Fundamental or Technical Analysis

Technical vs Fundamental

Playing the markets and snagging a fast profit is easy, right? Well, if you've ever invested you know that everything doesn't always go as planned. The market has a way of making a fool out of people.

Too many novice investors will watch CNN, MSNBC or some other money program on a major network to get their advise on what they should do. However, by the time you are listening to the news the opportunity is probably past, and that is only if you can weed through the spin masters who will make money of you following their advise as they take the other side of the trade.

Let's not fall into cliche trading and following the crowd. It is typically those who are willing to go against the crowd that makes the money. I may be wrong on where I heard the quote, but I believe it was Warren Buffet who said "Be fearful when everyone is greedy and be greedy when everyone is fearful." So let's look at the two schools of thought and determine what approach is best for us.

Fundamental Analysis is a method where a trader will focus on

company-specific events to determine which stock to buy and when to buy

it. This field of research is an approach that looks at the underlying business model, earnings, products, and management in order to determine how to trade a particular stock. Therefore, looking at the business itself instead of a chart will be the key focus.

It seems that trading on fundamentals will follow more of a buy-and-hold strategy more than then focusing on short-term trading. The goal of this approach to investing is to determine the intrinsic value of a company in order to determine the direction and strength of future growth.

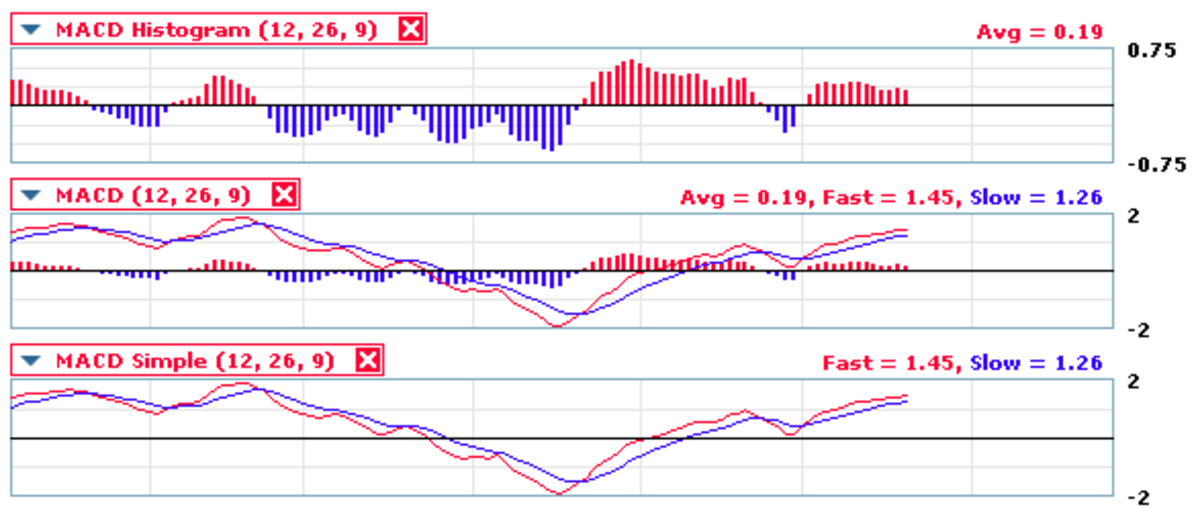

Technical Analysis on the other hand is process of evaluating a stock by studying price and volume as reflected by current market activity. Technicians don't try to measure the intrinsic value of a security, but will look at the stocks charts in order to identify patterns and trends that may suggest the future direction of the stock.

In reality Technical and Fundamental Analysis are on completely opposite sides of approach spectrum, even though some have successfully merged the two philosophies into successful trading strategies. Trying to determine which approach is best has been a long heated debated, therefore it is important to determine for yourself which approach you will use.

My Opinion

While I see the importance of Fundamental Analysis, it is also very clear that to be really good at it you better be good an analyzing businesses. While I know that there are programs available that will crunch the numbers for you and "rate" the company, but in my opinion this is only a starting point and serves as a means of sifting through the multitude of stocks in order to find the best picks.

The way I see it, in order to do good fundamental work you better enjoy research and being a CPA or having an MBA will help you tremendously. I'm not that person, but I do enjoy trading. That is why I went the way of technical analysis. To be a good technician you just need to know how to read the charts and it is really not all that hard.

Technicians tend to believe that the current price of a company reflects all the current fundamental information. It is an amazing thing to see how certain patterns manifest over and over again and will signal the direction of a stock. By taking a little time a person can easily learn how to be a successful trader in both bull markets and bear markets. Learning key signals can lead to a very lucrative business trading the markets.

Getting A Jump Start On Successful Trading

If you want to trade successfully I would encourage you to purchase a book called, "Secrets for Profiting in Bull and Bear Markets" by Stan Weinstein. This book was written in 1988 and is one of the easiest technical books to read and understand that I have ever read. Let me first warn you to not judge a book by it's cover because the cover of this book is real dorky. However, the contents of it are outstanding.

This book was originally released in 1988, that's 27 years ago based on when I am writing this Hub. It is interesting to note that as you read this you can pull up current charts in today's markets and see how timeless Stan's information is.

"When you read most books on technical analysis, you are quickly introduced to all sorts of exotic and confusing formations. Suddenly you are thrust into a world of triangles, pennants, and flags. I'm not saying there isn't merit to these fancy formations, but they aren't crucial to your scoring big profits in the market. I promised you at the beginning of this book that I'd only deal with the most important technical indicators. So forget about saucers bottoms and flying wedges and what-have-you. Nevertheless, there are a few formations you should be familiar with; these are both easy to spot and very profitable." (Secrets for Profiting in Bull and Bear Markets by Stan Weinstein - page 118)

This is a very easy book to understand as Stan Weinstein uses everyday language and examples to explain his approach to technical analysis. For any serious trader who has not seen consistent profits, this is a must.

Happy Trading!