Detecting Price Bubbles - Tulipmania

What is a Speculative Bubble?

When you buy something it generally has an intrinsic or utilitarian value. For instance, a vehicle might allow you to get a better job. A truck might allow you to transport goods for a profit. A good coat might keep you warm in the winter. Even an aesthetic item will have value for boosting your social status.

Some things are purchased for their ability to earn money. Land and housing are a great example for this. If you bought a $100,000 home and rented it out for a $1000 profit per month, that would be a 12% return on your investment.

Imagine though, that the value of investment was also rising. Say that $100,000 home becomes a $110,000 home after a year. You not only earn $10,000 from the increase in value of the home, but $12,000 from its rental income, for a total return of $22,000 dollars on a $100,000 investment.

Note that the reason for the increase in the value of home could be caused by many things. A government program to increase ownership, a shortage of land for new homes, people moving to better places, or increases in population due to births or immigration.

Inflation of the money supply could also create a perception of an increase in value. Even if the owner was aware that the true value of something did not increase, he would still be better off if he was buying something on credit.

Regardless of the reason for the increase in value of an investment, this will usually draw in more people into that investment. This brings about greater demand and even greater prices. Everyone starts making a lot of money. If this continues for a long time, even banks or other lenders will start to consider an investment to be very safe.

The investment becomes a self-fulfilling prophecy to getting rich. Eventually everyone wants to get in on the action. A lot of money will be made. This will continue until a certain point is reached.

Popping Bubbles

The point at which a bubble pops is when there are not enough new investors to jump into a market to cover heightened expenses. In a bubble, many speculators are using borrowed money that they are paying interest on. As new speculators join in the frenzy, new money is injected into the hot item. Banks inject money also through new and bigger loans.

At some point though, new money starts to dwindle. Even banks can generally run out of money, although it may take them a lot longer since they have a lot of resources.

Rich people with a lot of wealth are often very attuned to the dangers of bubbles. One speculator decided to get his money out of the stock market before the crash in 1929 when he heard the elevator operator talking about his investments. He realized that once everyone had joined into the market, there would be no more money to push it up. It had no where to go but down.

This brings us to two important things to watch out for when you suspect bubble investing:

- Everyone is jumping in and borrowing money to invest in something. The housing market was a prime example of this. Few people paid cash in the housing market. During the stock market crash of 1929, most people were using highly leveraged margin accounts.

- Interest rates are higher than Inflation rates. Borrowing money to buy an appreciating asset can often be a good idea if the rate of interest on the money borrowed is less than the rate of inflation. But if the interest that you are paying is greater than the rate of inflation, then you probably need to get out of that asset quickly.

Are Commidities a Bubble?

This brings us to a final question. Are commodities forming a bubble? I very much doubt it and here is why.

