Economics 104

Introduction

Despite the disadvantages placed on the average investor, there are ways to participate in this wealth creation and growth. Understanding how the system works is just the first step. The next step is to position yourself to take advantage of all the wealth that is available. There are millionaires created everyday.

- April 2020

Background

Wealth creation is about making good choices. There are many elements to that. I will touch on a few of them. It starts when we are growing up and choosing our careers.

- education

- career

- saving and investing

- retirement planning

Choosing the career path is important since it dictates what kind of higher education that is required. Education and knowledge is accumulated wealth. Wealth is not always about money.

A career for most of us lasts 3 or 4 decades. This is our main job. It is where we earn the bulk of our salary and make our dent in the world.

Saving and investing goes hand in hand and it starts from the day you leave school and enter the work force.

Retirement planning is something most people don't think about until it is too late. It is advised that we start thinking and planning at least 10 years before retirement.

Personal Investing...

The economics of personal investing is very simple. Time is your friend. The sooner you start, the better you will be. Regardless how much you make or how high a position you may have, it is how much you save and put away that dictates how well you will end up.

"Time is money" is really true. The more time you have, the more money you can make. In the first tutorial, I said money is labor. Labor is time performing some function. In addition to that, there is an escalator where money saved and invested will grow or compound with time.

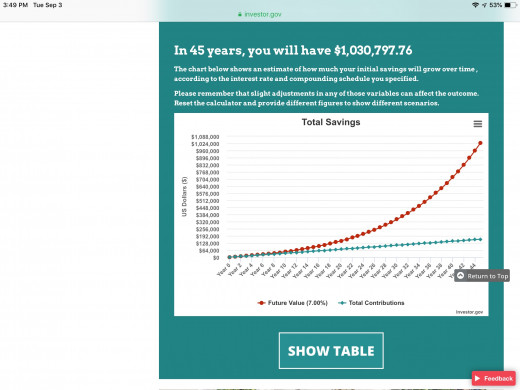

Checkout the following chart. An investment of just $10 per day, over 45 years with an average return of 7% will make you a millionaire.

How Do You Get 7% Return?

It seems simple enough but how can anyone get 7% return these days? Most banks and CD are only paying less than 1% interest.

The only answer is the stock market. The S&P index has on average risen 7% per year for the last 40 years. Moreover, in any time slice of 10 years period, the S&P has never gone negative. Think about that. This has an important implication for investors.

It means, as long as you are a long investor, with a long horizon of 10 years, you can invest in the stock market without fear.

The only caveat is that you keep enough cash on hand to carry you over a few years of major corrections.

Plot of the S&P Index Over Last 40 Years

Summary

In this tutorial, I have demonstrated that anyone can retire comfortably if they make the right choices.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2020 Jack Lee