How Do You Get Money When You Are Too Sick To Work?

It seems so unnatural and morbid to anticipate total and permanent disability. But how many currently disabled people expected the accident, disease or other medical condition that took them from their workplace?

Do you think their families had any warning that their lives would soon be tossed into total turmoil? Mine didn't.

I believe every adult should have appropriate Disability Insurance. Here's my experience, plus top tips for choosing an appropriate policy and insurance company - and claiming disability insurance if ever you need it.

Why have Total and Permanent Disability Insurance?

It is difficult to imagine being totally and permanently disabled. How can a fit and healthy individual possibly consider themselves ever being unable to cope on a daily basis without help to achieve even the most basic daily tasks?

When one of my adult daughters was unexpectedly declared totally and permanently disabled, she had two insurance policies in place that would provide her with financial relief. Disability insurance had been provided as part of previous employment packages.

Without appropriate insurance, her life now that she is disabled would be far more difficult.

Here is our experience when claiming total and permanent disability on her insurance cover.

Disability Payout

What will happen if you become Permanently Disabled tomorrow?

Do you have appropriate Disability Insurance in place?

Disability Brings Heartbreak and Tears

If you have never lived through the hearbreak of having a loved one become disabled, let me warn you that with the hearbreak comes lots of tears. I offer my own experience as an example.

My eldest daughter was in her early 30's, independent and responsible, and had worked her way up to a management position within a difficult and demanding career.

After leaving university, my daughter had never been without work. Having children was on her to-do list, but she was determined to be financially stable and the time for having children was not yet right.

If you have an adult child, say their name out loud and then add the words "is totally and permanently disabled."

You might have to repeat it a few times before it sinks in. We all like to think that our kids are invincible and will have long, healthy lives. But if the unthinkable were to happen and your adult child was to stumble and fall from their successful career path, how would they cope financially? Could you pay their bills and support them for the next 10, 20, 30 years? What changes would you all have to make?

As you think through the implications of how your child's life will change, you'll understand what I mean when I say disability brings heartbreak and tears.

Not yet old enough to have an adult child? If you have young children, consider the implications for them if you or your spouse become disabled. What will happen to their lifestyle if you can no longer work? Without appropriate insurance, you could lose everything.

Even if you are young and single, currently without any significant personal or financial commitments, imagine for a moment what it would mean to you - and your parents - if you were to unexpectedly become disabled.

If your world ever tumbles around you as the result of a permanent injury or illness, it is not just the disabled individual who will cry themselves to sleep at night.

