How To Stay Out Of Debt For Good

Sometimes it seems like it's all too easy to get IN debt but how do you get OUT of debt and get out of it fast?

Well, unfortunately there are no easy or really instantaneous solutions but there are some great ways that you can get out of debt relatively fast.

It's important to remember though how you got here/there in the first place and to NOT repeat the process.

Once you learn to stay out of debt or manage your debt, try to prevent it from becoming a recurring nightmare.

Following these simple tips can put you on the way to financial happiness and keep you there for the rest of your life.

Learning to manage debt is the key to getting out of debt and staying out of debt!

SIMPLE WAYS TO GET OUT OF DEBT AND STAY THAT WAY

- You can't spend more than you make. Do the math.....it doesn't add up. You have to learn that you can't have everything that you want or at least not everything instantly. It's called discipline and it isn't a 4-letter word.

- Throw out or hide your credit cards. If you're addicted to spending or Internet browsing only to find yourself ordering and ordering, take the cards away from yourself or from each other. If you don't stop spending, the cycle will never stop.

- Set up a plan of attack. List all your debts and see which ones are the highest but see which ones have the highest APR (annual percentage rate). Blast those accounts first. You won't be able to pay them off if you only pay the minimum amount each month. Take an extra chunk of change and throw it repeatedly at the bill that is the highest. Once you get that paid off, hit the next highest and so on.

- Pay twice per month. Paying your bill every 2 weeks regardless of the amount paid will help decrease the bills faster by lowering the interest that you're paying.

- Call your credit cards and ask for a lower rate. It never hurts to ask they say and it's

true. You also won't know if you don't

ask! All things in life are negotiable, including debt and interest rates.

- Card transfer loans. You can

transfer your credit card debt to another card but make sure you go for a card

with 0% transfer rate. That way you

won't be caught in the vicious cycle of wasted money on interest. And make double sure that the card you're transferring to will cover ALL your debt or you may get really screwed and end up paying more rather than less!

