- HubPages»

- Personal Finance»

- Tax & Taxes»

- Tax Advice

Filing Your Tax Return With Missing or Incorrect K-1

The Problem

Nothing is more frustrating than waiting for tax information. W-2s and 1099-Rs are required before filing. You can file without a W-2 or 1099-R in hand if you follow a few simple rules. Missing K-1s are a different matter.

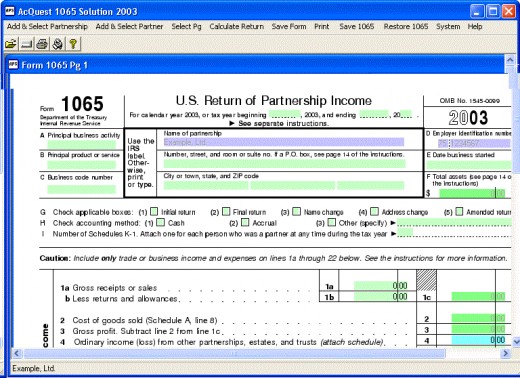

You have a paystub to help you prepare a substitute W-2. With a missing K-1, you have to estimate the profit of a company without access to the company's books. K-1s are not due until the due date of the entity, meaning you will have to file an extension if a K-1 is late.

Consider This

For every tax problem, there is a solution. Use this article for future reference on missing tax documents. Use the solution below to handle missing or incorrect K-1s. Consider selling an investment that issues K-1s later than April 1st. A business that far behind in their paperwork may have other problems as well.

Other resources include:

IRS Appeals, and

The Solution

A reasonable effort must be made to acquire a missing K-1. Since most K-1s are not due until April 15th, there is no remedy during the regular tax season. You must file an extension.

Form 8082, Notice of Inconsistent Treatment or Administrative Adjustment Request, is filed for missing, incorrect, or inconsistencies on a K-1. The form name sound horrible, but isn't that bad. Form 8082 should be filed for missing and incorrect K-1s and also for instances where your treatment of a tax situation is different than the entities, such as the capital account.

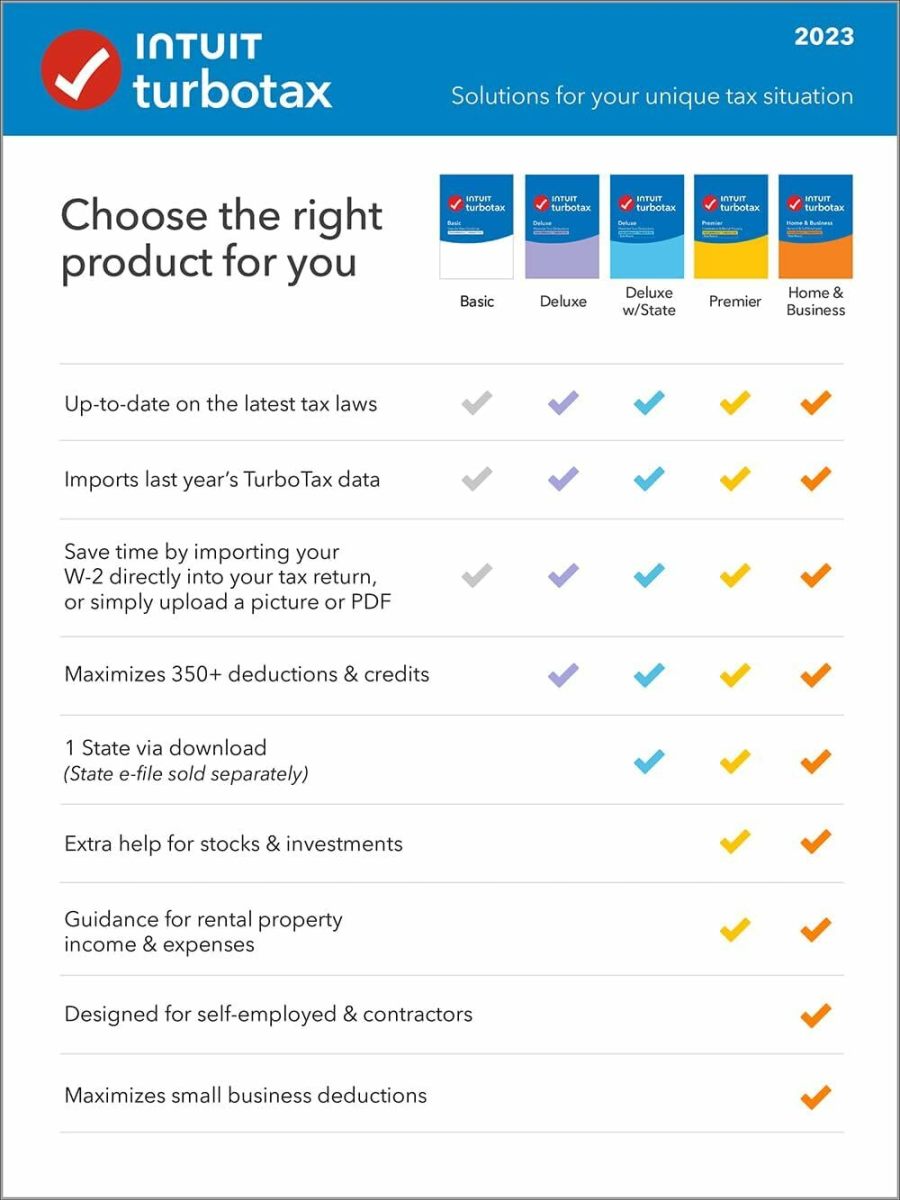

Most online tax software has Form 8082. 1040.com is the best. If you use a tax professional, explain the situation to him. He can file an extension, make efforts to acquire the K-1, and file Form 8082.

Best Online Software to Use

The best online software to use when you have missing or inclorrect K-1s, W-2s, or 1099s is 1040.com. Most people can file for free and for high income people the fee is amoung the lowest in the industry. Be sure to follow the rules outlined above in this article.