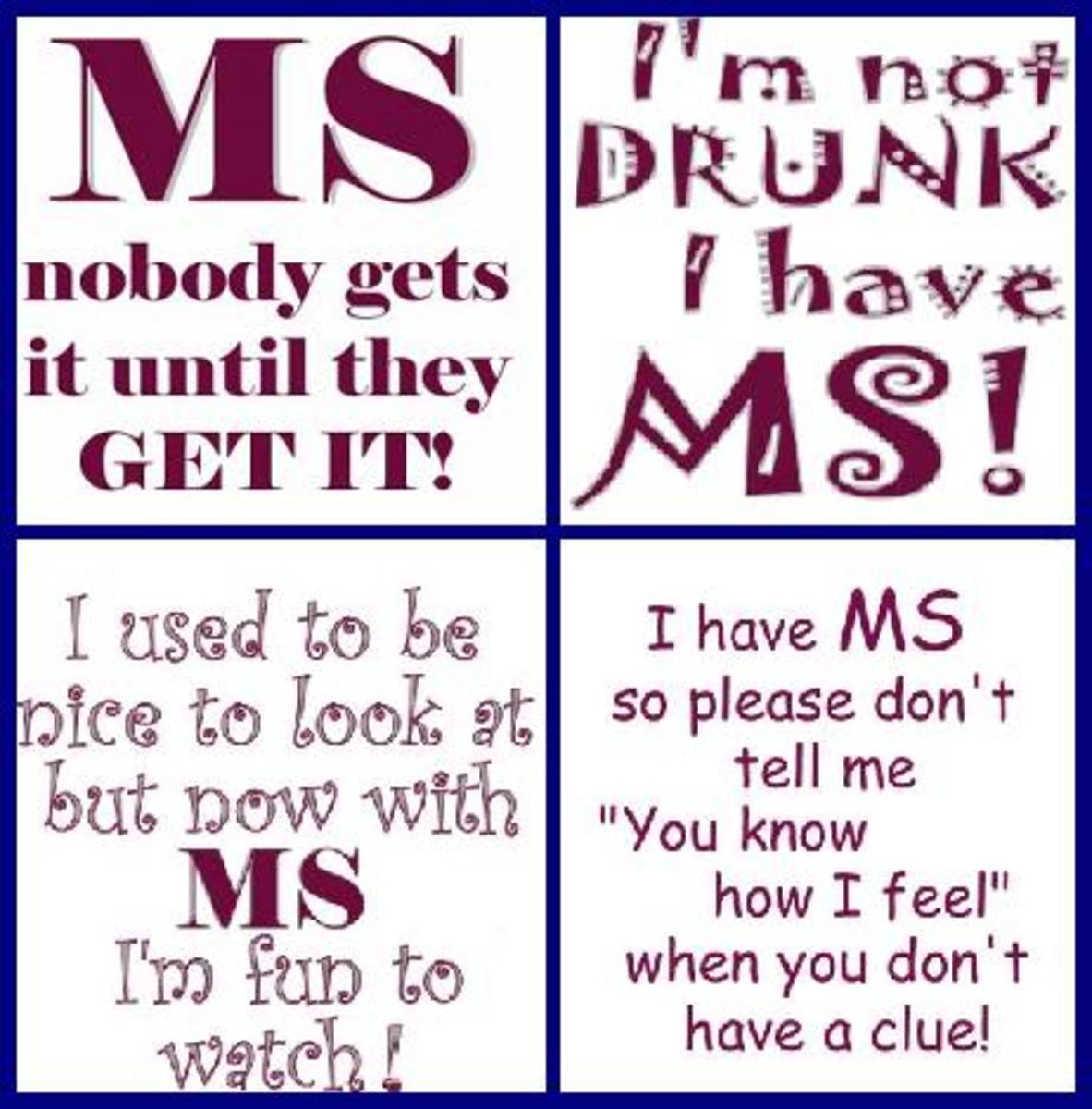

My Daughter's Multiple Sclerosis

My daughter was diagnosed with Multiple Sclerosis in October 2011. Her first obvious episode effected her vision, balance, memory and cognitive function. She was visiting my home at the time.

About 18 months before her first admission to hospital, she had been too exhausted to continue working and was already suffering memory problems. I told her I thought she was just burnt out and should take a holiday. We were living in different states and I hadn't seen her for months. We spoke often on the phone and she always complained about being tired.

"You don't understand how tired I am," she'd say.

I kick myself now for one light-hearted response when I answered, "Sweetheart, you don't know what tired is until you have children."

Had we lived closer, I like to think I'd have bundled her up and taken her to a doctor earlier but I can't rewrite history and I don't know if we'd have had a different outcome even if I had. We had no reason to suspect MS.

She resigned from her job. Her employer offered her more money to stay but she said she just couldn't. We all believed it would be simple for her to get another job once she'd taken the time to refresh and recharge her batteries, but she never recovered from the fatigue.

MRI scans in October 2011 showed multiple lesions in her brain and spine and her specialist explained the MS was the reason for her on-going exhaustion. She had tried desperately to return to work since leaving her fulltime job but for over a year was unable to work more than a couple of hours at any time before falling back into bed. I feel guilty and sad for not being aware of that earlier.

When she was released from hospital after tests and unsuccessful steroid treatment, she stayed at our home until her vision was restored. I fed her organic foods and medicinal herbs and took her for alternative therapies, including visits to a functional neurologist who suggested food allergy testing.

The doctors said it might be four to six years before her next 'episode', but in less than six months she lost the use of her legs and was hospitalised again. We managed to get her back on her feet, again thanks to a natural remedy, but every few months she was slammed with more major episodes, and all the while she had numbness in her limbs - sometimes extending up the length of her torso.

I travelled interstate to visit her and be by her hospital bedside, but it pained her to need her mother's care. I totally understand and respect that.

She had a mortgage on her home and when she'd been working she was comfortably making payments on her cute 3-bedroom house. Raised above the ground with parking and storage beneath, an easy climb up wide wooden stairs led to the covered patio above. Positioned on a large sloping block of land, there were only three stairs at the back.

When her MS robbed her of the use of her legs, she was unable to negotiate the stairs into her home, remained indoors and rarely saw anyone other than the people who delivered fresh organic vegetables to her door - and friends mostly my age who came to check if she needed anything. For a long time she kept her illness secret from her own friends, still struggling to come to terms with the devastating effects on her life. She worried about making payments on her mortgage, and feared losing her home.

