Financial Basics, Some ABC's

January 10, 2011 updated September 31, 2014

Financial Advice, The Basics, A.

A. Always leave your self some financial padding in your checking / debit account.

- Today's banks are not your grandparents or parents banks. In 2014, they are mainly in business to make money.

- With the banking bailout of 2010, came proof that these financial institutions are not there to take care of the average depositor.

- Today a customer pays more fees, deposits by customers have longer and inconvinient holds, so debits can go through first are just one of the ways banks make a 300% profit on insufficient funds fees.

- Losing a lot of money to bank charges in a short time has taught us that it is wise to always keep at least $20.00 in each account for padding. If all you have is a debit card, ATM, savings, or checking account try to keep at least $20.00 in there at all times.

- Pretend the $20.00 is not there at all. For-get-about-it.

- The padding is your own personal insurance that unexpected fees levied, or delayed deposits will not wipe out your funds.

Just this one simple building block of Basic Financial Advice,

- This will save you a lot of money over the years.

A. Keep a Padding of Money in Your Account

Financial Advice, The Basics, B.

B. Beware of offers for things that are not really wanted or needed.

- Because an item is on clearance, or deeply discounted, in close-out or buy one get one, does not necessarily a healthy budgeting move.

- Be aware of falling into temptation by believing the storytellers in the glossy and exciting ads you receive weekly in the mail, and daily on the internet. Advertisers and marketers spend billions to trick a consumer into buying products. High color and glossy ads, show only a dream.

- Buy only what you need, really want, and can use. If you do not have a place for it, or cannot use it today, you may not need to waste today's money on it. Put it back, or decline to purchase it at the checkout.

- Buy what you can pay for at the time.

- If it is necessary to put an item on a credit card, because a shopper does not have the money, stop to consider how you will eventually pay for it.

- Paying the minimum monthly payment on a Credit Card will keep you in debt forever. Not having it paid off means, this item you are willing to go into debt over, will never be yours.

b. Be Vigilant in Rewarding Yourself

Financial Advice, The Basics, C.

C. Clear out the old, clear a space for the new:

- Closets, cupboards and cartons can become full and running over in a very short amount of time.

- Doing personal property inventory is a good way to check the health of your spending habits.

- Credit is NOT EXTRA MONEY. Charge cards only benefit those who are able to pay them off each month. Not paying the balance off each billing period, causes the card user to pay someone else a very high percent, to use their own money..

- After inventory, after locating items that have not been touched in more than three months, make a decision to use it, or pass it along.

- Clothing, recyclables, charity items that have been there more than three months are taking up your money and peace.

- Clean a new space for each new item. If you Must have a new item, make sure there is a specific place for it to go today.

- Make up your mind up today, what you will get rid of, donate to charity, or throw away, as a trade for space.

Financial Advice Basics, Make Your Own Plan

Rich Dad, Poor Dad

Personal Budget Kit.

