First Credit Card:Tips for First Time Credit Card User

First Credit Card Tips

First crdit card tips - Things to look for while applying for first time credit card

Here in this post I am going to provide few vital first credit card tips, which would help a first timer to take a right decision to procure a good first credit card. When it comes to applying for first time credit card there are few critical things that need consideration. Your first credit card may very well be important for you, because that is one of the most vital steps for building your credit. Though there are many good credit card deals out there for a first time credit card user, there are also lot of unreliable offers from unethical card companies. It would, therefore, be wise for the applicants for first time credit cards to follow the vital tips given below, which would help them to procure a good first credit card:

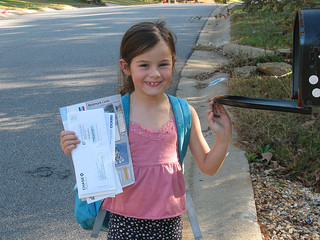

1. Avoid the credit card soliciting mails you often receive

Majority of Americans receive several annoying mails in a year containing credit card offers from unethical companies. In these offers all you have to do is to apply and you get a bunch of free stuff. Surprisingly, a high number of students and young people who are not conversant about the subject settle for such easy credit card deals with horrible offers as an effortless decision and not as the right one. There can not be two opinions that for something as important as credit card you must know how to get your card for the first time and the efforts needed to choose your cards wisely so that you can have your first time credit cards among the best out there in the market. If you are in USA you can avoid these worthless card soliciting mails by going go to the website, 'optoutprescreen.com' that lets you to shun these irksome mails containing credit card offers. This website helps you to avoid these offers by adding your name to the do-not-call mail lists at the three major Credit Bureaus. But the web site is only reachable through Internet Service Providers located within USA and its surroundings.

2. Go for Secured Credit Card

One of the best options for applicants for first time credit cards is to get a secured card. If your application as a first time credit card user for a regular credit card is turned down by the credit card company due to little or no credit you should go for a secured credit card. These cards are basically ‘starter’ cards, where you are to make down payment of about $300 to $500 as security deposit because you don't have a credit history. Over time, as you build up your credit you'll graduate into a regular credit card. Since secured credit cards charge high fees and restrict your credit, your aim is to move from a secured card to a regular card as quickly as possible. In order to do this you are to establish a good payment history by paying off your secured credit card dues on time every month. With a positive credit score it should not take more than 6-12 months for you to graduate to a standard credit card.

3. Do not go for exorbitantly high-fee credit card

There are many cards out there for first time credit card user that charge shockingly high annual fees like $80 or more per year. Such high fees may be logical for premium travel cards for which a first-timer won’t even qualify. Therefore, there is no point in paying an annual fee that high for first time credit cards. For a first regular credit card you should not pay more than $45 per year or even less.

