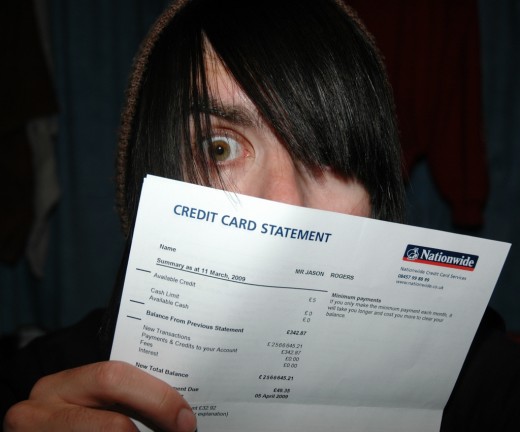

Financial Fitness For Those Up To Their Ears In Debt

The month always seems to be far longer than your paycheck lasts. Every sent you earn is allocated to some form of commitment. You seem to be dipping into your savings more than ever and your debt is at an all-time high. You simply can’t afford to clear off your revolving loans, you need it to survive throughout the month. What are your options?

Drop Your Style

Many people end up in a mountain of debt because they are trying to keep up appearances. When things go wrong and they need to start selling their goods, their friend and family are horrified and usually have no idea that things were that bad. This will include moving into a cheaper property and getting renters into yours to cover your instalments if you happen to still be paying off a home loan. Cheaper transport and entertainment will also need to be considered.

Plan Your Meals

This may seem simple enough, however, very few families actually do this. Taking an afternoon over the weekend to prepare and freeze meals for a week or two ahead, will save quite a bit in the long run. This will also take some of the restaurant and takeout bills out of the equation.

Follow old recipes passed down from generation to generation to prepare baby meals as the bottled options can be quite expensive. The best part about preparing baby food yourself is that you know exactly what you’re putting into it.

Canning, preserving, freezing and drying are more methods in which to make your food last a little longer instead of having it end up in the trash can. Some of these methods are still used today to preserve foods in rural and rustic areas that have very little access to stores.

Keep an eye out for websites that are able to produce recipes from the food you have in the house. This will save you an extra trip or two to the shops for unnecessary ingredients. Often, the most delicious combinations come out of a kitchen with seemingly no ingredients.

Start Off By Paying A Small Percentage Extra

Once you start freeing up some of your cash, start clearing off your debt by paying a little bit extra every month. Once you’ve paid off one of your debt items, start with the next one.

Saving For College Starts From Day One

Getting into debt early on in life is tough to break free from, but doing so when your kids go to college even more so. By saving up for college from the day your child is born, will not only take a lot of pressure off you but also your child. Even the smallest savings can make a substantial difference to that college bill.

Save On Transport

Do a few calculations to figure out whether your mode of transport is more expensive than the alternative. If using a different mode of transport is simply not possible and you happen to use your own vehicle, find out whether there is someone who is willing to carpool with you in order to split the costs. Keep to just below the speed limits in order to save a bit of gas and ensure that your car is serviced regularly to reduce costs. Many of the services are cheap and can usually be done at home, for instance, oil changes and spark plugs. It’s also important that you check up on the tire pressure and battery water as well, as these things could turn out to be quite costly in the long run. When you’re struggling financially, it’s easy to fall behind on services but it could end up costing you much more in the future.