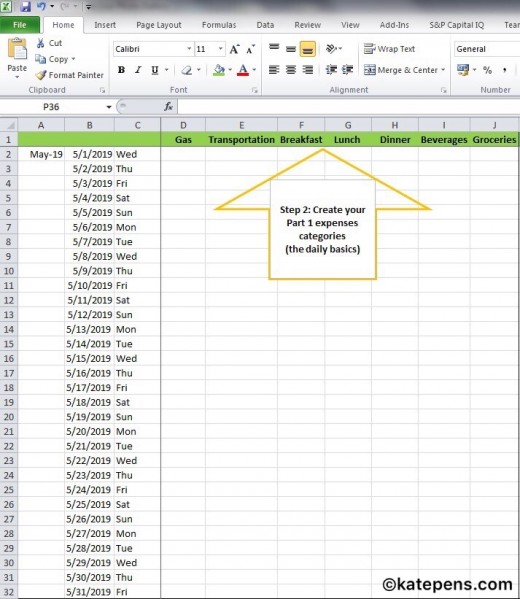

Step 2: Create columns to categorize your daily expenses. There will be 2 parts to this. For Part 1, you will start with your most basic day-to-day expenses such as food, beverages, gas, transportation etc.

Tip: Construct a more granular category so that you can interpret your data more meaningfully later on. For example, instead of having a column for food, create columns for breakfast, lunch, dinner, and groceries instead.

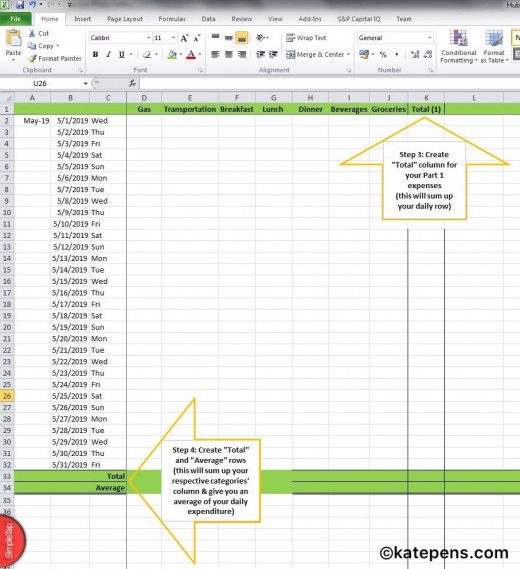

Step 3: Sum up your categories of expenses for both column and row by using the “=SUM” function in Excel. In this way, the column sum will give you the total that you have spent for your respective categories while the row sum will give you the total spent in a day. You can name your row sum as “Total (1)”. This means the total for your Part 1 expenses.

Step 4: Create another row below your monthly total to calculate the average of total spent per day using the “=AVE” function.

Optional: You could also average up each of your category if needed.

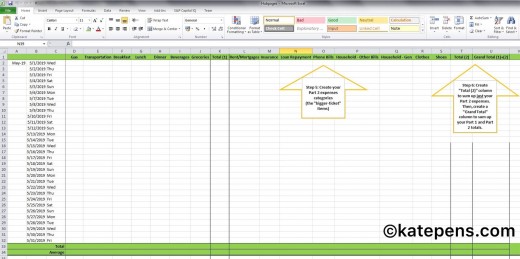

Step 5: Now that you have created Part 1, you will replicate the same for Part 2. Part 2 will be the big-ticket items and any other ancillary items. For example, rent, mortgage, phone bills, insurance, clothes, shoes, household items etc. Apply the same “=SUM” and “=AVE” functions for your Part 2. Name the row total for Part 2 as “Total (2)”.

Step 6: Create a “Grand Total (1) + (2)” column after your “Total (2)” column. This would be the column where you sum up your “Total (1)” and “Total (2)”.

Step 7: Save and backup your file often!

Bonus Tips: Construction of ETT

1. Use a new tab for each year in order to avoid potential data corruption as you are

going to accumulate data throughout many years assuming you are using this ETT

continuously.

2. Improvise and customize your spreadsheet along the way as you see fit.

Interpreting your Expenses Data

Now that you have a system to track your daily expenses, how do you interpret and make use of the data that you have been maintaining? Remember, data will only be meaningful if we interpret them.