D, E, F, G and Beyond

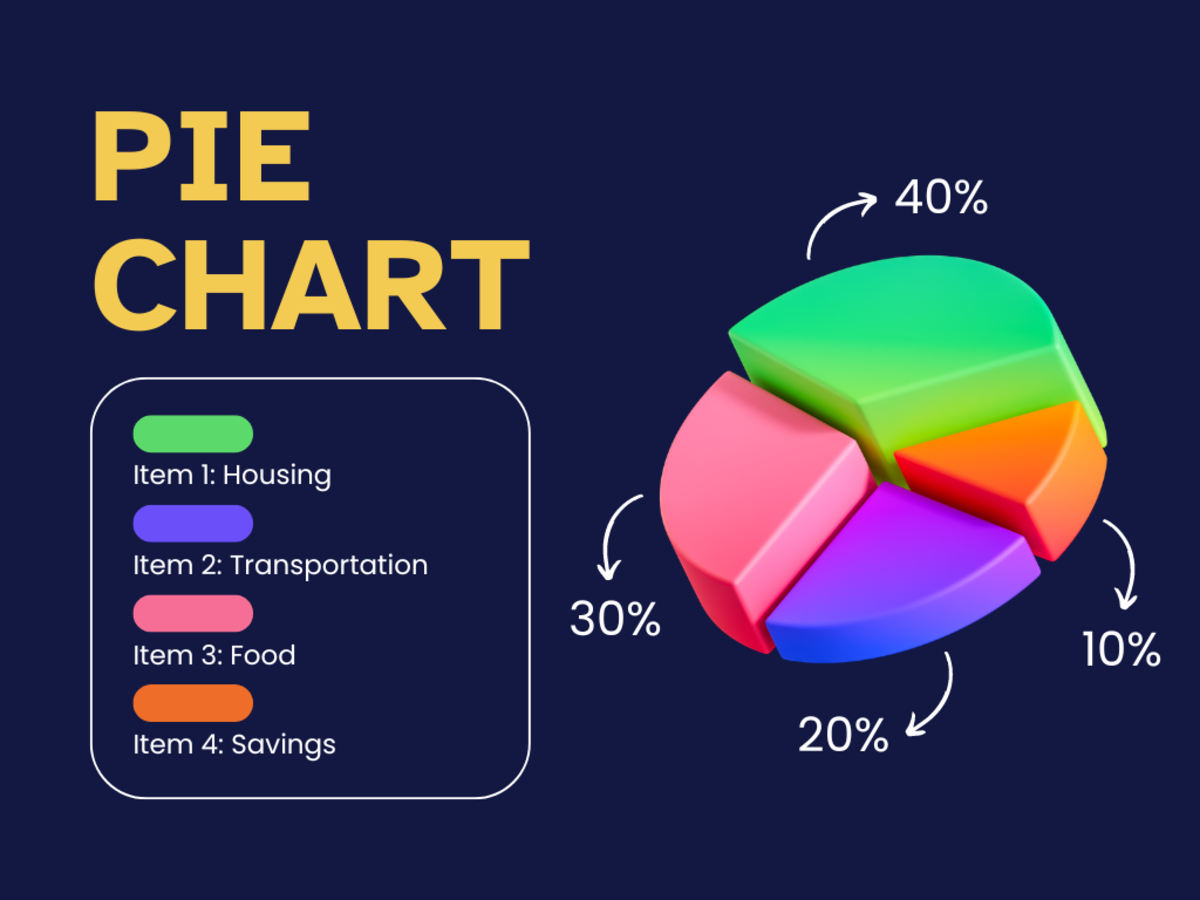

There are basic principles to budgeting and finance. This is not a topic people often discuss in a relationship or family. It is often a trickier subject to discuss than Sex. Humans are very connected to their finances.

If an individual, couple or family hope to have success in finance, they must openly discuss money and finance. Infidelity, and money problems are the main causes of divorce. There are so many programs available, to people, there is every possibility to traverse this rocky road.

No one is perfect, and in setting a budget or financial plan for the individual, couple or family, it is important that the budget doesn't become a terrible task master.

- It is important to budget Fun and Enjoyment in every person's life. This does not have to be a vacation to Disney World, it can be as simple as a standard Date Night for Mom and Dad. Camping equipment, or movie night.

- If the budget is not successful on the first try, it is like anything else; it takes time and practice. Do not be too hard on yourself for not making the budget, just learn from it, readjust and go on.

- In North America, there are many Counties, States, Cities and Parrish's who offer financial counselling free of charge or for a few dollars. Some of these programs actually will help First Time Home buyer's get down-payment assistance.

Organizations & Tools For Finance and Budgets

- Excel Free Family Budget Planner Spreadsheet

- Budgeting for home ownership

- Making Homeownership a Reality: Survey of Habitat for Humanity International Homeowners and Affiliat

Habitat for Humanity Int'l seeking to end Poverty Housing. - Owning a Home - USDA HUD

Several programs to help US residents into Home Ownership - Family Vacations on a Budget, Fun Things to do Outside, Arkansas Family Vacation

Arkansas is a great destination for family vacations on a budget. Arkansas offers lots of exciting activities and fun things to do outside that families, seniors and nature enthusiasts will enjoy. Visit some of our 52 State Parks, go hiking, explore

Personal banking

© 2011 Lori J Latimer