Financial Literacy and Mindset Training-Evidence and Implications for Financial Education in Papua New Guinea Schools

As PNG aspires to be a modern nation that is politically and economically independent, she is faced with a daunting task of understating the underlying dynamics, governing its political and economic welfare. Economist and independent thinkers are beginning to investigate the causes and consequences of financial illiteracy in Papua New Guinea (PNG) to better understand why many small businesses and individual entrepreneurs fail to succeed in business as compared to their Western counterparts operating in PNG.

A basic review reveals that even many small business and individual entrepreneurs are familiar with the financial concepts thought in schools around PNG, may lack the basic understanding and the necessary mindset required to prosper in business. Financial illiteracy is not only widespread in PNG, but other parts of the world. Young and old and, in PNG and across the world appear to be woefully under-informed about basic financial concepts from the conception of a wealth creation idea to actually creating wealth. Lack of this critical, yet basic understanding of the vital financial concepts and the necessary mindset required, results in serious implications on major financial decisions such as planning, budgeting and, saving and investment. This financial knowledge deficiency is noticeable at both local and global level. This represents an ever-widening gap between Western business and indigenous business. The gap poses new and complex challenges that may demand multiple solutions

In response, Government, Churches, Corporate bodies and Non-Government Organizations have undertaken initiative to teach financial literacy to enhance the understanding of financial knowledge in PNG. However, the general trend observed from this review is that many small business and individual are still failing to prosper in business.

The driving question asked by SkillTech Corporate Training is; Are we treating the root cause of financial illiteracy in PNG or we just treating the symptoms?

In this juncture, we stop to observe a strong challenge mounted by Narokobi (1983). Narokobi said;

“It is disappointing that Papua New Guineans have not realized the tremendous heritage they posses”

He also claims that people in the Government and outside the Government have not grasp the history and cultural values that exist in the country. It is no different to Narokobi’s calling that many Papua New Guineans haven’t grasped the values and the tremendous potential that exist within them.

Skill Tech Corporate Training however, has taken a slightly different approach to understanding this situation in a deeper sense; that, understands the mindset of those involved in wealth creation activities. The simple question we ask is “Given the same amount of resources; same climatic, geographical and economic conditions, why do other’s succeed while others fail?”. Here we observe some evidence and implications for financial education in Papua New Guinea Schools and suggest some ideas for further detail research and recommended for financial literacy to be taught in PNG schools from the very bottom level to tertiary institutions.

Financial Literacy

Understanding the phrase financial literacy in itself posse a fair degree of difficulty to lowly educated small business owners and entrepreneurs in PNG. It is even more surprising to see highly educated individuals in PNG lacking basic financial education and the necessary mindset required to prosper in business.

What is financial literacy?

The dictionary definition of financial literacy is; the ability to understand finance. More specifically, it refers to the set of skills and the knowledge that allows one to make informed and effective decisions through their understanding of finance.

Taking another definition of financial literacy;

Financial Literacy is the ability to read, analyze, manage and discuss Financial Conditions that lead to Economic-wellbeing

Distorted perception of financial literacy

The general public’s weak grasp of financial literacy has been only part of our greater financial problems. Financial literacy in the high echelons of some of our banks has been pretty poor, too. They fail to comprehend the extent of liabilities they had run up. Financial illiteracy is not just about planning, generating revenue, budgeting, saving and investing. There is more to it than what one observes on the secondary or tertiary level. Financial literacy is about a holistic, integral development of a human being that encompasses his physical, spiritual and mental makeup.