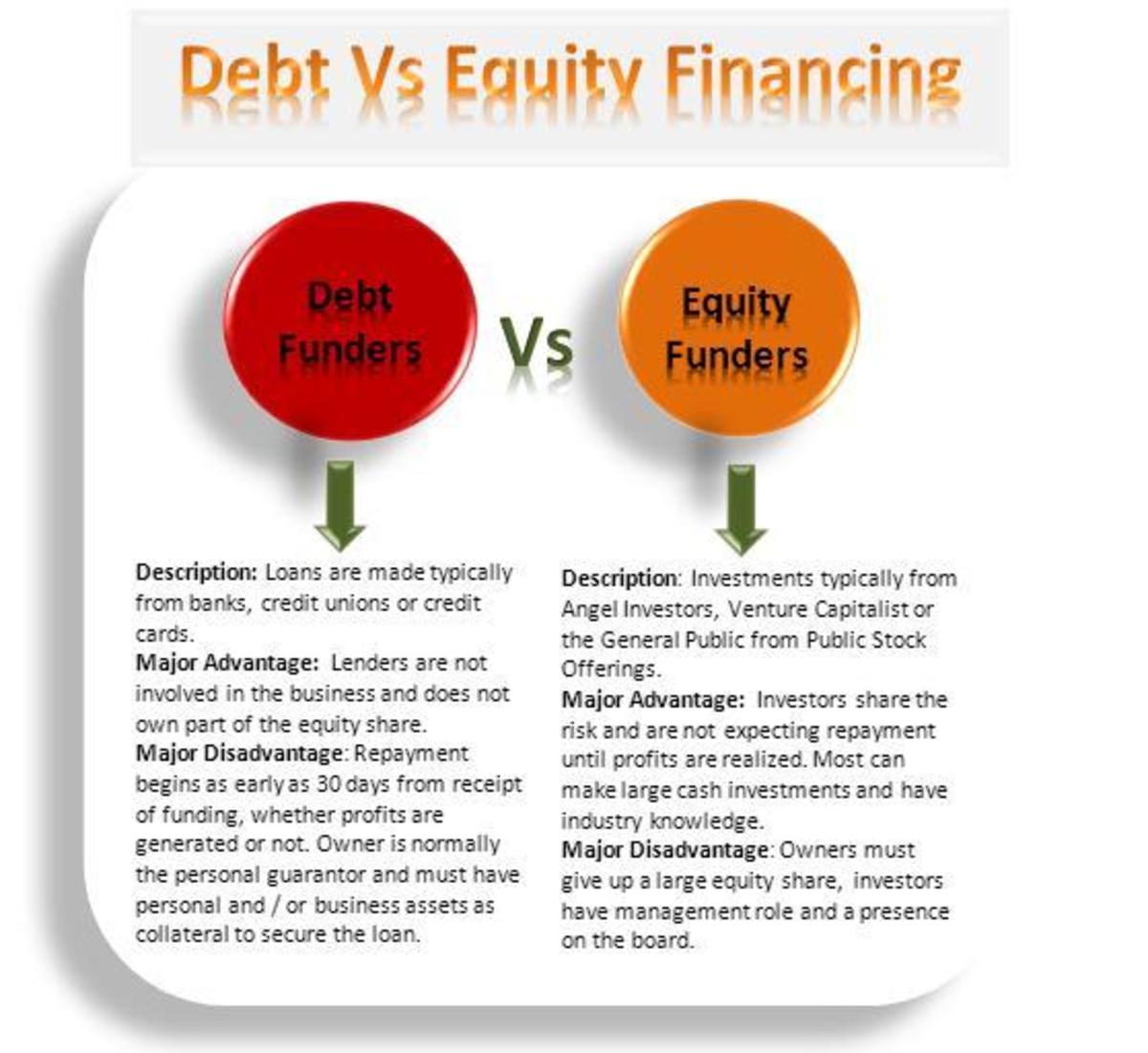

- Try to get a personal loan. Remember that if you get a personal loan, you'll still have the debt but if you can lower the interest rate, it makes sense to pay off outstanding loans or credit card debt....but ONLY if you get a lower rate and can still throw money at the debt to pay it down.

- Sell your stuff. Look into selling on CraigsList, ebay or Amazon for starters. Have a huge garage sale or put ads in the paper and get rid of things you do not need and that could bring in money. Use the money to pay off debt not go out and celebrate!

- Late fees. Paying late fees on car payments or any bill that you have is like throwing money down the commode and flushing it. Pay attention to your bills and pay them on time...and if you can figure out the cash flow, pay them twice during the month instead of once.

- Less is more. Always look for the LOWEST

interest rate on EVERYTHING. Check

online for the best deals out there and if a company won't match it, don't go

with them. Use your knowledge to negotiate for lower prices and rates on everything. If someone is offering it, someone else is probably going to match it.

- Home equity loans. Don't get a home equity loan to pay off your debt. You're tapping into your savings by doing that and you'll be no better off in the long run.

- Using 401(k)s to pay off debt is the same as home equity...don't do it. Again, not a good idea because that's your savings. Leave things that are assets alone and pay off the debt any other way.

- If you do not have enough money, think about making more. Until you get your debt paid off, it might be that everyone will have to help out, make sacrifices and sometimes you just can't rob one envelope to pay another. The solution? Make more money or get a second job.

Debt Management for a Lifetime

WHAT IS GOOD DEBT?

Mortgages and student loans.....they usually have lower interest rates. They build our credit history. You will notice car loans are not listed as "good debt". See below!

WHAT IS BAD DEBT?

Credit card debt is only good for credit reports and credit scores.

Credit card debt is never "good" debt if you're not paying it off regularly.

Car payments are perhaps somewhere in between and usually a necessary evil but if you can afford it, buying a used car and paying cash is the way to go to avoid debt.

SAVINGS TIP

For every dime that you prove that you save being frugal or reducing debt, etc., take that money and sock it into a separate account (preferably an online checking or savings account that will earn you even more interest).

You'll be surprised at how successful saving money can make you feel. It also teaches you the value of what your money can mean over time and how it can be put to good or better use.

In summary, there is no easy way or way lacking some pain to get out of debt once you're there.

Sacrifices are usually not pleasant and that's why they call them sacrifices.

That being said, the rewards of learning how to stay out of debt are immeasurable.

Leading a financially healthy life is the greatest reward you can give yourself and your loved ones because they lead to confidence and relaxation in knowing that you can afford whatever you decide to buy in the future.

Hoping that these helpful hints on getting out of debt are just that....helpful....and wishing you every financial success in the future!