Tips For Stock Investment

Stock Market

Sleeping in is what most of us dream of doing if we could afford such a luxury. Waking up and leisurely reading the latest news over a specially brewed cup of coffee, maybe go to the golf club or just go see the latest action flick. Go pick up your niece or nephew or grandkids, go out to have dinner, and at the day's end know there is a check waiting for you in the mailbox.

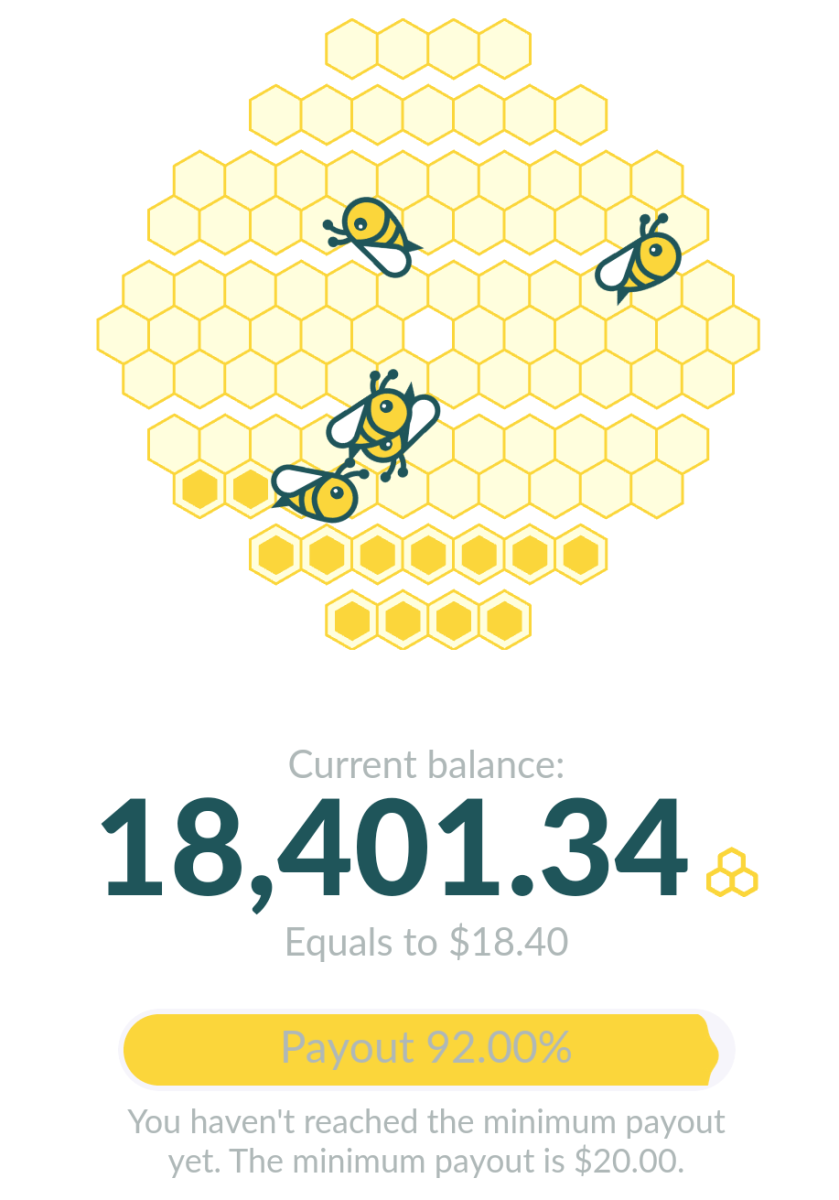

Although there was no designated employment for years that check is always there waiting to be received by you. How? you might ask. There are lots of claims on

full-time how to get rich working from home for just a few hours of work per week, which in turn generates residual full time for you. The problem is I haven't come across any that actually works.

If you want income whether you spend 12-hour days working or sipping sex on the beach cocktails at the pool, now is the time to initiate the streaming flow of money.

Here are a couple of ways to get the checks coming into your mailbox

(1) Continued flow of income from stocks that raise their dividends on a yearly basis or (Perpetual Dividend Raisers)

Investing in companies of the sort guarantees that you get a pay raise each year. This doesn't mean you are working harder to achieve the yearly raise, it only means your investment is working harder for you. This type of investment (Perpetual Dividend Raisers) ensures that you stay ahead of inflation and raises your purchasing power.

Here is an example, let’s say I bought a stock like Darden (NYSE: DRI), which is paying a dividend yield of 3.7%. Over the past five years, Darden's raised its dividend by a stunning 28.4% per year. Darden's most recent raise was 16.2%.

So – in the next five years – Darden boosts its dividend by 16.2% per year, in five years, my dividend yield increases to 6.7%.

Within the next 10 years, my dividend yield would be over 14%.

This doesn't include any gain in the price of the shares, just the dividend portion of my Darden investment alone would increase my buying power.

This is a critical factor as inflation rises on a yearly basis. If you are not in need of the income that is being generated now from your investment, I strongly advise you to reinvest the dividends, so if there is ever a need for the income the increase in shares will be generating more cash.

Using this example, let’s say you have bought 200 shares at $57.21.

Within five years, your 200 shares will turn into 245 shares because you automatically reinvest in more stock with the dividends rather than taking the cash.

And, if after five years you decide not to reinvest the dividend and take the cash because the dividends were working hard for you during the past five years, you’ll receive $954 per year instead of $771 – which is a 24% increase.

Due to the enormous leverage of compounding, in 10 years, the increase would be extremely high. You may ask how high? Deciding not to reinvest and start collecting the cash after 10 years (instead of 5 years) you would collect $3,294, instead of $1,635. Which is almost two times more!

A Perpetual Dividend Raiser will yield the passive income that you're seeking, whether you need the money now or later.

Real Estate Market

(No. 2:) Within the USA and Canada, the rental markets are steaming hot right now, and it is visible to investors that the real estate prices have bottomed out.

Now is a great time to purchase a rental property if it is within reach of your retirement planning.

In the present real estate market, rental property rates are at an all-time high as the prices of the home remain at low cost, especially in the USA. The big question is, are you able to handle the risk? And, the reality is that a property can remain vacant for months without the cash flow to you or me. But with all this awareness, acquiring rental property is a fantastic way to generate monthly residual cash flow.

One fantastic thing about rental properties is the monthly rental income stays toe to toe with inflation. In spite of the past few years, real estate trends are generally higher (contrary to the housing boom) over the long term.

You have to be in a mindset and be comfortable with an asset that is not very liquid. Another aspect to be aware of is maintenance costs from wear and tear of things such as plumbing, roofing, moisture seeping into a basement, insulation issues, lousy tenants, and so forth.

But with the correct approach, the purchase of a few rental properties is an excellent avenue to generating monthly income and having someone else paying for the asset that is saleable whenever you choose with the possibility of huge profits from the sale later on.

If you don't want to be the sole owner of the properties, you can shop around for partners, you would be surprised how many investors are willing to spread the risk between properties and investment. If a managing partner is put in place of yourself thoroughly find out who you are doing business with, when found trustworthy, owning five or more properties among five or ten investors may be a more passive way of having income-producing real estate.

Don't delay when setting up your passive streaming income, which is the foundation of your retirement plan.