Every day we spoke on the phone. As I dialled her number, I held my breath. She was so extraordinarily brave and determined, but it broke my heart to hear how weak she was.

Her hopes were pinned on an appointment with one of Australia's leading MS specialists. The wait felt like forever.

Your Specialist's Role in Determining Total and Permanent Disability

It takes two days to comfortably drive between my home and my daughter's home. It is faster if you only stop for fuel, and much easier on a plane. When the time finally came for my daughter to see the leading MS specialist who hopefully would hold the key to restoring her health, I took a road trip with my youngest child. It would be nice, I thought, for the sisters to see each other.

We left on Saturday around midday after my little one's soccer match. We'd stay visiting for a couple of days after the doctor's appointment and I promised we'd be back in time for the next soccer game.

When the specialist reviewed her test results, looked at three sets of MRI scans taken during the past year and saw the increasing damage, she said, "I'm sorry, there's nothing we can offer you." My daughter, an independent young woman, was faced with deteriorating health at a speed that could not be predicted.

It had never occurred to me for one moment that my daughter with MS would not be considered suitable for some kind of medical intervention. So much has been written about drugs for Multiple Sclerosis. We had researched on the internet and had discussed the possible options. But apparently my daughter demonstrated symptoms of both MS and NMO, which excluded each other from treatment.

The specialist offered to complete the paperwork declaring my daughter totally and permanently disabled, and nominated her last date at her fulltime management position as the date the Multiple Sclerosis caused her to be unfit for work.

Our two day visit extended to two months.

I offered to send my youngest daughter home but she didn't want to leave. Her sister was discussing funeral arrangments and her wishes regarding life support. It was a horrible time, and so sad for my little one but she had friends at a local school and we enrolled her there. She missed her soccer grand final and the celebration when her team won.

Do You Need a Lawyer for a Total and Permanent Disability Claim?

My daughter responded to a television commercial advertising a 'No Win, No Pay' legal service. One of their selling points was assistance in making disability insurance claims. She phoned me in distress when she received their paperwork.

The legal firm had made initial enquiries and advised that she was likely to receive a positive outcome from both her TPD policies, urging her to sign up with their firm and proceed.

However not only would the lawyer take a significant percentage of any insurance payout she received, but the law firm also reserved the right to terminate the agreement at any time - with the expectation that she would cover any expenses incurred prior to their withdrawal.

I phoned the insurance companies directly to ask whether it was necessary to engage lawyers for a Total and Permanent Disability claim. Both companies advised it is possible for clients to represent themselves, and to nominate someone to help them - such as a parent or spouse - and that assistance would be given to help us understand the requirements.

Because the involvement of a lawyer would reduce the money my daughter received by tens of thousands of dollars, she nominated me to deal with each insurance company on her behalf - and did not accept the lawyer's offer.

The Psychological Effects of Making a 'Total and Permanent Disability' Claim

My daughter doesn't want to be disabled. She wants to be well and to return to work. I knew that, and yet I didn't anticipate the psychological effects of making a Total and Permanent Disability insurance claim.

From the day of her 'possible MS' diagnosis (which even then, some doctors at the hospital referred to as 'probable MS'), she was determined to change her lifestyle choices to give herself the best possible chance of recovery.

She stuck to an organic vegetarian diet and avoided all alcohol. She paid attention to the results of her Food Allergy testing and eliminated all possible offenders from her meals. A functional neurologist gave her exercises to do, which she did. When she was well enough, she began attending a naturopath and took the recommended supplements and sought to eliminate the fungus he identified in her blood.

She requested Reiki treatments and attempted gentle yoga - but she didn't have the strength to hold herself in positions and it quickly became evident the yoga exercises may be causing more lesions as she suffered more numbness, more pain and loss of limb control after doing her best to participate.

Her detailed food diary records every morsel that passed her lips, although there were periods when she couldn't hold a pen and was incapable of preparing her own food so those notes were made by me or whoever else was feeding her. Some days she was unable to get out of bed and, being too proud to call for help, stayed in bed and ate nothing at all.

In the two month period after her MS specialist announced there was nothing mainstream medicine could offer her, and the news that the MS would most likely continue to progress at its surprisingly rapid rate, I helped her address the paperwork for her first claim for TPD. It was slow and arduous. She had all the records and documents to prove her work history but couldn't remember where to find specific documents and lacked the energy to tell me where to look.

Stress exacerbates MS symptoms and this was a tragically stressful time.