Below are some 3 useful high-level insights that I have created that you could use:

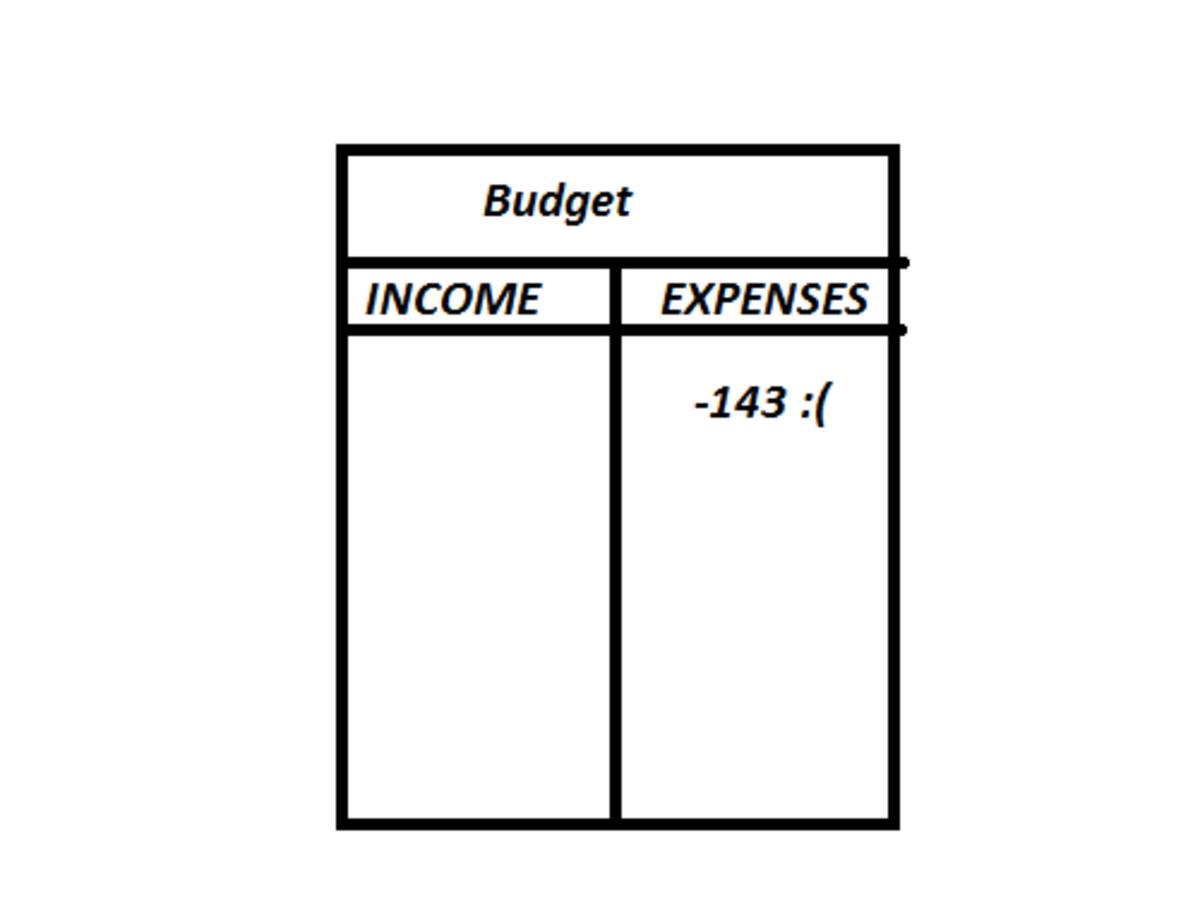

1. Ask yourself: What are my financial goals? Am I trying to reduce expenses in the immediate term or am I trying to increase my earnings to continue to cover my expenses and to make room for more expenses? The latter would be ideal and it is good to set it as your ultimate goal.

If what you make is sufficient to support your current lifestyle in a sustainable manner; naturally, you would want to find ways to increase your earnings moving forward in order to maintain that sustainability at least. In this case, it would make little sense if you were to focus on reducing your expenses instead of focusing on increasing your earnings.

However, more often than not, reality hits. In this case, you might need to cut down expenses in order to avoid deficit. Good thing is you now have the ETT to help you out!

2. If you are planning to reduce your expenses in the near-term, zoom into your “Part 2” expenses first. Some big-ticket items could be your luxury indulgence all these while and they would serve as a good reflection point as starter.

3. Following this, you can then (i) examine your existing mortgage, car loan, or rental expenses, or (ii) examine your “Part 1” basic daily expenses, whichever is more relevant and easy to execute.

Having identify your financial goals, execute your chosen available options, be it to increase your earnings or to reduce your expenses! Sometimes, this might mean stepping out from your comfort zone in both cases.

In Conclusion

Financial management and planning are essential and they could be executed from various angles. Do take note that it will not be easy to cut down on certain expenses especially when we have been cultivating that spending habits all our lives. Through this exercise, we aim to make informed financial decisions. Finally, I hope that you can take this ETT with you or at least leverage on this framework for new idea generation to help with your daily expenses tracking.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2019 Katy Phun