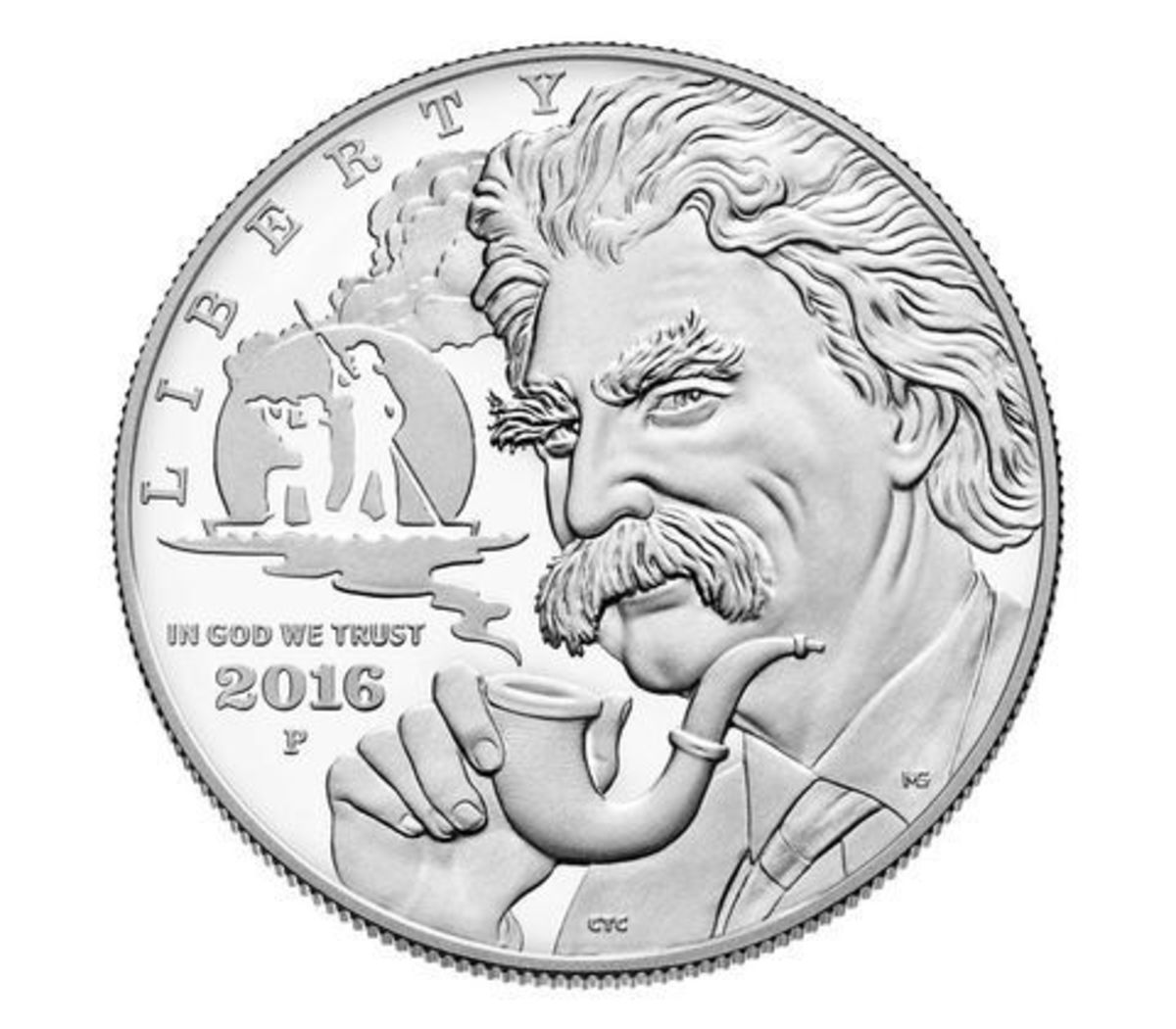

Very few people are investing in silver or gold. I would say less than 5% of the U.S. population owns a silver or gold coin today. More important is the fact that of those who do own precious metals, they own them outright without using borrowed money.

When the stock market collapsed in 1929, borrowed money meant that speculators had to cover margin calls when the market dropped. When they couldn't cover them, the market dropped even more. The same effect was somewhat apparent in the housing market. Owners couldn't refinance their homes due to a drop in value or an increase in credit requirements. Other owners engaged in buy and flip trading couldn't find sellers when their balloon mortgages became due.

People buying precious metals aren't forced to sell if prices drop. They can continue to hold on for the long haul. The same is currently true for other commodities.

As for these other commodities like food and fuel, they are mostly bought for consumption. However, during 2007-2008, there was some speculation using borrowed money on consumable commodities. The fast price increases with falling consumption was a precursor to a bubble popping. A temporary contraction of the money supply furnished the final needle.

When prices go up enough, supply will begin increasing. Even oil can be derived from jatropha plants for around a $100 per barrel. Farmers will begin to plant more crops when prices go up. And once the quantity of a scarce resource increases, prices will inevitably drop. If a bubble has formed, the price drop can be very drastic.

Inflation can complicate all of this by sending false price signals through the free market. The important thing to watch for in this type of environment is to observe the amount of resources being allocated to a commodity. In the past, during hyperinflation, food will become overpriced, while land and housing will become under priced.

Is the Dollar a Bubble?

Normally, when we think of bubbles, we think of something in reference to money. Would it be possible for a currency to become a bubble? At first, this would sound nonsensical, but here is a possible scenario as to why the dollar could form a bubble.

For decades, the U.S. dollar was the most solid currency in the world. It was backed by gold and a powerful economy. The U.S. was known for the most ethical government in the world. No other currency commanded as much trust as the U.S. dollar and many countries used the dollar as a backup currency. Some countries totally relied on the dollar.

This reliance on the dollar has resulted in a huge demand for U.S. currency. Unfortunately, it has also created the illusion that the U.S. can print money without serious consequences. Even though the dollar has slowly lost value over the years, this decrease in value has been slower than the decrease in value of other currencies. The only other safe and portable haven for wealth has been precious metals.

In the last decade, the dollar has not held its value as well as the Euro, the Yen, or many other currencies. Knowledge has been slow to spread about the weakness of the dollar, but the internet is changing all that. With quantitative easing (inflation) of the money supply, the dollar will lose strength even faster. There may come a day when the world may lose faith in the dollar. The following video is a hypothetical scenario based on a rapid and catastrophic decline in the value of the dollar.