When I had finally written the last word on the claim form and compiled all the supporting documents, my daughter stubbornly refused to allow me to send it. We'd had many late night talks as I lay on her bed beside her and she reflected on her life and the likely circumstances of her death. I felt I had an insight into how she was feeling, but I was surprised by her reaction to posting her insurance claim.

"Don't you understand?" she demanded. "I am trying to fight this disease but if I'm totally and permanently disabled, that means I'm giving up!"

The Real Benefits of Disability Insurance

The Good and Helpful Disability Insurance Company

My daughter had disability insurance with two separate companies but we began filling the forms for one company at a time. The whole process was overwhelming for her, which was very sad because I was used to her taking control of computers, forms, and all kinds of complex issues in the past. She had been very quick and astute, but the MS made it extremely difficult and very stressful as she tried to concentrate on what needed to be done.

I am extremely fortunate that I happened to choose the forms for BT Insurance for our first project. The Claims Manager was compassionate and understanding. I apologised for crying when I spoke with her and asked her to ignore my tears. I am still simply incapable of voicing the extent of my daughter's difficulties without tears pouring down my face.

She advised me to answer the questions to the best of our ability and to send whatever supporting evidence we had. There were forms for the GP and consulting neurologist to complete and a range of other documents required, including a statement from her former employer.

My daughter's case was more complicated than most people making a claim on their disability insurance policy. The very nature of Multiple Sclerosis makes identifying the exact date of the onset of the condition difficult. If you have an accident with a chainsaw or fall down stairs or receive injuries in a car accident, the date is easy to identify. If you have a heart attack or a stroke, you have a pretty good idea of exactly when your condition worsened. But the onset of MS is something that is determined with the benefit of hindsight.

It took months to gather all the information and I was completely honest about my daughter's circumstances. Sadly she couldn't remember dates or addresses or people's names or any of the specifics that would have made the process faster and easier ... so I delved into her filing cabinet and worked the phones and rang her previous employers and her doctors and everyone else who could help shed some light on her case.

The claim form had perhaps a dozen pages in total to complete. In addition to completing those pages, I compiled over 100 pages of supporting documents, medical reports, references, statements etc.

When it was ready but my daughter refused to allow me to post it, I phoned the Claims Manager again and explained that my daughter wants to keep trying to get better. She feared that the day may come when she had to pay the money back. I needed to know if there was a time period within which to make the claim.

What a lovely, helpful, compassionate woman! The Claims Manager told my daughter that she should send the forms in because she's "allowed to get better". They would assess her claim and, if she received the payment, she could use the money for treatments. If a cure is found for Multiple Sclerosis in the future, she'll have the money to pay for it.

"Really?" my daughter said. "Oh, thank you."

We submitted her claim. It was approved and the money transferred into her bank account within one calendar month.

The Unhelpful Insurance Company That Made a Bad Situation Even Worse

It doesn't matter how important a task is, Multiple Sclerosis has no respect for deadlines and episodes will not be dictated to. We were forced to wait before attempting the next claim because my daughter's health was too fragile.

The money from the first claim was significant. It sat in the bank, waiting until she was well enough to make decisions about how it was best spent. She put her house on the market, knowing that it was unsuitable for her to live in. Even if it was renovated to widen the back door and a ramp was added to allow wheelchair access, the interior doors were too narrow to pass between rooms if she couldn't walk. The block was too big and she'd need to pay someone to mow the grass. She would need a wide concrete path from the rear of the property out onto the street, but the entire street was lined with grass and had no paving - and the road itself was too busy with traffic for her to negotiate in an electric chair. She loved her house but she knew she'd have to leave it.

We completed the forms for her claim with MLC and posted them, along with the same supporting documents we'd sent to BT. But we had a very different outcome.

MLC took months to assess, decline, review and, finally, make payment - for a payout figure that was only a fraction of BT's insured amount.

Perhaps other people have had positive and painless dealings with MLC, but it was quite the opposite for myself and my daughter. For instance, I explained to MLC that my daughter's eyesight had deteriorated dramatically and she was teetering on the edge of total blindness in addition to the numbness, pain and spacticity associated with her condition. I asked that the reviewer contact me, not my daughter, because stress exacerbates MS symptoms. I was assured repeatedly that my daughter would not be contacted.

Then the reviewer rang my daughter. That was the beginning of recurring problems and stressful interactions with MLC. During one conversation when I was pushing for a review after her claim had been rejected, a staff member assumed I was calling about my daughter's "estate". I burst into tears. "My daughter is not dead!"

