- HubPages»

- Personal Finance»

- Tax & Taxes»

- Income Tax

Donate Car For Tax Credit

Car Donation Changes to the Tax Code

Over the past few years when car donations made for a great tax deduction, large numbers of taxpayers eager for a fat deduction began to give their used cars away to charities.

Before 2005, the IRS would allow people to donate cars to charity and deduct the suggested retail value of the vehicle rather than the lower fair market value from the taxes paid for that year. The fair market value is typically quite a bit lower than the suggested retail price of a vehicle donation.

The suggested retail price is the amount a dealer might receive for your car if he were to sell it. The fair market value is the number the IRS was looking for when filing for a tax deduction. Some taxpayers were using the higher suggested retail price so the IRS changed the rules for car donations back in 2005.

For a taxpayer in the 33-percent tax bracket, a vehicle donation for a car with a $3,000 fair market value might net a cool $990 (USD) tax deduction. Things are a bit different now.

.

Should I Still Donate My Car to Charity?

With the new tax laws, a vehicle donation may not be worth the trouble, however, it is still possible to get a decent tax deduction for a car donation or to get cash in your pocket by selling the vehicle outright. Tax code is very complicated so be sure to check with your tax advisor or accountant before making a final decision.

Car Donation for Tax Deduction

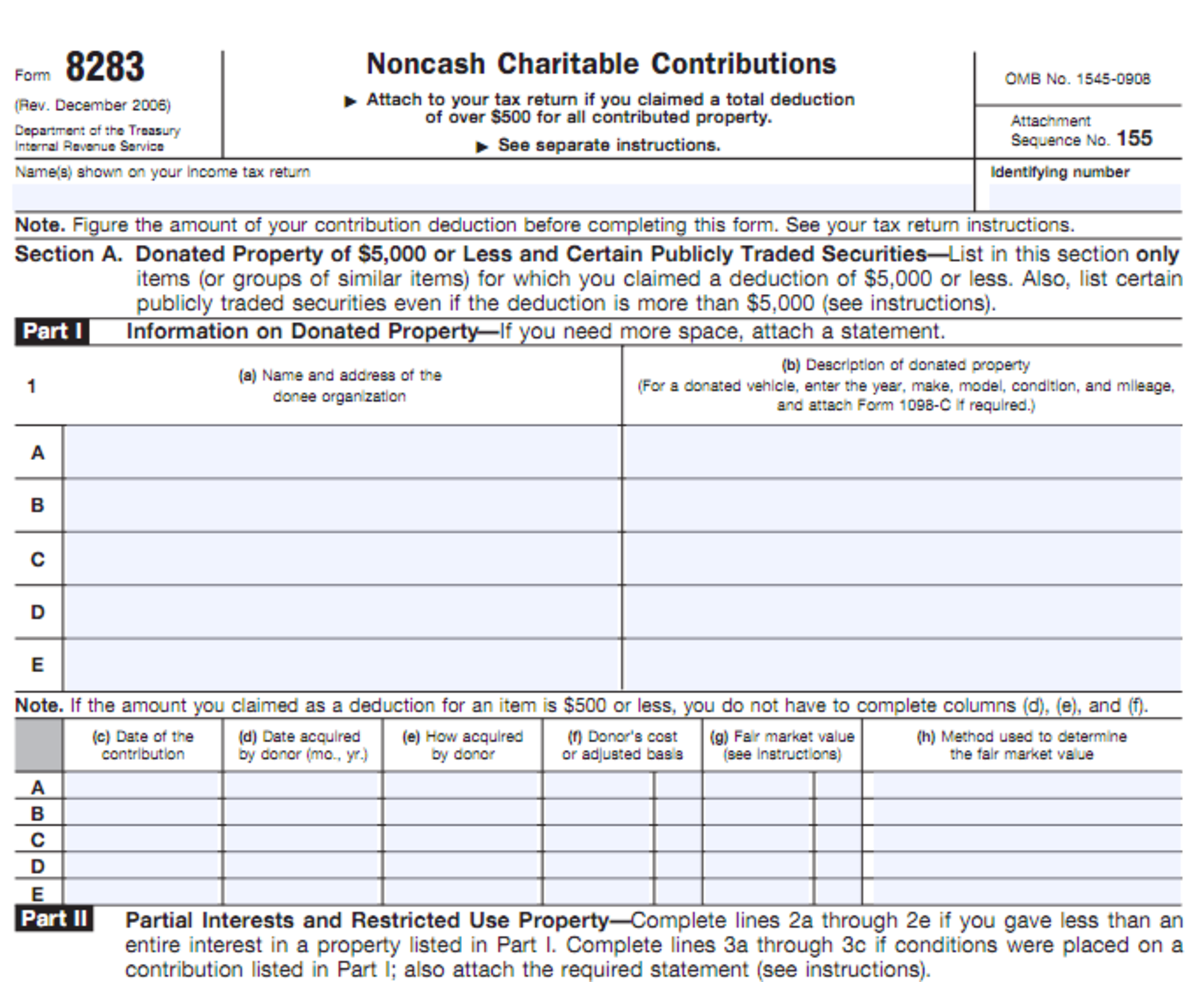

The IRS made a change to the tax code in 2005 which limits the tax deduction on vehicle donations valued at more than $500 to the charity's actual selling price of the vehicle.

The code also mandates the taxpayer to attach a bill of sale from the charity in order to get the car donation tax deduction.

Charities are obligated to provide you with the proper bill of sale and any other documents within 30 days. Taxpayers may not know how much the deduction will be prior to vehicle donation.

.

Donate a Car and Help Someone Out

While there may not be much incentive for a decent tax deduction, especially for those who own higher value vehicles, there is still good that can come from a charitable automobile donation.

Non-profit organizations like 1-800-Charity Cars will take your car donation, refurbish or repair it and provide it to an economically disadvantaged person or family who is in need of reliable transportation.

Most of these folks simply need a reliable car to get to and from a job. Organizations like this are in business to help needy folks to become more self-reliant and stable citizens. The financial payoff of a tax deduction for a car donation may be substantial and it sure makes you feel great to know someone is making use of your unwanted vehicle.

.

