End Your Money Crisis Now: Get a Hold of Your Money

Houston, We Have a Problem!

One of the major things you can do to end your money crisis is to admit you have a problem. Just because everyone have loads of debt to acquire things to look like they are living "The American Dream", doesn’t mean it's what you are supposed to do. Stop living a lie. Stop lying to yourself like you have it all together. Look at the person in the mirror and see things for what it is. Having loads of debt to your ears is not normal. Using credit cards to help you "stay afloat" is not normal. Living paycheck to paycheck and having more month than money is not normal. If this is you, Houston, you have a problem! Don't fake it till you make it. And don't believe that your family and friends have got their lives altogether either. No, the grass is never greener on the other side, and no, the Joneses are not all that!! Don't believe the hype!

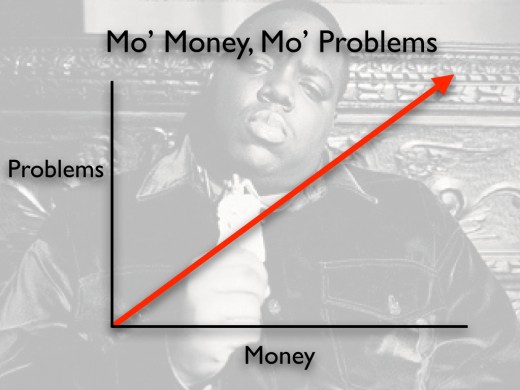

Mo Money/Mo Problems

Many people think making more money will solve all their financial problems. News flash: If your finances are not handled responsibly, making more money isn’t going to make a difference. On average, the more money a person makes, the more money they spend. Don't reward yourself with a new car because you received a raise. The only thing you are rewarding yourself with is a new monthly note, a higher insurance premium and car maintenance fees. Notorious B.I.G. was not lying when he said, "Mo Money/Mo Problems". Making more money is not going to solve your financial problems if you don't know how to manage your money.

Forget About "The American Dream"!

Get a hold on your finances by creating a budget. Creating a budget is something you can do and easier the sooner you start. Don’t make the mistake thinking you must wait until you make more money. Focus on mastering how to handle the money you have now. Think about it, if you aren’t able to handle the little money you have now, how do you expect to handle more money? Your money will just slip through your hands and you will be all confused, wondering where it went! The goal here is to remove your idea of the "American Dream" by living below your means. People these days are living well beyond their means. They are living paycheck to paycheck and even using credit cards to help them stay afloat. Find the root of the problem. Track your spending habits and cut and minimize or remove the extra spending.

See the Educational Video Version of this Article..

Listen to the Educational Video Version on SoundCloud!

- Change the Way You Think About Money by Queen Kay Life Podcast | Free Listening on SoundCloud

Stream Change the Way You Think About Money, a playlist by Queen Kay Life Podcast from desktop or your mobile device

What is going to be the hardest for you to reduce or remove from your spending?

Don't Make This Mistake When Purchasing a Vehicle!

When purchasing a vehicle, the #1 thing one may ask the car dealer is "How much is the car note?" The car dealer, will be like, "How much can you pay? Let's get you in that ride." When purchasing a vehicle, there are other numbers you need to look at than just the monthly note. You need to look at the total amount of the car. Is the amount they are asking worth it? You might even need to bring a calculator. Even if that car dealer is able to provide you with a car note you can afford, can you really afford it? Does paying that small car note on a 14% interest rate for 6 years is something you can live with? At that cost you could have purchased a newer, nicer vehicle. Look at everything because all three numbers greatly affect the actual amount you are paying on your vehicle.

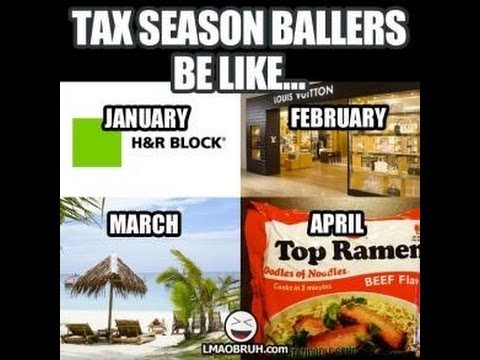

Don't Be An Income Tax Baller!

Don’t be like the income tax ballers who are buying cars and clothes, and shoes. These people usually come across a windfall of money and splurge on the luxuries that they couldn’t otherwise afford. This newfound money isn’t enough to pay for these things in cash, usually it is just enough to put cash down on something that will have to be paid off later. I used to envy these people flashing off those new cars. Now I just shake my head because they are actually flashing an additional car note, car insurance payment, and car maintenance expenses to their already overbearing expenses. If they were smarter, those tax refunds could have been used to pay off existing debt, pay for an asset where they can actually make passive income on, anything else but accrue more debt.

Steer Clear of These Right Away!

- Credit Cards: Get rid of and stop using your credit cards right away. No longer use credit cards to make your everyday purchases. Credit cards are not your friend. Just because your got approved for those cards, does not mean you are “winning” and doesn’t mean you financially wealthy. Credit card companies are making millions each year because people are religiously making the minimum payment each month. You will never pay of your credit card this way. All you are doing is paying the interest on the balance. As long as there is a balance, you will always have an installment payment due each month.

- These Marketing Slogans: "LOW INCOME! NO CREDIT! BAD CREDIT! NO PROBLEM!" If you hear any of these marketing slogans, run away, fast!! Never fall for anything that is easy to get. You will pay for it in the long road, and hard! These companies may sound like they are trying to help you, but they are not. They make money stretching out the payment terms as long as they can so they rack up on interest payments. You can end up paying 600% in interest charges if you don’t pay them back right away.

-

Rent-To-Own Furniture Stores: If you actually pay out that couch in those 24 month term, you could have paid for 2 couches!!! You might be able to get the couch the same day by making a small low down payment and by making those easy “convenient” monthly payments, but trust me, you will pay for it in the end! Those Rent-To- Own companies are making millions from those customers who want things now and not later. Do without that couch for a few months, save and pay cash for your couch.

Learn From The Experts

Learn all you can about money. Educate yourself and seek credible experts who has won with money. Think about it: Does it make sense to ask a broke person how to manage money?

Dave Ramsey "Budgeting" Money Makeover

You Can't Afford to Wait: Start Today!

If you haven’t already, please create a budget for your home and stick with it. There are free budget calculators all over the internet. Find one that works best for you and your family. You can't afford to put it off any longer. Start today!!