Foreign Exchange for Business Organizations

Will there be anything called a foreign exchange market in this world, If there is only one currency in this world? Then what about foreign exchange or foreign exchange rate? There won't be anything like that. But in reality, many countries have their own national currencies like Dollar, Pound, Euro, Ruble, Yuan, Rupee and many more. Then there should be somewhere to facilitate making payments and transferring funds between countries. Also someone should facilitate the transferring of purchasing power from one currency to another and also to determine at what rate one currency must be surrendered in order to acquire another currency in making payments or in transferring funds. It is the foreign exchange market that plays the most significant role of providing machinery for all these transactions between countries.

What is foreign exchange and why do we need it?

Almost every country has its own national currency or in other words, its own monetary unit. It may be Dollar or Euro or Rupee or Peso or Lira or whatever, it is used for making payments and receiving payments within its own borderlines. But they all need foreign currencies for payments across these national borders. Therefore, in any country, whose residents carry out business abroad or make financial transactions with people in other countries, there must be a certain mechanism for providing access to foreign currencies. Then payments can be made by people in those countries in a form acceptable to foreigners. In other words, there is a need for exchange of currencies with foreigners or foreign exchange transactions that exchange one currency for another.

So, foreign exchange means money or currency of one country denominated in the currency of another nation or group of nations. As such, within the United States, any money denominated in any currency other than the U.S. dollar is, “foreign exchange.”

Exchange Rate

The exchange rate is the number of units of one nation’s currency that must be surrendered in order to acquire one unit of another nation’s currency and therefore exchange rate is simply a price. There is an exchange rate for the currency Dollar in U.S. There is an exchange rate for every other national currency traded in that market.

Although we talk about an exchange rate for the Dollar in the market, there is no single or unique dollar exchange rate in the market. The market price of a particular commodity is determined by the interaction of buyers and sellers in that market. Likewise ,a market exchange rate between two currencies is determined by the interaction of the official and private participants in the foreign exchange market.

Foreign Exchange Market

In a foreign exchange transaction a party purchases a quantity of one currency by paying a quantity of another currency. The purpose of the foreign exchange market is to help international trade and investment. A foreign exchange market helps businesses to convert one currency to another. For example, it facilitates a U.S. business to import European goods and pay in Euros even though the business's income is in U.S. dollars.

Therefore, Foreign exchange market or foreign currency market or forex market trades currencies and lets banks and other institutions easily buy and sell currencies.

The foreign exchange market is the largest and most liquid financial market in the world. Traders in the foreign exchange market include large banks, central banks of countries, currency speculators, corporations, governments, and other financial institutions. The average daily volume in the global foreign exchange and related markets is continuously growing.

History of foreign exchange

The modern foreign exchange market started in 1970s when countries gradually switched to floating exchange rates from the fixed exchange rate system. According to the Bretton Woods Agreement in 1944, each country had an obligation to adopt a monetary policy which maintained the exchange rate of its currency within a fixed value in terms of gold. This is called fixed exchange rate system. This system collapsed in 1971, after the United States unilaterally terminated convertibility of the dollar to gold.

A floating exchange rate is a type of exchange rate system where a currency's value is allowed to fluctuate according to the conditions in the foreign exchange market. A currency that uses a floating exchange rate is known as a floating currency. However, in cases of extreme appreciation or depreciation, the central bank of that particular country will normally intervene to stabilize the currency. Thus, the exchange rate system of floating currencies is known as a managed float. The central bank might allow a currency price to float freely between an upper and lower level. Management by the central bank may take the form of buying or selling large lots of currency in order to provide support or resistance.

Participants in the foreign exchange market

The participants in the foreign exchange market may be called as a diverse group. Some of the buyers and sellers may be involved in conducting international transactions for the purchase or sale of goods for sale or other assets like plant and equipment. Some may be engaged in portfolio investment, dealing in stocks and bonds and other financial assets across borders , while others may be in the money market trading short-term debt instruments internationally. The time period for investment may be few minutes to several years depending on the type of participants. Whether their motive is investing, hedging, speculating, arbitraging, paying for imports, or seeking to influence the rate, they are all part of the aggregate demand for and supply of the currencies involved. They all play a role in determining the market exchange rate.

Mechanism of executing a foreign exchange transaction

Executing a foreign exchange transaction requires two transfers of money value in opposite directions. It engages the payment and settlement systems of both nations and those systems play a key role in the operations of the foreign exchange market. Various forms of payment are legally acceptable in the United States. Payments can be made by cash, cheque, automated clearing house, and electronic funds transfer . Each of these accepted forms of payment has its own settlement techniques and arrangements.

Most of the payments in the United States are still made with cash or cheques. However, the electronic funds transfer systems account for more than 80 percent of the value of payments in US. Therefore, the electronic funds transfer systems represent a key component of the

payment and settlement systems. It executes the inter-bank transfers between dealers in the foreign exchange market. The two electronic funds transfer systems operating in the United States are CHIPS (Clearing House Interbank Payments System) run by the New York Clearing House, and FEDWIRE a system run by the Federal Reserve.

