Economics 103

Introduction

The role of government in economics is the focus of this tutorial. Our government is a republic, or a representative democracy. We elect leaders to represent us in Congress and the Executive branch. In turn, they make laws and enforce laws that governs all of our behavior. As part of that responsibility, it includes economics.

- April 2020

The Proper Role of Government

In the Constitution, there exist a commerce clause. It is the framework of how our government is to work in promoting commerce across State lines. It is also the idea of a limited Federal government that does the minimum to maintain order and fairness but allow the people free exercise to conduct commerce.

What are some of the duties?

- a banking system

- a treasury that print money and collect taxes

- a Federal Reserve that set interest rates and control the money supply

- an agency like the SEC which monitors the stock exchanges...

- a host of other agencies like FTC that is there to promote fair trade and open competition

What Is and Is Not the Role of Government

One thing is for sure, our government was never intended to pick and choose winners and losers. That is to say, in a free and open society, government should not play favoritism. For example, if GM and Ford are both car manufacturers, the government should not favor one company over the other in their dealings. In any government contracts, there is an open bidding process. The company that can deliver the same goods at the lowest prices wins.

Another key role is to prevent a monopoly. The government will not allow one company to buy out a competition and be left as the only game in town. In the past, when a company becomes too large and dominate an industry unfairly, the government has stepped in to break it up as it has done with injunctions against ATT IBM and Microsoft just to name a few.

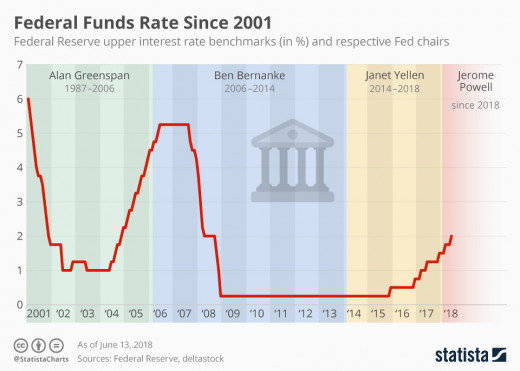

The Federal Reserve

The Federal Reserve is an independent entity. One of its important role is to set interest rate target. The interest is the cost of borrowing money. This is one of the tool used to stabilize the economy. When the expansion is too fast, a higher rate will discourage business investment, where as in a recession, a lower rate will stimulate growth. That is the general theory but in practice, it may not work as planned. There are other factors that may influence the business cycle.

The other tool it has is called Quantitative Easing. It is a fancy name but it is simply printing money that we don't have. This is how the Federal Reserve fight recession by borrowing money from our future. By keeping interest very low, it is essentially "free" money.

A Picture Worth A Thousand Words

General Principles

The SEC is a federal agency overseeing the stock market and other investments such as futures. The goal is to make the environment behave fairly and without fraud or cheating. Many of the regulations and guidelines and forms are to keep companies honest and report their finances properly, while also keeping individuals from engaged in insider trading.

In theory, it suppose to work to keep the market a level playing field. In practice, it favors the rich and powerful. For example, did you know Congress members are exempt from insider trading rules?

Just recently, we learned about four US Senators who sold their stocks after being briefed on the coronavirus outbreak long before the market downfall.

Summary

This is a very brief summary of government involvement into our economy. As you can see, we don't really have a free enterprise system. Ideally, everyone should have equal access to investment opportunities. In practice, we know for a fact that only the rich have access to hedge funds. They are able to get returns on investment at a much higher rate.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2020 Jack Lee

![Obama's General Motors [GM] Tarp Bailout - The Untold Details Obama's General Motors [GM] Tarp Bailout - The Untold Details](https://images.saymedia-content.com/.image/t_share/MTc0MTU0NDA1OTcxNzY1MTE2/obama-general-motors-gm-tarp-bailout-untold-details.jpg)