We were given timelines for responses that MLC broke, and their dealings with us were - in my opinion - unprofessional. For instance, I was required to send a copy of a letter that the Trustee office said had not been provided ... yet I had a letter from their Assessor which clearly stated they had received the same letter. Why was it not passed on to the Trustee?

The insurance was linked to a superannuation account. In the same letter in which MLC rejected her claim for Total and Permanent Disability, they announced that because she is disabled she could withdraw the value of her superannuation account - which would negate her insurance claim.

.

Little Things Become Huge When You Are Disabled

My Personal Experience

This hub is based on my personal experience with the two companies I mention. Of course others may have different views of their performance and service but I have the evidence to support my statements.

Please note that I will be monitoring all comments to this hub and there will be a delay before I approve them. Some comments will be deleted. I encourage readers to share their thoughts and experiences, but I have no desire to publish questionable feedback.

I trust by reading this far, you can see that I have enough to worry about without making life any more complicated. By publishing my experience, I simply hope to help other families avoid some of the inevitable stress and problems associated with unexpected disability.

Thank you.

Important Issues When You Are Disabled

Completely blind in one eye and with limited vision in the other eye, my daughter's existing house hadn't sold ... but I began actively encouraging her to find a new home to buy.

I believe it is important to see a home you're going to live in and I wanted her to see for herself what the layout of the home was, what it looked like from the outside, what the road that passed by her house looked like ... and I wanted her to meet her new neighbours while she could still see them.

If we had waited until she was completely blind, she would have had an endless list of questions. Is it possible to accurately paint a picture with words? Of course I'd have done my best to help her choose an appropriate property and to describe its look and location, but I knew that she would always wonder if she'd actually like the place if she could see it.

There was a real sense of urgency. I stressed the urgency to MLC but the delays continued, with one manager with a leading role in the review of her claim telling me my daughter wasn't the only case the company was dealing with - as though I was being unreasonable by picking up the phone to ask why we'd not heard back from them. My daughter's claim was still undergoing legal review and the manager wasn't responsible for how long that process took.

I pointed out, however, that the manager was responsible for what she had told me - and she had insisted she'd have a response from the legal department and an answer for us by the end of a preceding week "at the latest."

Even when her payment was approved, the delays continued. It took another phone call to establish that their authorised payment had not been processed days later.

I appreciate that my daughter's case was not the most simple and clear-cut, and I am certain I was considered 'difficult' to deal with but when a company's glossy brochures promises prompt help and assistance I believe it is reasonable to expect that service.

As I explained to representatives of MLC, while my daughter's case was just words on paper to them, her disability was very real for us.

Every day, every week, and every month that passed was a very long one.

Could you afford to pay your power bills?

Disability Insurance Provides Hope and Security

My daughter found a house she liked in a beach-side town and used her disability insurance money from BT to buy it. It remained empty for months because she wasn't well enough to move into it and couldn't even consider furnishing it until she received her payment from MLC. She was under enormous stress, fearing that MLC would keep delaying her claim indefinitely and she might lose her still-mortgaged original house or have to sell her new home to pay the bills.

I pushed MLC and their trustees to make a final decision even if it was a second rejection of her claim so that I could move her appeal to the Tribunal, confident in the independent professional advice I had received that she was entitled to her payment. During this further stressful period, my daughter was suffering another severe episode but I don't regret urging her to find and buy a more appropriate home - and I am extremely grateful to BT for having made their prompt payment, allowing her to pay for it.

Her new home has two levels and is large enough to accommodate a live-in carer. From her upstairs bedroom there is a view of the ocean. She'll be able to watch for whales if her eyesight is good enough during the migration season. Even if she can't see the whales herself, she'll have a memory of the view from the window and be able to benefit from the fresh seabreeze.

The two other bedrooms upstairs can potentially accommodate a carer - plus friends or family when we come to visit.

The staircase is carpeted, which makes it a little softer if she takes a tumble. It is also wide enough for her to be carried upstairs and downstairs in the event that she can't make the climb unaided.

She should be able to safely make her way between the bathroom and separate toilet on the upstairs level in periods when her vision is compromised - far more easily than finding her way in her last home.

Downstairs, there's plenty of room for a daybed or sofa bed in the living area if she's bedridden but wishing to come down for a change.

Her open-plan kitchen and dining area could accommodate a wheelchair if needed, and the glass sliding door leading to her small, paved courtyard at the rear has no stairs.