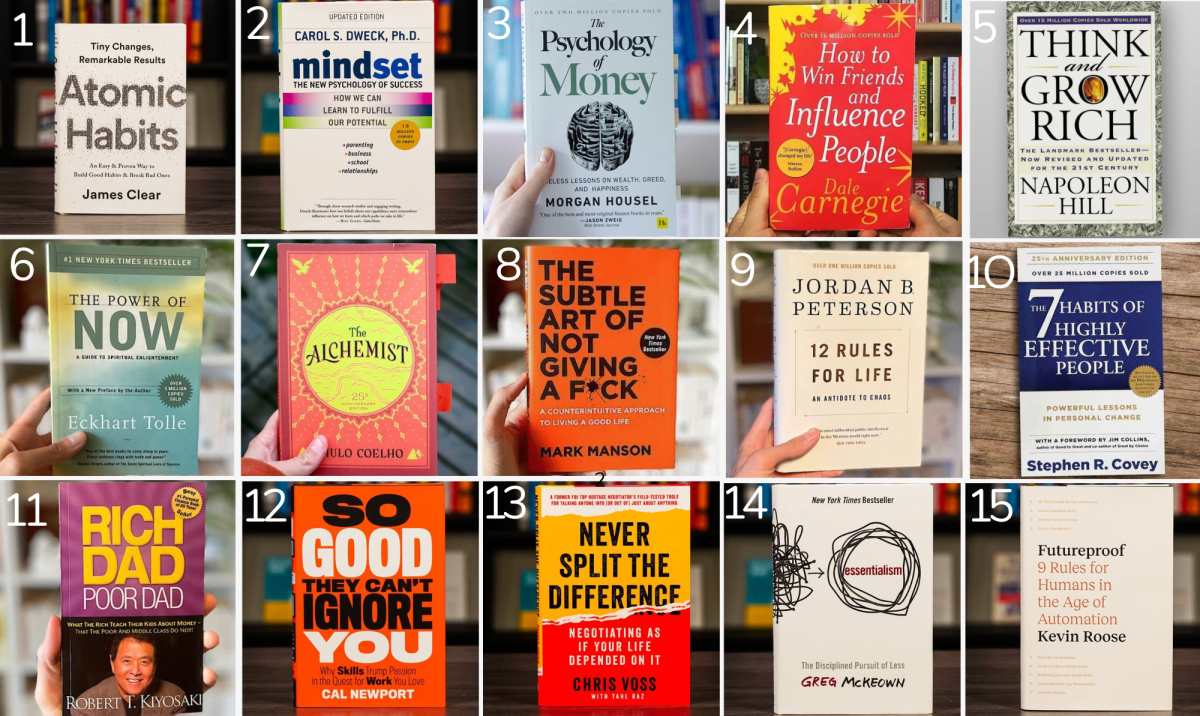

Causes of Financial illiteracy-Mindset

When presented with the opportunity to discuss causes of financial illiteracy, one often jumps to listing down the social, economical and political causes of financial illiteracy. What is often neglected is the root cause of these problems. What motivates of demotivates a small business owner in PNG to do what he does daily? What is it that his Western business counterpart operating in the same locality has that he lacks?

Take an example, an Asian and a Papua New Guinean may open two tucker boxes beside Waigani market in Port Moresby. After few years, the Asian prospers and expands business to wholesale and retailing, all creating different streams of income for the Asian man whilst the Papua New Guinean man either remains as tucker box or runs out of business. Again we ask; what is it that the Asian man has that the Papua New Guinean man doesn’t? The answer boils down to mindset.

Mindset

+ Positive Mindset

- Negative Mindset

Putting it simply, mindset refers to a person (s) setting of the mind. It may either be positive mindset which is denoted with a (+) symbol or negative mindset denoted with (-) symbol or both.

