Dumb Things People Do With Money

Dial your excitement back a few notches if gifts, windfalls, or inheritances come your way.

© 2012 Express10

There are many dumb things people do with money. The most common offenses include not actively planning for your future, not saving enough, not saving at all, and relying on others such as family or the government to help you in old age. Those who don't actively plan for their futures are wasting time and money. They are only sticking their heads in the sand. These offenses make the offender lose the potential power of interest and dividends.

Many people live check to check but this is not going to be an excuse or consolation when you find you cannot or simply don't want to work in your old age. If you never have any excess funds now, how will you have any later without making changes right now? Not saving enough and not saving at all are common reasons that many people in their 60's and beyond live in poverty, homelessness, or unsavory/abusive situations at the hands of others. When you are unable to be independent, your options are few. Ask yourself if you want to be independent and comfortable whenever you retire. If you do, then you should be actively planning for it right now no matter how young or old you are. If you have not already started, now is as good a time as any.

While there are some people who truly want to work in their old age this is the exception rather than the rule. Even if you want to work, your health or other factors may prevent you from doing so, plan accordingly. Whether or not you wish to retire at some point you need to avoid the following dumb things people do with money.

Feed the pig frequently!

Dumb Things People Do With Money - No Savings

This one is particularly troublesome because there are times when you may find that you "get by" living check to check. The problem comes in when this becomes a habit or when unexpected financial expenses crop up and you are not prepared. This is one of the more common dumb things people do with money. Things can go along swimmingly and then one accident, injury, health problem, an urgent home maintenance issue, or lawsuit can make everything very difficult. Having at least an eight or nine month emergency fund is very important for this reason.

An emergency fund is used for emergencies only and protects you from dipping into retirement/investment/stock accounts, resorting to credit cards, and worse when your financial life attempts to go off the rails. If you don't have an emergency fund, get started on funding yours today. It should contain an amount of money that is equal to at least eight or nine months worth of your expenses, everything that you currently spend on a monthly basis. Even if it sounds like an extremely large challenge to do, it is well worth the effort, particularly when (not if) you need it.

Dumb Things People Do With Money - Squandering Tax Refunds, Gifts, Inheritances, and Windfalls

Of the dumb things people do with money, this next one stinks because the money is often a one-time deal and never regular income which makes it crucial to get it right. I tend to look to those older than me as having more life experience and wisdom than myself. I'm promptly shocked when my belief is proven incorrect. For instance, I know a woman who was the beneficiary of $100,000 insurance policy when she was in her forties. However, she went broke in less than a year spending frivolously on extravagant gifts, hairstyling, shopping sprees, etc. I still shake my head in amazement at that.

Also, there are many people who anticipate tax refunds and when received they go on shopping sprees. Many of them don't seem to understand they could have been putting their money to better use all along. Instead of giving excess money to Uncle Sam during the year, how about planning better so that you don't get a refund (pay only what you owe) and save or invest the excess yourself? When you receive a gift, inheritance, or windfall of any sort, take just ten to fifteen percent of it and spend that amount without planning or thinking, have fun...for just a bit. However, the balance of that money should be put to use for your future with a great deal of planning and thinking.

Dumb Things People Do With Money - Not Teaching Your Children About Money, Credit, Budgets, Saving, and Investing

This is another common offense on the list of dumb things people do with money and is frighteningly common. This offense is committed by parents who don't give their children the gift and necessity of financial literacy. Having no financial literacy taught is how many people grow/grew up including myself. From someone who has lived this way, I beg you not to do this to your children. Literally, not even the smallest of these lessons was taught to me by my parents, in any of my schools, or by anyone else. I had to seek out information for myself that should have been taught to me at home years prior but the problem is there are many people that don't have the curiosity or self motivation to learn for themselves if they weren't taught while they were still living at home with their parents.

Doing what's best for your child(ren) is most important and these lessons are too important to ignore. So if your child is old enough to want or ask for money, you had better start teaching all the lessons about managing and growing it. If you haven't done so before they leave the nest, you are sending them out into this modern, money based world unprepared and you are falling down on your job as a parent. When they get older, they will appreciate your efforts, especially if they ever want to be independent, let alone wealthy. Teach your kids about money, credit, budgets, saving, and investing so they can get off to a good start in life. If you don't know much about investing or other aspects, it's a good idea to make the effort to learn for yourself and your child(ren). There are many free resources online, at your library, etc. Financial lessons are too important in our modern money based world to be left to chance.

Don't let your money be easy come, easy go

Dumb Things People Do With Money - Paying To Your Detriment For College For Your Child

This one is a no-no for obvious reasons to many people but some parents are selfless in this area and suffer the consequences after the money slips through their fingers. Some parents even go into debt for their children's education and this is equally bad, if not worse. Of all the dumb things people do with money, this one at least has good intentions but, those good intentions can have devastating consequences. There is nothing wrong with helping out children in college, if you have your financial house in complete order and abundance.