In her previous home, when she lost the ability to walk, she remained inside and avoided going outdoors. Of course we hope she won't lose the use of her legs again, but if she does she could in theory exit through the front of her new house in an electric wheelchair as well.

Total and Permanent Disability Insurance payouts gave my daughter sufficient funds to provide her with hope and security.

At first glance, disability insurance is all about cash. But for those who need it, disability insurance represents far more than money.

Top Tips When Choosing Disability Insurance

Key Features

| What To Look For

| What To Avoid

|

|---|---|---|

Honesty and integrity in the insurance company you choose.

| Word of mouth is the best recommendation. Ask people you know if they have experience or knowledge about helpful and reliable disability insurance companies.

| Use the internet search engines to look for complaints or problems when making claims under the policy you are considering. If others have problems, you don't want to get caught in the same trap.

|

How much are the premiums? What will you pay - and what will you get in return?

| You should not be looking for the cheapest insurance, but the best insurance. If you become disabled, you won't be thinking "Gee, I'm glad I saved a few dollars a week when I was healthy."

| Don't focus on 'cheap' and 'affordable' when choosing a disability insurance policy. Focus instead on 'how much' they'll pay and 'how long' you'll have to wait before receiving payment.

|

Flexibility and mobility.

| Your insurance needs to follow you if you change jobs. It also needs to keep covering you as you grow older.

| Check the fine print. Ask the tough questions. Have the insurance salesperson show you in the policy the precise wording that promises you can change jobs and grow older without your insurance cover being compromised. Make sure your policy is 'guaranteed renewable' for as long as you need it.

|

Acceptable definition of 'Disability'.

| The best disability insurance covers your inability to work in your 'own' occupation. It is relatively easy to establish whether or not you can return to the same kind of job you have been working in. You have experience, you know the demands of the position, and you can address the criteria with confidence.

| Avoid disability insurance that refers to being unable to participate in 'any' occupation. If you are a structural engineer and don't want to work as a switchboard operator, be careful of the wording in the definition of 'disability'.

|

A big enough pay-out to meet your specific needs.

| You will need enough money to pay out your mortgage, move house if necessary, pay bills for the rest of your life, purchase medical aids, pay for a carer plus treatments and therapies, If you have children, you'll also need to factor in the cost of their education, clothing, toys etc year after year. Do the maths before agreeing to a policy that simply won't meet your ongoing needs.

| Don't assume that your spouse, partner or parent will manage to make the same level of contributions as they do when you are not disabled. The disability of an individual can directly influence the earning capacity of an entire family. You need a big enough payment to support yourself and your dependents.

|

How hard is it to make a claim?

| Ask the insurance company if individuals can make claims without the involvement of legal advisors.

| If the day comes when you need your insurance payout to survive, you will resent losing a large slice of it to a legal team. If you are clearly entitled to make a claim, you or a friend or family member should be able to complete the claim process. Stay away from insurers who make it hard to access your money when you most need it.

|

When choosing a Disability Insurance policy, make sure that it can effectively cover all your potential expenses for the rest of your life. If you are totally and permanently disabled and can never work again, how much money will you need to cope fin

Adapting to a Disabled Lifestyle

Empowerment from Choice

During her most recent hospital visit my daughter was given the option of joining a new drug trial. We were told the ethics committee was likely to approve her participation.

She has decided she doesn't want to be a guinea pig and will exhaust every natural therapy available to her as she strives to regain her health. She fears she was selected because her condition was considered 'hopeless'. Could that make her somehow expendable?

Fortunately she now has the financial independence that allows her to make choices. I think that's very empowering.

I am extremely proud of her fighting spirit and the self discipline necessary to avoid all potentially harmful chemicals and, yes, untested pharmaceutical products that may cause her body to react badly.

And I am very grateful for the insurance payouts that give her that financial independence and allow her those choices.

Hope for Happiness but Prepare for the Unexpected

The best advice I can give anyone is to always hope for happiness, but prepare for the unexpected.

If someone in your life becomes totally and permanently disabled, you will be faced with challenges - many of which can be relieved at least just a little if you can afford to make changes.

There are many disability insurance options available from many different companies. Take the time to research them and choose the one that you believe would best meet your needs should you ever lose the ability to work.

Most of us insure our homes and we pay to cover our prized possessions. Cameras, laptops, big TVs, jewelry ... all the items we value but could replace in time even if we didn't have insurance - as long as we had a job.

Stop for a moment and look at the bigger picture. Which is most important in the greater scheme of things?

If you can only afford to pay one insurance policy ... which type would you choose?

© 2013 LongTimeMother