Similar to FEDWIRE and CHIPS in the United States, other countries also have large-value interbank funds transfer systems such as CHAPS (Clearing House Association Payments System) in United Kingdom, EAF in Germany.

Size of the foreign exchange market

The largest amount of foreign exchange trading takes place in the United Kingdom, even though the pound sterling is less widely traded in the market. United Kingdom accounts for about 32 percent of the global total turnover and the United States ranks second with about 18 percent, and Japan is third with 8 percent and thereafter comes Singapore with 7 percent.

The foreign exchange market is the largest and most liquid market in the world. U.S. Government securities market is the world’s second largest market. The worldwide turnover of foreign exchange market is several times the level of turnover in the U.S. Government securities market.

Main participants in the foreign exchange market

Foreign Exchange Dealers

The foreign exchange market consists of a number of major dealer institutions mostly commercial banks and investment banks. These dealer institutions are active in foreign exchange, trading with customers and with each other. They are geographically located in numerous financial centers around the world. Wherever located, these institutions are linked to, and in close communication with each other. Foreign exchange trading takes place among dealers and other market professionals in a largenumber of individual financial centers such as London, New York, Chicago, Los Angeles, Tokyo, Singapore, Frankfurt, Paris and many others.

Financial and Non-financial customers

Financial and non-financial customers include:

- smaller commercial banks and investment banks who are not major dealers

- firms and corporations who buy or sell foreign exchange in the process of buying or selling products and services

- managers of money funds, mutual funds, hedge funds, and pension funds etc.

For these customers the foreign exchange transaction is part of their payments process and a means of completing certain commercial, investment, speculative, or hedging activity.

Central Banks

Central banks of all countries participate in foreign exchange markets to a certain extent and their operations can be of great importance to those markets. Intervention by Central banks to influence foreign exchange market conditions or the exchange rate, is a critically important aspect of each central bank’s foreign exchange transactions. However, the intervention practices of individual central banks differ greatly with respect to objectives, approaches, amounts and tactics.

Many central banks serve as their government’s principal international banker and they handle most of the foreign exchange transactions for the government as well as for other public sector enterprises. A central bank may be operating in the foreign exchange market in order to acquire or dispose of foreign currencies for some government procurement or investment purpose. A central bank may also participate to accumulate, reallocate among currencies, or reduce its foreign exchange reserve balances.

Brokers

The role of a broker is to bring together a buyer and a seller in return for a fee or commission.

A broker is an intermediary who acts as agent for one or both parties in the transaction and the broker does not commit capital. The broker relies on the commission received for the service provided. Brokers do not take positions or face the risk of holding an inventory of currency balances subject to exchange rate fluctuations. In over-the-counter trading, the activity of brokers is confined to the dealers market. Brokers handle about one quarter of all U.S. foreign exchange transactions in the OTC market.

The factors that determine Foreign Exchange Rates

Economic factors

- Fiscal Policy and Monetary Policy of the government.

- Government budget deficits or surpluses

- Balance of trade levels and trends

- Inflation levels and trends

- Economic growth and health

- Productivity of an economy

Political conditions

- Internal political conditions

- Regional political conditions

- International political conditions

Market psychology

- Unsettling international events can lead to investors seeking a safe haven.

- Currency markets often move in visible long-term trends

- The tendency for the price of a currency to reflect the impact of a particular action before it occurs.

- economic numbers are important to market psychology and may have an immediate impact on short-term market moves.

- Technical trading considerations

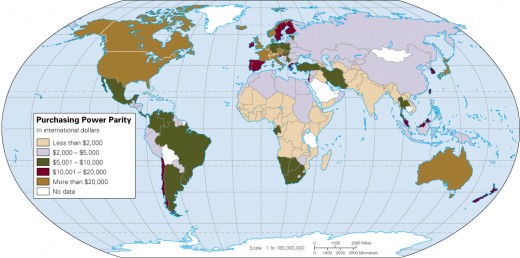

Theories that explain the fluctuations in foreign exchange rates

- International parity conditions: Relative Purchasing Power Parity, interest rate parity, Domestic Fisher effect, International Fisher effect.

- Balance of payments model

- Asset market model

Financial instruments

Spot

A spot transaction is a straightforward exchange of one currency for another. The spot rate is the current market price. It is a two-day delivery transaction except in the case of trades between the US Dollar, Canadian Dollar, Turkish Lira and Russian Ruble, which settle the next business day. It represents a direct exchange between two currencies.

Forward

Here, money does not actually change hands until some agreed upon future date. A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of the market rate on that day. The duration of the trade can be a one day, a few days, months or years. Usually the date is decided by both parties.

Future

Foreign currency futures are exchange traded forward transactions with standard contract sizes and maturity dates. Futures are standardized contracts and are usually traded on an exchange. The average contract length is roughly 3 months. Futures contracts are usually inclusive of any interest amounts.

Swap

The most common type of forward transaction is the currency swap. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. These are not standardized contracts and are not traded through an exchange.

Option

A foreign exchange option is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date.