This means no debt, abundant emergency and retirement funds, savings, investments, etc. Do not offer or agree to pay for your child's college education if you don't have your financial house in order. Your child will need to research careers that will allow them to be comfortable financially and weigh this against expenses of getting the degree. If they are not doing this for themselves anyway, they should not be going to college, let alone getting you to pay a dime for it. Trust me, you would not want me to tell you what some of my college mates are spending mommy, daddy, and grandma's money on!

Not comparing the cost of getting a degree versus the actual odds of getting the job is one of the reasons there is well over a trillion dollars in US student loan debt. If your child has good grades they may qualify for some grants and scholarships and everyone does not have to go to an ivy league school. Some choose to work though depending on their career path I might discourage this as getting near perfect, perfect, or greater than perfect grades (definitely possible if you are motivated enough) is often a full time job in itself and some careers do require excellent grades in addition to the student being active in other school & community related activities. Nevertheless, the student would be the one attending and they are the ones responsible for paying for college, not you.

Make it rain, in your bank accounts and portfolio

Dumb Things People Do With Money - Lending Money To Friends And Others

For the one doing the borrowing, getting a loan from friends, family, or coworkers is a great idea. But if you are acting as the bank, this has great potential for becoming a headache for you. When someone asks you for a loan, simply do not do it whether they are a friend, colleague, or family. Refer them to a credit union or bank. Quite often loans change the relationship because you become a bank rather than a friend, family member, or colleague. What used to be easy conversations could become tense or awkward because the borrower cannot or will not pay.

Often, friends and family loans go unpaid and this a common reason for arguments, failed relationships, and small claims court cases. In addition, you may simply be avoided by the borrower when they can't or won't repay. Even if you do the "smart" thing and get everything in writing, this is no guarantee that you'll be able to collect as some people are habitually delinquent and others may simply have no intention of repaying friends/family, let alone have any money to do so. And money is what they asked you for isn't it? Don't change your relationships by loaning friends and family money.

Dollars & Bitcoins

Dumb Things People Do With Money - Co-signing Anything For Anyone

See the above section about lending money to friends and others. Do not commit this offense from the list of dumb things people do with money. In this case while you aren't lending money, you are allowing them to borrow your great credit which is in many people's eyes, more dangerous. Even for those with the best of intentions, things can go wrong, plans can be derailed. If you are willing to co-sign for anyone (including your children), you should have the ability to pay the full tab in cash and still have plenty of money left over for your needs and wants. If you can't afford to do so, you can't truly afford to co-sign and you should not do so.

Also, it is important to understand that if you wish to apply for loans and other things requiring credit approval you will likely be offered less or declined because you have accepted responsibility for someone else's obligations. Imagine being turned down for a home, a car, or a business loan because you went out on a limb for someone else. Don't entrap yourself by co-signing for anyone. In addition, if the person you co-sign for doesn't pay up or causes damages, you are also held fully responsible, no excuses. One slip by the one you co-signed for can tank your good credit for years. Never co-sign for others. The person will just have to create their own path to meeting their needs and goals without your good credit.

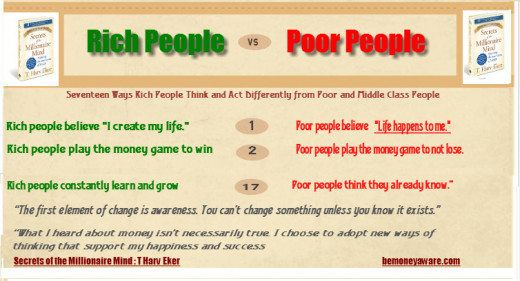

Rich People v/s Poor People (Mindset)

Dumb Things People Do With Money - Not Being An Informed Consumer

Being an informed consumer allows you to make the best choices for your financial life because you've made the effort to gather important details before making a decision. Informed consumers benefit in the short and long term. Comparison shopping whether in person or online can lead to increased knowledge about the item that will allow you to make better choices or help you find great deals. Comparison shopping also allows you to benefit from high quality products and services at better prices than you may have otherwise paid while making it more likely that you find exactly what you were looking for.

Informed consumers usually spend for quality rather than quantity. Ladies, why pay $40 each for several purses that quickly fall apart year in and year out when you can spend $200 on one well made classic that can last you for several years or more? The same thing goes for shoes. Men and women's shoes that are well made can be re-soled and with proper care, will look and feel great for several years or more. When searching for a home, are you going to read the fine print, get your own inspection, etc. or are you just going to trust that everything is above board? Make the effort to get the information that you need to make the most sensible money choices for you.

Remember: nobody can possibly care more about your money than you.

© 2012 Express10

- 5 hard facts on retirement - - MSN Money

These sobering truths about the cost of retirement make it clear that when it comes to saving for your golden years, sooner is better than later. - MSN Money retirement-plan tips and articles

- Kids and Money - Money 101, Lesson 12 - Money Magazine

Check out Money's parent guide to kids and money. Help put your children on the road to handling money responsibly.

- How Much Should People Have Saved In Their 401Ks At Different Ages | Financial Samurai

A realistic guide to how much you should have in your 401K at different ages. The 401K is a woefully light retirement tool. But, it's better than a poke in the eye.