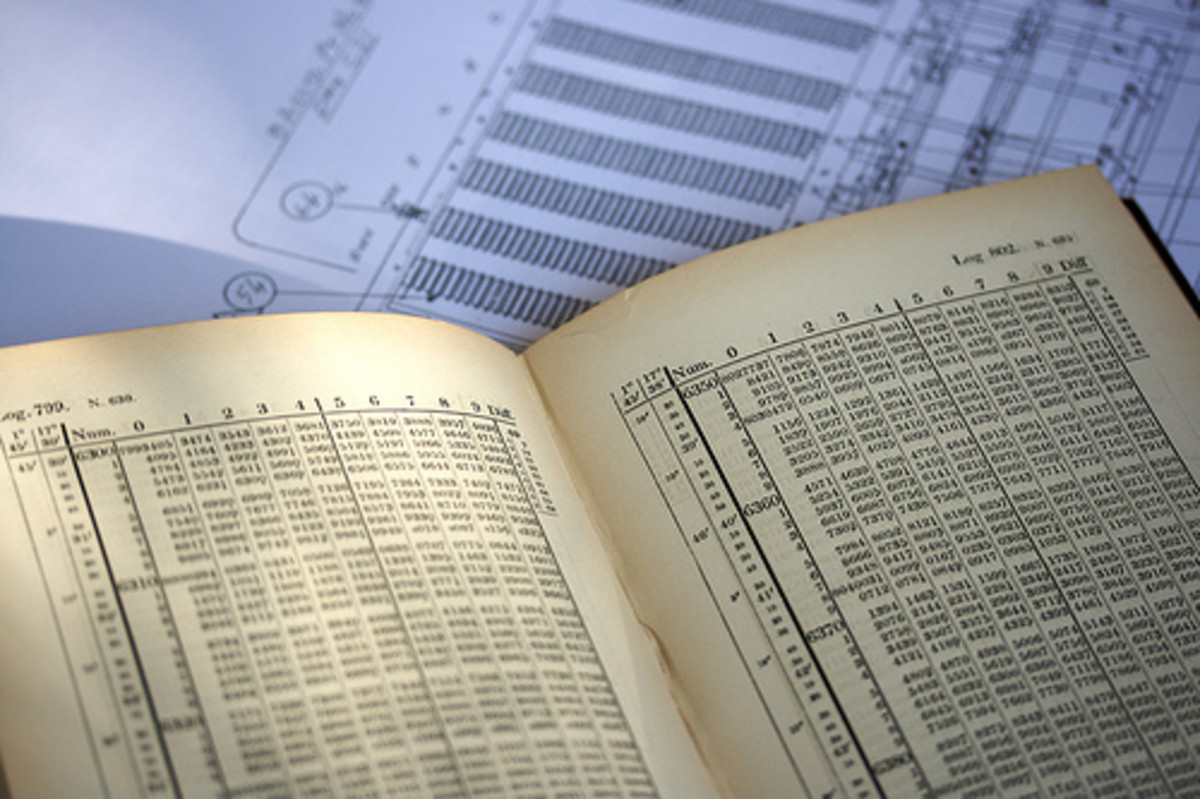

Creating wealth as we aspire to achieve follows a simple mathematical formula that combines a person’s mindset and attitude;

(-) + (-) = 0 (Fail)

(-) + (+) = 0 (Fail)

(+) + (+) + 1 (Success)***

Formula explained

Negative mindset + negative attitude = Failure

Negative mindset + positive attitude = Failure

Positive mindset + positive attitude = Success

Scenarios

If a $100 was given to a person with negative mindset and negative attitude, that $100 will be blown with 24 hours or even lesser time. If that same amount money was given to a person with negative mindset but has positive attitude, that money will also be blown. But if same amount of money, $100 was given to a person with positive mindset and positive attitude, the amount will be double or tripled.

Time line if Life

To fully understand the root causes of financial illiteracy, it is vital to understand ones timeline in life. Few questions we ask are listed;

1. What is the choice of your destination?

2. What decisions are you making daily to bring you to your destiny (Discipline)?

3. What level of academic, professional and financial literacy do you have?

Every individual create their own life with their thoughts. The master beautifully and wonderfully bestowed upon humanity, the power to create. When one decides to be economically well or financially free, he sacrifices other things over his decision to be financially free. He is willing to discipline his daily habits.

The success of that individual depends on his self-awareness, the external positive and negative influences and the habits he practices daily. The life expectancy of Papua New Guineans fall between 60 and 70 years. The diagram simply shows us economic efficiency of a working class in PNG. At 70 years and over, one is believed to be gradually winding down to enjoy his old age.

Implications of Financial illiteracy

When one is born till the time he lands a college degree, that individual has countless dreams and the value of his dreams are big. Along the way, negative influence keeps reducing the value of his dream. Some end up getting a degree that keeps them bounded in a system or structure that that exploits their mental and physical resources at a fixed rate. This is the thing call JOB. Potential entrepreneurs in PNG may have great business ideas and positive mindset (+) but aren’t doing so because they fear losing their job means the whole world ends, which is negative mindset (-) as observed in the simple mathematical formulas presented already.

Conclusion

A basic review reveals that even many small business and individual entrepreneurs are familiar with the financial concepts thought in schools around PNG, may lack the basic understanding and the necessary mindset required to prosper in business. Financial illiteracy is not only widespread in PNG, but other parts of the world. Young and old and, in PNG and across the world appear to be woefully under-informed about basic financial concepts from the conception of a wealth creation idea to actually creating wealth. Lack of this critical, yet basic understanding of the vital financial concepts and the necessary mindset required, results in serious implications on major financial decisions such as planning, budgeting and, saving and investment. This financial knowledge deficiency is noticeable at both local and global level. This represents an ever-widening gap between Western business and indigenous business. The gap poses new and complex challenges that may demand multiple solutions.