Getting Out of A Debt Cycle… Without Too Many Tears!

The Vicious Cycle: Credit Cards and Payday Loans

With the best intentions, many of us begin the month by thinking, this month I won't resort to my credit card.

But when three quarters of our salaries have disappeared from our bank accounts by the second week of the month - rent, utilities, standing orders - and there are still bills to pay, our resolve inevitably weakens.

The Illusion of the Quick Credit Line

Most of us blame ourselves for spending too much. If I could just spend less during the month, I would not need to get into debt at the end of it. Whilst this reasoning has its logic, we need to in fact look at it another way: if I stop getting into further debt, I will spend less.

At first this sentence does not seem to make much sense, but what we need to do is figure in the emotional factor. The thing about quick credit lines, especially when used as a crutch to get to the end of the month, is that they are addictive. Our emotional wellbeing is linked to how comfortable we feel, and as soon money seems to be running out, we experience discomfort. That is where the sweet promise of payday loans and the credit card comes in, assuring us that at least for a moment, our pain and worry will be relieved.

The long term reality is, however, that whilst on the surface we seem to be doing OK for a while, our situation is becoming worse because we are getting more into debt. Debts are a major source of worry and distress and will niggle away at self-esteem, causing acute stress and even depression.

How to Break the Cycle

The trick to get out of this cycle, is to stop debting. That sounds ridiculously simplistic, but the fact is, once you stop piling more debt and more interest on top of your existing outgoings, your situation will begin to improve dramatically - guaranteed. It will, however, take one to six months to get over the initial hurdle, before things will normalize. Having an action plan helps immensely.

Most people think that getting out of debt can only be achieved by cutting spending. That can work, but the more direct way to address the situation is to make a commitment to stop debting first. The spending will fall in line, once we have committed to not borrowing any more money.

Not using credit lines can be daunting. We might feel we cannot possibly survive without our credit cards. But once you know how to do it, it is not hard at all. It is, in fact, easier than trying to spend less.

Firstly, we need to commit. Write down on a piece of paper 'I will not debt.' Pin it where you see it every morning and evening. That's it. We have made a promise to ourselves, we know where we are heading.

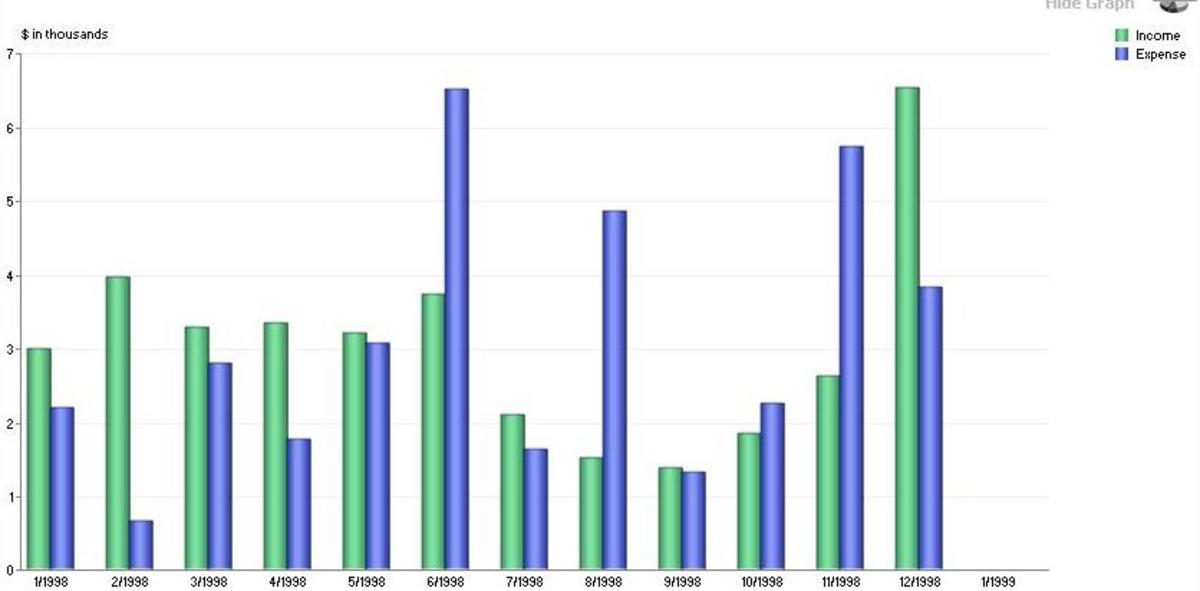

Next, we need to work out what our monthly deficit is. This is done by writing down income Vs. expenses. Maybe we earn 2000 dollars a month, but our expenses are 2300. Then we know we need an extra three hundred.

Now we simply need to locate that extra money, without resorting to payday loans or the credit card. These methods can include:

- Selling or pawning jewelry or other valuable items

- Selling clothes and toys on eBay or books on Amazon

- Working overtime during one month

- Finding an extra job on the side for a month or two (baby sitting, cleaning, painting, writing)

- Always planning grocery shops and only shopping with a list

- Instead of turning on the heater during four hours, heat the room for one hour, then wrap up in a cosy jumper and get under a blanket

- Rent out a spare room in your house for a while

- Car wrapping: rent your car's external surfaces to an advertising firm, allowing them to put publicity and brand stickers on it

- Teaching or tutoring: English, maths, languages, drawing… whatever is your expertise

- Freelance online on sites such as Elance.com or iFreelance.com

What now?

Try it right now. Take a pen and paper and write down twenty ways in which you think you can make some extra money this month, so that you don't need to resort to credit. Then pick one and do it.

The end result will be this: You will have extra money this month and you will not need to rely on a credit line. You will make minimum payment, or more, on your debt. Next month, you will have less debt. You may need to repeat the exercise for 1-6 months, until your debt is gone or your minimum payments have gone down, but you will notice that the hurdle decreases, as soon as your debting ceases.

Being Solvent = Being Happy

Being solvent does not mean being out of debt. It just means being able to meet our financial responsibilities. Stopping debting is the key to solvency and feeling good about your finances and yourself. Next month, when your loan and credit card debt are no longer piling up, but going down, your worry levels will decrease and self-esteem and happiness will resurface. Guaranteed.