Disposable Income: The Easy Way to Get More Money

Disposable Income

I was thinking about the term “disposable income” today when I was throwing some of my money away. Well, I was not throwing the money away directly, but I was buying some garbage bags which I was then going to throw away. I started thinking about how stupid it is to buy something that you intend to throw away. In some ways it would be more efficient to simply throw the money away- this would avoid consuming all of the resources required to produce the garbage bags, ship them to the store and I could save the time and gas it takes to drive to the store to buy them. The only downside of just throwing the money instead of buying garbage bags is that I still need a way to contain my garbage when throwing it away. So I went ahead and bought the garbage bags and continued thinking about disposable income.

Disposable income is a widely misunderstood term of economics. My first thought would be that disposable income is money that you have left to spend after you have paid all of your bills- but that is not correct. The definition of disposable income is money that you have left after paying your taxes. Since most people pay around 40% of their income to taxes, this leaves 60% of your income as disposable income for almost everyone. Since I misunderstood the definition of disposable income, I have a lot more disposable income than I thought!

What most people think of as “disposable income” is actually known as “discretionary income”. Discretionary income is how much of your income you have left after paying your taxes and bills. Discretionary income varies a lot among people depending on how big your bills and spending patterns.

How Can You Increase Disposable Income?

Since disposable income is how much income you have left after taxes, there are two ways you can increase your disposable income:

1. Reduce your tax bill: I use a professional accountant to do my taxes to make sure I get all of the deductions and pay the lowest taxes possible. This costs about $300 and I realize that I could do it myself for much less, but I am confident that the accountant is saving me money on taxes by finding all of the legal deductions. You can also reduce your tax bill through certain types of donations. I donate items to Goodwill and get a tax deduction every year.

2. Increase your income: You can try to get a raise at work by performing well or simply asking for a raise. You can also get training or education and try to get a higher paying job.

How Can You Increase Your Discretionary Income?

OK, so let’s say you’re making as much income as you can and you’re paying the lowest amount of taxes that you can. This means your disposable income is maximized. Now, how can you increase your discretionary income? The good news is that this is probably much easier than increasing your disposable income. The key to increasing your discretionary is to reduce your bills and reducing your spending.

I usually think about reducing spending by breaking spending into two categories. There are big bills that are pretty difficult to change. Bills like your mortgage, car payment, and student loan payments. There are ways to reduce these big expenses, but this usually requires a major action such as moving to a smaller house, or selling your car and buying an older one. You may be able to consolidate your student loans and save money on your payment.

The next category of expenses is easier to deal with. Everyone has expenses they can cut with a little planning and work. People get into the habit of spending money and don’t even notice it. Did you buy coffee today? If you simply make your own coffee at home instead of buying coffee at a coffee shop, you can save around $600 per year. Do you buy magazines and newspapers? Would you miss them if you cut a few of ones you don’t always have time to read? The list of ways to cut your expenses goes on and on- it is worth spending some time to think about ways you could cut back on spending.

How does spending less increase your discretionary income? If you have more cash available every month to pay down your credit cards, loans, and other bills, you reduce the amount you have to spend each month and have more money available to save or invest. Plus, when you invest money you get a return which produces more income for you. This cycle leads to more and more discretionary income.

Stop Disposing Of Your Income!

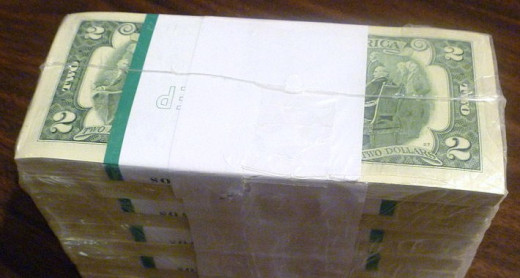

One way to cut down on unnecessary spending is to spend cash rather than buying things with a credit card. It is so much easier to spend money using credit cards because it does not feel like real money. If you have to hand over actually paper currency and see your wallet getting thinner, you are less likely to buy things you don’t really need. Another way to spend less money is to try to get more use out of things that you do buy. I am going to try to get more things in each garbage bag so I can use less of them. This will not only save money, but conserve resources as well.

Paying interest on loans is often an expense that can be reduced. Of course the best way to reduce interest expenses is to reduce the balance on your loans. You can also try to find lower interest loans, expeciallyif you have credit cards with high interest rates.

Find ways to hang on to more of your income by looking at your spending and finding things you are buying that are disposing of your money without providing much value to you. Start cutting unnecessary spending and keep track of how much you save. Spending habits can be learned, but saving habits can be learned as well.

© 2015 Dr Penny Pincher