FINANCIAL ANALYSIS TECHNIQUES - Liquidity Ratios

Introduction to Liquidity Ratios

Liquidity ratios are used to measures a company’s ability to meet its short-term obligations. These ratios measure how quickly assets are converted into cash to cover the liabilities. High liquidity ratio mean the company is more likely to convert the assets into cash in short term and vice versa. Liquidity ratios reflect a company financial position at a given time hence unlike activity ratios the data from the ending balance sheet is usually used for the liquidity ratios calculation instead of averages value. Now let discussed 5 different liquidity ratio:

1) Current Ratio

2) Quick Ratio

3) Cash Ratio

4) Defensive Interval Ratio

5) Cash Conventional Cycle

Current Ratio

Current Ratio = Current Assets / Current Liability

Every company has current asset and current liability. To be financially healthy the management shall kept the current asset more than current liability except the service sector where they always required customer to pay advance prepaid payment.

The higher the current ratio, the more likely it is that the company will be able to pay its short term liabilities. A current ratio more than 1 indicated that the company had more current asset compare to current liability (positive working capital). A current ratio of 1 would indicate that the book value of its current assets is equal to the book value of the current liability. While a current ratio of less than 1 indicated that the company has less liquidity. The company with current ratio less than 1 reliance on operating cash flow and outside financing to meet short-term obligation.

Not all industry had a current ratio > 1 as discussed earlier industry like mobile operator industry usually had a current ratio of less than 1. These is because mobile operator company usually sold prepaid card to their customer for their service in the following month which means their collect money before providing the service (unearned revenue which is included in the current liability).

In current ratio, we assume that the inventories and the account receivables are liquid which presumably not the case when the inventory turnover is low. In the case where the inventory is had to liquidate current ratio is not suitable for the analysis. Then come the quick ratio as discussed below.

Quick Ratio

Quick Ratio

= (Cash + Market Securities + Account Receivables) / Current Liabilities

Quick ratio as known as acid test ratio. Quick ratio is a more conservative ways to measure liquidity of a company compared to current ratio because it does not include inventories and others current assets which might not liquid.

Similar to current ratio, the higher the quick ratio, the more likely the company is able to pay its short term liabilities and vice versa. This ratio taken into account that a company is unable to convert their inventories into cash quickly, furthermore, if the company required to converts their entire inventory into cash quickly their might not able to sell all their inventories at the carrying value most likely will be sold at discount price (clearance sales).

As quick ratio still considering all account receivable is still able to be pay off by the customer paying credit whenever they required the cash. Normally these is not the case, most credit term has due date and some of it might not be collected and will impaired. Hence there is another more conservative method when the account receivable is remove from the formula which is cash ratio.

Cash Ratio

Cash Ratio = Cash + Marketable Securities / Current Liabilities

Cash ratio is the most conservative liquidity ratio among the three. Cash ratio removed the account receivable from the quick ratio. Similar to the previous to ratio the higher the cash ratio, the more likely the company is able to pay its current liabilities and vice versa. Cash ratio taken into account not all account receivable is able to be collected back, some of it might be impaired.

Although cash ratio is the most conservative liquidity ratio, there are cases like during financial crisis the fair value of the marketable security might reduce significantly hence these ratio might not able to provide a reliable information.

Defensive Interval Ratio

Defensive Interval

= (Cash + Marketable Securities + Receivables) / Average Daily Expenditure

When analyzing a company, we will like to know how much cash / liquidity asset the company have to pay their daily operation when there is no cash inflow. These is importance because without the spare cash when there is no cash inflow for a few days (no sales) the company cannot sustain itself and it operation.

Defensive interval ratio is use to measures how long a company can continue paying its daily expenditure from its existing liquid assets without receiving any additional asset. A defensive interval of 10 would indicate that the company is able to continue paying 10 days of its expenses before running out of liquid assets.

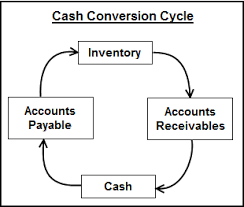

Cash Conversion Cycle

Cash Conversion Cycle

= Days of Outstanding + Days of Inventory on Hand – Days of Payable

As per formulae above the cash conversion cycle uses the activity ratio which had been discussed previously. Cash conversion cycle is always being confused with operating cycle. Operating cycle does not include the day of payable into the formula.

Cash conversion cycle is the length of time it takes to turn the firm’s cash investment in inventory back into cash, in the form of collection from the sales of that inventory. As a good businessman want to collect back the money they borrow as early as possible and pays their debt as slow as possible. However the management had to play around with the credit term without giving customer a credit term they might go to the competitor and easy credit term will cause the cash collected back very slow and company might had cash flow problem. Besides that, the management of the company also required to pay their debtor as late as possible but not too late because some might cause penalty charge and end up paying more. It also will cause the company had to lend funds for capital investment if their are not good payer.

A shorter cash conversion cycle means a higher liquidity which mean the firm is able to collect the money from sales fast and pay its payable for purchase of inventories late and vice versa

Liquidity Ratio Criteria

Liquidity Ratio

| Criteria

|

|---|---|

Current Ratio

| > Industrial norm

|

Quick Ratio

| > Industrial norm

|

Cash Ratio

| > Industrial norm

|

Defensive Interval Ratio

| > Industrial norm

|

Cash Convertion Ratio

| < Industrial norm

|