Get Your Household Finances Under Control

Determine your monthly take home pay

Take home pay is the same as net pay. This is how much you make after taxes and deductions. For most, it is the amount that is direct deposited into your checking account. Whether you are self-employed, a contracted employee, or a W2 employee, it is important to understand what your take home pay is on a monthly basis. If you are in a field of business, like sales or self-employed, it may be more difficult to have a good idea of your monthly income. If this is the case, you my need to take a twelve month, or quarterly average to determine a good estimate for your monthly income going forward. For the rest of us, who are wage employees it may be a little easier. If you do not work standard hours, you will need to try to get a good average. For the most part, if you have been at your job for a bit you should be able to get an average too. Here is a rough calculation that may help if your pay varies on a monthly, or seasonally basis:

- Add together the pay for the last twelve months, if possible. If you don’t have this far back, just use the most information you have. Twelve months is best, especially if you are in a field that is seasonal since it can greatly vary.

- After you have the total for how much your income was, divide by the number of months you included. Here is an example:

- January through December gives a total income of $36,000

- Take $36,000/12=$3000 per month.

This would be your average monthly income that you can use for budget purposes. We will be using the net (after taxes and deductions) for the budget, since you cannot spend money you do not receive. For those who do not have taxes taken out, like self employed, you may want to set a certain percentage aside to make sure you have enough money to pay taxes when you file.

Less Expensive Route

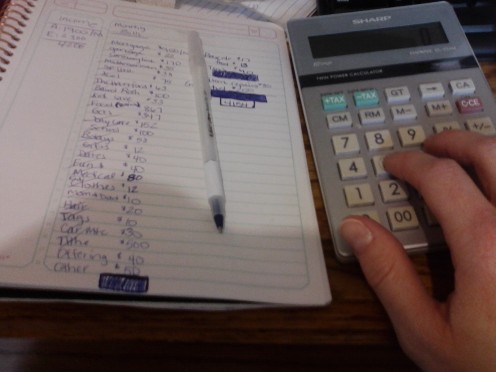

Determine your monthly bills

This is a much more difficult task, at least it was for me. It took me about 3-4 months to compile all of my bills. The reason for this is that I don’t pay all my bills every month. Some are annual, semi annual, or quarterly. One trick I tried was to mentally walk through the year and write down everything you pay for. This includes automobile tags, oil changes, gifts, etc. Here is a list of the most common bills that I thought of to give you a start:

1. Tithe: we do 10% of our gross income.

2. Mortgage payment (including property taxes and insurance) or Rent payment

3. Utilities: This includes anything for your home use like Gas/Electric, Water, Garbage

4. Phone: home phone and/or cell phone

5. Food: this includes groceries only, not eating out. That will be under “entertainment”

6. Gas and insurance for vehicles

7. Daycare costs (keep in mind if this will change during school) you want a monthly average.

8. School: this can be for tuition, uniforms, supplies, etc

9. Entertainment: anything from dates with that special someone to movies by alone.

10. Medical expenses: This can be copays, payments on bills, or premiums not taken out of your pay.

11. Clothing

12. Toiletries

13. Hair care

14. Vehicle tags renewed annually (divide total by 12.)

15. Car maintenance: this should include any vehicle payments you may have. We have none because we buy used vehicles, so we put money aside every month toward the purchase of another vehicle or repairs.

16. Pets: food, toys, vet, etc.

17. Home repairs

18. Outstanding bills: credit cards, personal loans, etc.

19. Life insurance

20. Retirement

21. Savings for children

22. Parties: I have 2 kids, and I spend about $100 per party (100*2=200/12=16 per month

23. Gifts: I determine how many gifts I typically give, and the average cost (I buy 20 gifts a year with an average of $50/gift. This is 1000 per year, or $83/month.)

Now that you have a start, you just need to go a few months and determine if any new ones pop up. If so, add it to your list. I like to use an excel document since I find it easy to modify. I also put in formulas so any changes are automatically updated.

Crunch some numbers

Calculate if you have a surplus

If you have more money going out in bills, than you have for your income, see below under deficit. If you have more income than bills, you have a surplus. In this case, you can decide if there are areas of your bills you would like to include additional amounts. It may take a few months of the budget you will have a better idea of where you can put additional funds. If you put it into a savings account for a few months you will be sure you have money if you forgot some bills in the months to follow. Then, it is easier to allocate the money. You don’t want to be too quick to make a change after having a surplus since if you underestimated or forgot a bill you could put yourself in a deficit another month. You need to decide what you want to do with the extra money for yourself, but here are a few I like to apply our surplus:

- Retirement fund(s): If you are not contributing at all, or not to the maximum amount, you can add to this. If you are a wage employee and your employer matches, you can increase the percentage coming out. Both my husband and I have the amount that the employer is matching (usually 4 or 6%.)

- Emergency or additional saving funds: remember to save for a rainy day so you do not need to take additional credit. It will rain!

- Pay additional on any debt, including your mortgage. I think it is very important to try and pay off any debt as soon as you can. This could be a whole additional topic on it’s own!

- Give more money to your church or charity

What to do if you have a deficit

If you are spending more than you are making, you are at a deficit. Just like our government, this is not good situation to be in. You cannot keep taking out debt, as it will soon catch up to you. Do not get too upset. There is a solution. It may be difficult at first, but it will be well worth it. Here are some steps for you if you find a deficit each month:

- Determine the bills that are essential. This is not the great outfit, new shoes, or power tool. This is what bills do you need to pay to keep you and your family safe and healthy. For us, it would be shelter, limited clothes (most have enough to get by unless you have growing kids,) food, and utilities. No one can tell you what this is for you. For me, it would not be a smart phone with a data package if I can’t pay my mortgage.

- After determining what bills you must pay, eliminate or decrease those you don’t need. For example, can I find second hand close (some look like new) for my family and me. Many consignment shops give you credit for bringing your unwanted items in. I have purchased a whole season of clothes for both my kids’ wardrobes and only paid $45.

- Make tough decisions. It doesn’t mean you can never have that big screen TV, it just means you need to prioritize your purchases. You have to be very unselfish for this one.

- Call your lenders to see if they can reduce your rate. You can also get rid of cable, or ask if there is a cheaper package.

- Find cheaper places for hair care. I switched from $45 every other month to $20.

- Stop services that are unneeded. Nails, and other spa services (ouch!) This one really hurts if you are used to it.

The lists could keep going, but you will have to decide what is right for you and your family. If you only have a month deficit because you needed four new tires, that is different than having a deficit every month because of spending habits.

Recourses to use

You can find many books written on this topic. Most of what I have is from a Dave Ramsey class I remember taking six years ago. The cost was well worth it. You can also look in your local library, or purchase material to use. I would start with anything free if you are struggling. This way you don’t add another bill. I use the library for a lot of resources if I am not sure I will like something.