Extracting Value From the Credit Union Supply Chain

A key differentiator between a credit union and a traditional financial intermediary is that the members (owners) of the credit union are also its customers. In a bank, the capital providers (shareholders / owners) may also be customers, but there will typically be a larger number of customers that are not shareholders than those who are. These two stakeholders have different self interests and each seek different value from the bank. The customers will be looking for value in the products, services, total cost of dealings, etc., while the capital providers are looking for value by means of profits, retained earnings, dividends, and increasing the value of their shares or stake in the organization (capital appreciation).

A further difference that is a bit more subtle is that typically a large proportion of the suppliers (and therefore supplier cost) of a credit union are also members (i.e., its employees). These members typically also use credit union products and services and so they are at once customer, supplier, and owner. In a traditional financial intermediary these three stakeholders, while not mutually exclusive, are three different groups of entities with their own goals and aspirations to extract value from the financial intermediary enterprise.

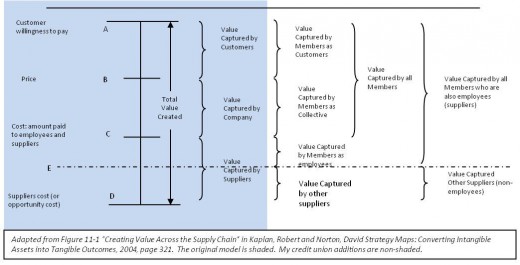

The diagram below provides a modified view of the traditional representation of the extraction of value from the supply chain by the three main groups of stakeholders.

In the traditional view (shaded section of the diagram), each of the three slices (lines AB, BC, and CD) of value are being pursued and attempts are made to maximize each slice by those in pursuit. For example, Walmart’s strategy is to push line C as far to the bottom as possible thereby allowing their customers to push line B down and Walmart and their customers share larger slices of an enlarged value pie (at the supplier’s expense due to Walmart’s price/cost differentiation strategy of tough negotiations with suppliers). Whereas, Microsoft and Intel use their near-monopoly positions to capture most of the value pie for the company (pushing line C down and line B up).

This picture becomes muddied when the stakeholders of line AB and line BC are identical. There is no need to distinguish between these two lines in the model for a credit union. So, line AC is really the slice of value pie that is of interest to all members (as owners and customers). This is the area that is desired to be maximized for all members (as owners and customers). In maximizing that slice of value, the owner/customer members may encroach on the slice of value that the members (as employees) are simultaneously trying to maximize. Note: Dashed line E represents the lower boundary of the value available to all members (as owners, customers, and suppliers).

It is also interesting to note that one could argue that the membership group that is most at risk of a credit union failing is the employee group as they would lose their source of income. However, because no other member individually owns any of the collective capital of the credit union, those members could obtain financial products and services at another provider with little inconvenience and no meaningful individual financial loss. This is a key point that should be considered – members as customers can bank anywhere; why do they choose a credit union?

The "eureka" in the diagram is that line B and line C for a credit union should actually be the same line if we are to maximize value to members as customers and owners. In other words, price should ideally equal cost! Well, almost equal. If they were exactly equal then all value generated by the credit union would go out to current members (both as customers and owners) and suppliers. How does a growing credit union continue to ensure it maintains enough capital to allow it to continue operating – in other words, how does the credit union sustain itself for the members’ long term benefit? More on this to follow in a future post...

Credit Union Value / Supply Chain