Five Sound Financial Goals for Women to Establish and Achieve

Ladies, when you graduated from high school, did you know how to handle your money? Did you know how to keep track of expenses, save for the future, and establish good credit? If you didn't you are not alone. Now in my mid 40s, it has taken me many years of up and down finances to learn the basics. If I could help any sister navigating a similar path, I would narrow down my advice to these five important factors in money management. These are sound financial goals that are never too late to implement, although the earlier in life you can achieve them, the better!

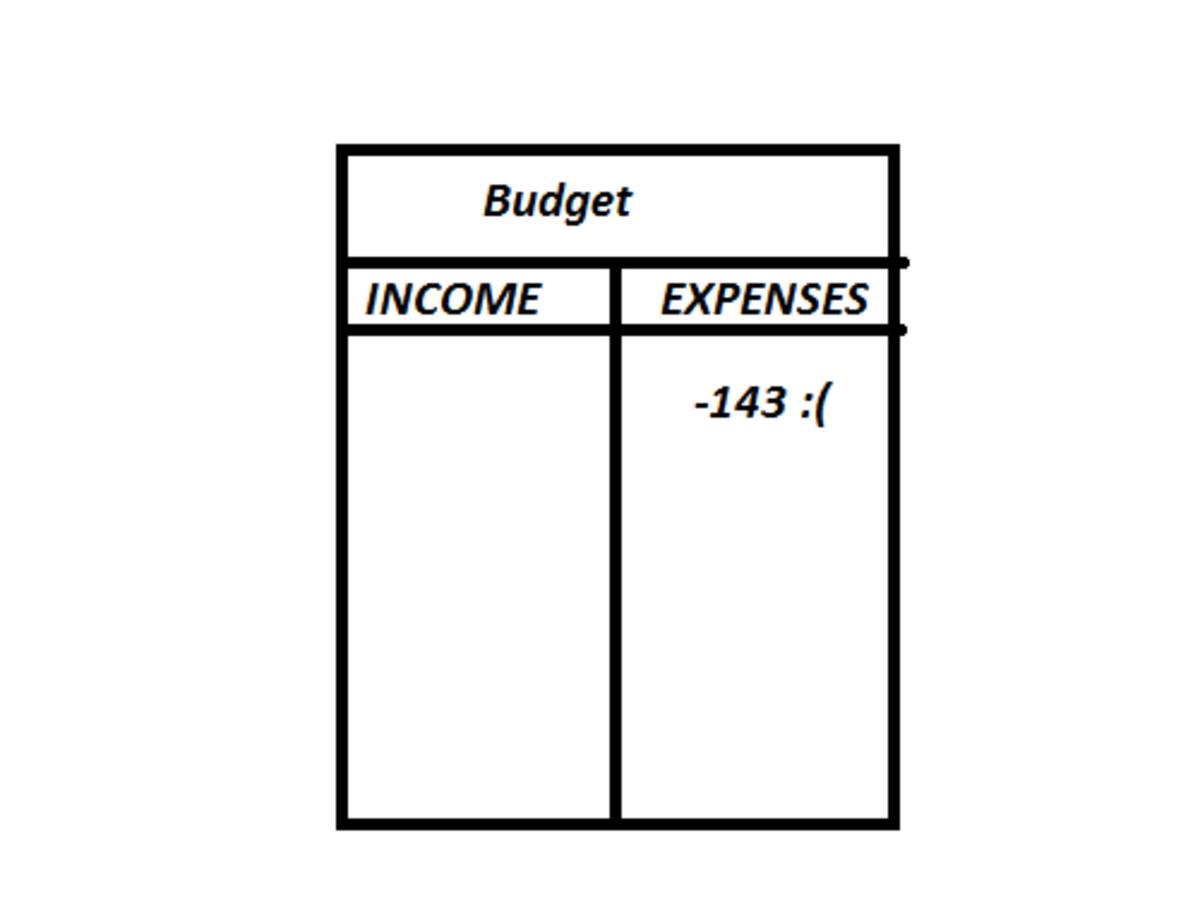

1. Have Budget Awareness. Know your gross and net pay, and exactly where all of your money goes in-between. Know exactly where all of your money goes. It is impossible to make any real or lasting changes in your finances if you don't know how much you have coming in, and where it is all going. Print out all of your bank account records and credit card statements for three to six months, and start highlighting and making categories. Once you have it figured out, you can start goal-setting.

Do you know exactly where all off your money goes from your gross pay down to zero?

2. Get Out of Debt...As Quickly as Possible. Or better yet, don't get into debt in the first place. Our country has such strong ideas and images associated with "a good life" including clothes, travel, cosmetics, gift-giving, and going out. We could spend and spend and dig ourselves in to thousands and thousands of dollars of debt and still not attain the glamor and happiness that the strong media images suggest. For all of us that have slowly and painfully dug our way out of credit card debt, we say create a happy yet frugal life that is genuine.

How many times have you been in over ten thousand dollars of credit card debt?

3. Minimize Spending and Bills. Once you are out of debt or on track with your payments, you can really study your incoming and outgoing money. Perhaps the biggest mistake that people make is not paying attention to it. Here is where you need to be brutally honest as to where you can cut down on things and minimize your spending. What can you easily make or prepare at home that you buy on the go? Have you checked with all of your utility companies to see if they are offering better packages? Can you bundle your insurances? Your utilities? This kind of investigating takes time, but if you could set aside one weekday afternoon a month to do it it will pay off in places that are unexpected.

When is the last time you reviewed your monthly bills and checked other providers to compare costs?

4. Pay Yourself First. Everyone has heard this phrase, but it is widely misinterpreted. People don't think they have the money to save for retirement. Ladies, we cannot depend on anyone else to give us money to live on when we are old ladies. Do you want to be forced to work when you are in your seventies? I don't, and so I have finally learned the true value and meaning of pay yourself first. Designate any amount of money, I don't care if it is twenty dollars, to be automatically taken out of your checking account the day after your paycheck is automatically deposited. If possible, have it withdrawn pre-tax (always take advantage of this option, always, to maximize your take home pay). You will learn to live off of whatever is leftover. I promise. You will adjust to it and forget you are even doing it. And it makes a girl feel awesome to be saving for her far-away future!

How much a month do you currently save for retirement?

5. Maximize Your Income and Designate Extra Money. Getting a raise? Great! Now, pay off debt or tuck that money away (in your Pay Yourself First fund) and pretend you never got it. If you are satisfied with your retirement savings and are out of credit debt, how about adding to the principal of your mortgage to pay it off faster? Or putting it in an account earmarked for Christmas, travel, or an emergency fund? Maximize your income by taking classes, or doing whatever you need to do to get up the pay scale in your chosen profession. Look for a second income doing a hobby or something you enjoy. Designate the money for a certain purpose, and you have added incentive to achieve your goal.