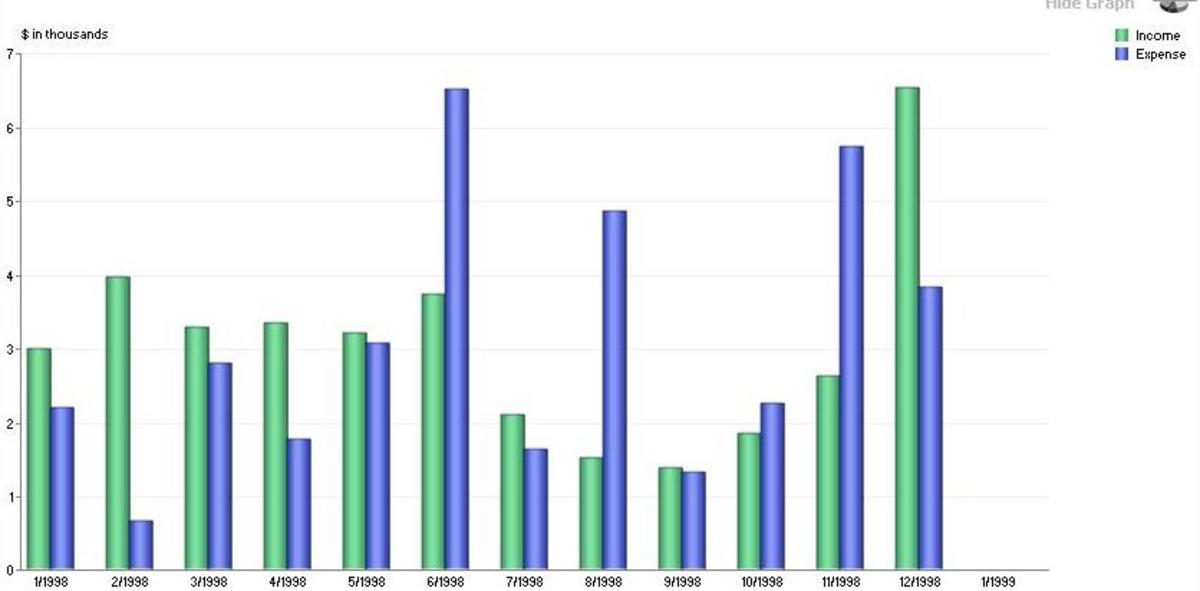

4. Try to avoid cash-back cards as far as possible

I know many of you will ridicule me for this statement but this is my discovery in my efforts to get my first time credit card. I can show you that cash-back cards actually pay you back an insignificant amount as compared to savings from other rewards program. It is true that with 1 percent pay back on all your spending in cash-back cards you get back $30 when you spend $3000 per month, which is surely better than nothing, but what if you could save more with a travel rewards card by getting free $600 flight and other rewards point? It may not be as noticeable as getting money each month, but in the long term you will save more with a card allowing free flight rewards. It is my strong belief that the majority of people would benefit more from travel rewards than from cash-back.

5. Do not go for retail cards

When you go for your first time credit cards it is usually not wise to apply for retail cards. The difficulty with retail cards is that you can not use the cards anywhere other than the retail store from where you got the cards. As a result if you can’t spend with the cards, you can not really build up your credit as quickly. On the other hand if you intend to spend with the cards you are compelled to buy items you may not actually need. Moreover, retail cards usually carry comparatively higher interest rates.

6. Compare credit cards online

You can find the credit card that is right for you by evaluating various offers online for which you can refer the website, 'bankrate.com'. Nevertheless, in order to get a good first credit card your bank should be the preferred place to approach for. Here the cards are linked to your bank account and you can select from a range of options including rewards, credit limit etc. However, for first time credit cards if you go for cards offered by your bank, it has both positive and negative sides. On the positive side such cards are easy to get without much research while on the negative side the rewards offered on these cards are usually seen to be quite average.

7. Make sure that rewards are valuable to you

You may be using your card rather frequently and spend a fairly considerable amount. Most of the card companies offer all kinds of rewards for using their credit cards based on the amount spent. Common credit card rewards include giving out prizes ranging anywhere from gift cards to electronic items with equivalent cash back as an option, free air flights etc. One who travels a lot, an airline card offering multiple free flights per year may be quite rewarding for him. But if you hardly ever travel, such card will have no use for you. Therefore, while choosing first time credit cards make sure that benefits and features of the rewards program associated with the cards are something you will actually want and value.

8. Do not go crazy with credit cards

It is important that when you, as a first time credit card user, go for having your first credit card, do it wisely and do not go crazy about cards. Be careful of being enticed by any number of card offers as every additional card you acquire, would add to complexity in managing your personal finance. As a common thumb rule it is good to have not more than 2/3 credit cards in your personal name (an American usually has four credit cards on an average!). Whenever a credit card company issues a new card, it checks your credit profile. Going crazy about cards may also potentially ruin your credit score before you even get your first credit card. Your credit score is determined on the basis of your sources of credit taken as a whole besides credit cards (installment loans, personal lines of credit, home equity lines of credit etc.) and is also influenced by the length of time you have been managing your credits. Paying off your debts on time and keeping a small number of card accounts are some of the methods by which you can build a good credit profile. Therefore, one of the vital first credit card tips is to limit opening of credit card to not more than one only in a year which would help you to build a good credit profile. The longer you do this, the better your credit rating will become and help you in getting a good first credit card you are trying for.

9. Best cards for beginners

Here are my top three recommended credit cards for the first time users:

- Capital One Credit Cards: They have best cards for first time users;

- Discover Student Credit Cards: You can apply for this card only if you are in school;

- Amex Prepaid Credit Card: It is a prepaid, re-loadable card that won’t build credit and with almost no fees. However, by using the card for a minimum period of six months, you can establish a history/reputation with American Express which may lead to you getting invited to apply for a charge card.

Conclusion

Now that the crucial points that applicants for first time credit card need to consider have been explained, you can go ahead with submission of your application for the first credit card to your liking keeping these first credit card tips in view. However, one point needs to be made clear here that while it is true that if you use your credit card judiciously it can help to build up your credit score and credit history which will enable you to take bigger financial moves in the future, it should never be forgotten that your credit card is just a piece of plastic that offers you necessary credit at a steep price if you don’t repay it in time. The best thing that you can do as a first time credit card user to maintain and build your credit in order to obtain a solid credit score is, to pay off your bills on time, each month. One late payment can significantly damage your credit score, especially when you're just getting started.