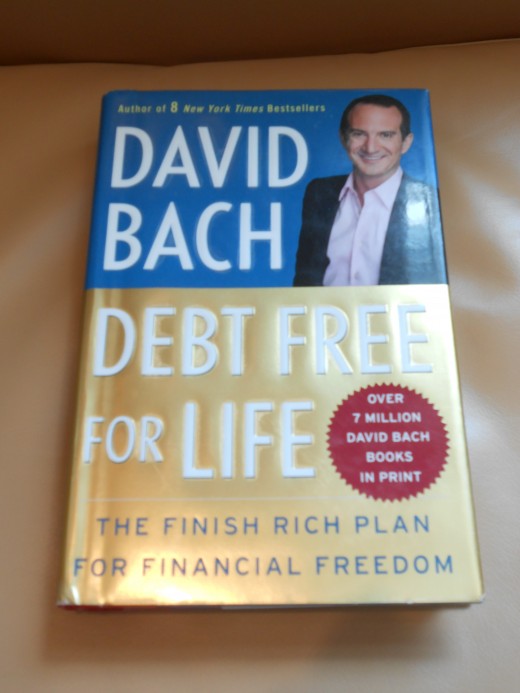

Debt Free For Life by David Bach: A Book Review

Great Book for Those Needing Money Advice

If a person is having trouble with money, or would just like to get some tips on how to deal with bills and financial responsibilities, "Debt Free For Life" is a great book to read. I picked this book up in the library on a vacation after reading all the material I had brought with me. I figured I could probably pick up a few financial tips from it. I was quite surprised to find this book a fascinating read for anyone who wants to find more money, either to pay off bills or to save for the future.

The chapters are laid out in such a way that you can skip around and only read the ones that you actually need. Not only is this book full of great ideas on how to find more money for your budget, but it's also loaded with websites to help you as well.

Of course, if you know anything about David Bach (and I did not before reading this book) you know he is a great self-promoter so that many of the websites or links he gives will lead you to his website or more of his books. But this fact is forgivable because the information he shares is quite valuable to the average person.

One of the most interesting pieces of information I learned from this book is his 12 step action plan to improve a credit score. Improving your credit score helps secure loans and mortgages and the like in the future. I enjoy reading stories about actual people who have had an experience and what they did to improve their situation. This book has many examples of people's financial troubles and how they got themselves out of trouble by using tips from the author. I think reading stories like these gives other people hope that they too can improve their finances.

Some of the tips I gleaned from this book that are the most helpful to me include:

- To get a free credit report, go to www.annualcreditreport.com. Every consumer is entitled to one free credit report each year.

- Google interest rates for your particular credit cards. Then call credit card companies to see if they can lower your interest rate. Tell them you know what they are offering new customers, and since you have been a loyal customer for ____ years, you would hope they could do something similar for you.

- If when calling a credit card company and they refuse to lower your interest rate, go one step farther and ask to speak with their supervisor. Often the supervisor has more power to lower credit card interest rate, and most people don't bother going that extra step when refused by the first person they reach.

- There is a statute of limitations on debts. ( You'll have to read the book to get more information on that)

- Having your credit cards paid automatically each month by allowing credit card companies to withdraw a certain amount out of your checking account on a certain day of the month will ensure you won't have late fees. You just need to make sure you have enough money in your checking account to cover that amount.

- To help pay off bills quicker and become more organized, have a folder for each outstanding bill you owe. Write the name of the credit card or company you owe back money to on the front of the folder in big black marker. Then also write the amount that you owe. Each month, as you pay down each bill, cross out the previous amount and write what you currently owe. Keep all statements and bills in the folder. Once you are done paying the bill in total, write paid in full across the front of the folder. Just the act of doing that will help you feel better about your financial situation.

I found this book extremely helpful to my financial situation. I think anyone who has had financial issues in the past, or the present, or would just like tips on how to take better control of their money and pay down debt quickly will also find it full of valuable information.

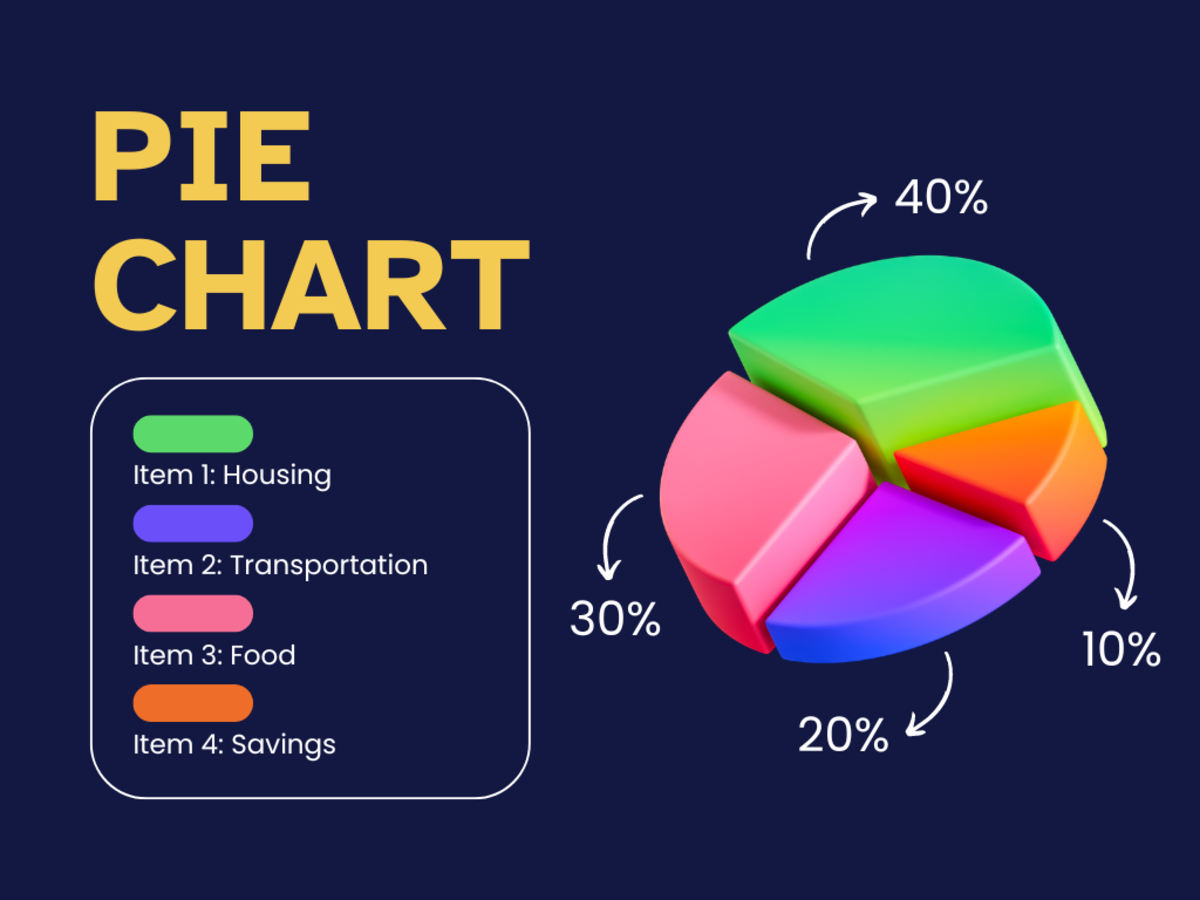

Debt Free For Life Poll

Do you think this book will be helpful to you?

If you think this would be a good one for you, you can buy it here...

© 2013 Karen Hellier