Fine Art Finance

Fine Art is an Asset Class

When people ask me ‘what do you do’…. I tell them Art and Finance. The most common reaction is - Wow, those are two different things! Well, actually art has been tied to finance as far back as the seventeenth century. Ever since there has been a market for art the two fields have been closely linked.

Aside from the artists themselves - a most interesting feature of art is that which makes it a commodity - its potential for buying and selling – and the return in real appreciable value over time. But this appreciation is more than financial – art can interrupt and change a person’s attitude. Even though works of art are just as viable as any other financial asset they are also enriching to the human psyche – and it is both of these aspects of art that keeps auction viable while moving our society to a different consciousness.

Until late in the 20th century, art had been exclusively for the amusement of only wealthy patrons. However, more recently the business of art has sparked the interest of the mainstream financial community. The fact that art is being considered an investment asset class, traded equally for its financial potential as for its aesthetic importance, is becoming accepted on the world stage. Art indexes are being developed to not only follow the sales of specific works of art but also to compare price movements in art with various indexes like the S & P – the Dow – the Nasdaq.

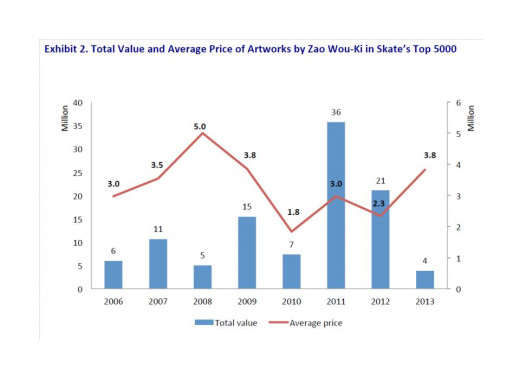

For example, Skates Art Investment Review points to Zao Wou-Ki’s artworks, an abstract painter who recently passed away. The strategy is based upon the performance of his work at auction over the last several years, bringing a doubling and tripling of prices from their estimates. Additionally, the work is scarcely seen on the market....

See Chart by Skates Art Investment Review

Being a supply – demand driven market, art prices are much like the prices in financial markets which result from pure economics and emotional decisions. Most who evaluate the value of art in the marketplace use dynamics such as cost/value, NPV against cash flows or calculating IRR to determine whether the returns on certain art investments will be worthwhile. What is fascinating to note, is that just after the great recession in 2008 there was an immediate drop reported by Artprice’s Art Market Confidence Index… but by the fall of 2009 global art sales had spiked to more $75 billion across all segments of the market; and this only accounts for those sales that were reported. By the fall of 2012 we see banner auction sales with Christies selling close to a half a billion dollars worth of contemporary art alone. It seems clear that art is not only big business, but that when other financial markets are down or sluggish investors seek refuge in art as a more viable and stable investment environment.

Art is also not a mass-produced item… nor is it mass-marketed. The value is often tied to a scarcity by increasing its desirability. Additionally, people tend to buy more art as their income increases – in economic terms this is called a high income elasticity of demand. But what is most important to keep in mind when looking to implement art as an asset class is that which makes it distinctive and to thoroughly assess the risks

Original art is unique. There is no close substitute – so its value is subjective.

There are very few buyers of art. Art is not a liquid asset – the major risk factor.

Risk tolerance and rate of return are always investment considerations. With art there are many aggregate submarkets – some of them hidden, and each of them possessing different risk factors. However, it is possible through careful consideration, expert help and analysis of the trading patterns for different artists to ascertain ways to hedge the risks as is the practice in other investment strategies such as with stocks and bonds. For example, art demonstrates a low correlation to more liquid assets, making it extremely suitable for portfolio diversification. And like stocks and bonds, returns can increase dramatically especially where there is a high risk tolerance in the investor. Wealthy people who are asset rich and cash poor may offer to stake their art as collateral against a loan, or speculate on future cash flows in art credit default swaps (ACDS).

However, where art as an asset class is most effective is in estate planning strategies - charitable donation being only one of these strategies, and not the most effective one either. Other tax strategies could include (1) securing a loan with the art as collateral from which to make a contribution to any kind of nonprofit organization – the investor retains ownership and usually possession of the art without reducing their liquidity in other assets.1 The investor also receives a more complete tax deduction than donating the art itself – and the interest on the loan can be mitigated against the investor’s current revenue streams. (2) Art can also be included in a charitable remainder trust. In this strategy an annual distribution can be made to beneficiaries and upon their death the remainder of the trust is paid to an exempt organization. The trust is exempt from income tax, so the trustee can buy and sell the assets without having to pay capital gains, and the grantor of the trust is entitled to an income tax deduction based on the present value of the remainder trust.2 Of course, whether this is appropriate for an individual investor remains a decision that needs to be discussed with an accountant or tax professional.

Now this only scratches the surface on art as an asset class......

What is important to realize about the art industry in general is that it lacks transparency, and there are very high transaction costs. But the art market is an intoxicating place where the cultural good is traded upon, and where the need for experts to decipher the fragmented nature of the art business is increasing and blossoming into new pursuits.

It has been predicted that within the next few short years, notable works of art will be selling for hundreds of millions USD – this is more than possible - it certainly will happen. Still, it remains important to recognize that works of art are cultural treasures which need to be preserved for future generations, and that the only good reason to buy art is if you love it….

Reference for this essay: 1,2: Claire McAndrew, Fine Art and High Finance; Skates Art Investment review; Artprice Art Market Index; Lain Robertson/Derrick Chong, The Art Business

The opinions contained in this essay do not, nor are intended to, provide any financial, investment, insurance, legal, accounting, or tax advice. Rather, it is intended to be used as an informational resource only. Art should be considered an asset only by investors who fully understand and can afford the risks.

Published July, 2013 - www.artequitymanagement.com - All rights reserved