Car Donation or Cash Sale: Doing the Math

So, as I see it, there are a few options if you want to get rid of an unwanted used vehicle. You can sell it privately, trade it in on a new car, donate it to charity for them to sell or you can donate it to a group like 1-800-Charity Cars.

Here's how each option breaks out for a used car worth about $1,500 according to Edmunds TMV (True Market Value) Used Vehicle Appraiser. You may also want to take a look at the IRS Donor Information Guide (Publication 4303) before you make a final decision on a car donation.

.

Option 1 - Trade In

This is probably the least profitable option. Let's face it, dealers just don't want to give you a lot of trade-in allowance. Dealers like to use this trade-in value to work a better deal for the lease or purchase terms of the new car you're buying. Be careful and do your research on actual trade-in value of your vehicle. For a car valued at $1,500, you might get about an $800 to $1,000 trade-in allowance if the dealer is in a good mood.

.

Option 2 - Donate Your Car to a Regular Charity

When the charity sells the car (usually at auction), you will get a letter that states the amount the car sold for. Be advised that this will almost always be far less than the actual fair market value of the car donation. Make sure the charity has a 501(c)(3) tax exempt status. If your car sold for less than $500, the IRS does allow for you to deduct the fair market value amount or $500, whichever is the lesser amount. Check the IRS Donor Information Guide for more specific details or speak with your accountant.

.

Option 3 - Donate Your Car to 1-800-Charity Cars

Donate the car to 1-800-Charity Cars or to a similar type organization that provides donated vehicles to those who really do need them. The IRS will allow you to use the Edmunds True Market Value Appraiser to determine the value of the car donation. If you're in the 33-percent tax bracket, that could mean a tax deduction that saves you almost $500 on your taxes this year if Edmunds places a $1,500 value on your vehicle. In both cases of car donation to charity, you must get the receipt or letter that states the amount for which your vehicle was sold dated in the same year you take the deduction.

.

Option 4 - Sell Your Car for Cash

You can always sell the car for full market value or whatever you can get for it - in this case $1,500 or more. Work at getting the car in front of as many potential buyers as possible and you may actually get the price you want, especially if you are selling a car that is in demand. This is the option that will put the most cash in your pocket although you may have to work for it. Look for help from online websites like AutoTrader and eBay Motors.

.

This article is intended for information purposes only and not intended to serve as legal or tax advice.