Get On Track, Adjust Your Finance; Initiate a Budget, and Teaching the Children the Importance of Saving!

Today businesses are shutting down their operations without notice, leaving the employees shocked and surprise. Life is so full of unexpected invasions that it can reduce the amount of the biggest checking account.

Perhaps you took ill, maybe you experience a malfunctioning thermostat, pricey car repairs, or a burst hot water heater. All these expenses require you to use the money immediately, which can cause a major crisis. And what’s worse, some people spend too much money on unnecessary things. Therefore, it’s really easy to get behind on the bills.

And for these very reasons, many people find themselves in debt, striving, in need of money when it's time to pay the bills. Only, you can get back on track by adjusting your finance; start a budget, and teaching the children the importance of saving.

I was among the many that spend too much on unnecessary things. Because I wasted my money regularly, and I took for granted the credit cards were available, I ruined my credit by overcharging and reaching my credit limit.

Purchasing stuff I really didn’t need, things like shoes and clothes, treating the family and friends. And going on vacation, eating out, shopping, hair salon, and having family nights.

It’s obvious many uses their card to pay for things, and when you allow yourself to get stuck in the habit of charging, it’s a lot easier to spend more than you intend to. Only when things got hard, I had to arrive at the realization I was not able to pay. I had no choice but to walk back and make some changes.

After being a debt junkie for almost three years, buying stuff I really did not need. I run up not only one credit card, but three credit cards living my life like my salary was the income of a millionaire.

Back then I had a healthy salary. As a financial manager, my bonus alone was two to three thousand without my salary. The more I made, the more I spent. I would spend all my cash from my wage and then I would start charging stuff to the credit card.

Making all unwise decisions, thinking I was enjoying living life, I would go on vacation, sometimes take a family member or friend with me, they would pay to go but I would treat them during the vacation. I would pay to get my hair done almost once every week, seldom did. I miss a week. Within three years, I found myself at a standstill, wondering how to emerge from a big hole I dug for myself.

All the poor decisions I made and my outrageous debt catching up with me. I had to conclude. I didn’t understand the importance of the choices I was making or the power that shopping had over me.

It took me a little time, but I learned from my failures and made an intelligent decision not to allow them to become a weakness, but on the contrary, to build upon them as strengths. From all the poor decisions I made, I learned in everything I do; I am choosing a direction.

My life is a consequence of the choices that I made. After learning that, I made some changes. Corrections that will assist me in getting on track, starting with a budget, something that can bring me back on course.

My life was a complete mess, so I need to get back on track. Take the type of action that will make changes like conducting a budget that will assist me to adjust my finances and teaching the children the importance of saving.

A budget that will make sure I can pay my bills. As it is so important to stop living in denial and put in place a plan for me, as a single mother, to help me and the entire family.

Budgeting is easy. The hardest part is starting it and overcoming all fears. And learning to change the past decisions that put you in an unpleasant situation. A budget is the best thing to be done if you want to get back on track and organize your expenses. The purpose of a budget is to justify a set of decisions that plan for your money. Something to make known how funds will be used, and track and control all spending habits.

One of the hardest things to do is get back on track, especially when you need to organize your assets. I’ve been there too, but when you find yourself broke behind on your bills, you questioning where to come to terms with a financial plan.

Here is what you need to do: accept and deal with how bad things really are and put forward an effort to maintain a setup working budget. After that, you need to organize your expenses; you need to understand how to create a budget. It begins with knowing what you are spending and the breakdown of your debts. All left to do is to implement the steps to take charge of your financial future. Then discuss with your family all expectations and teach the children to help save.

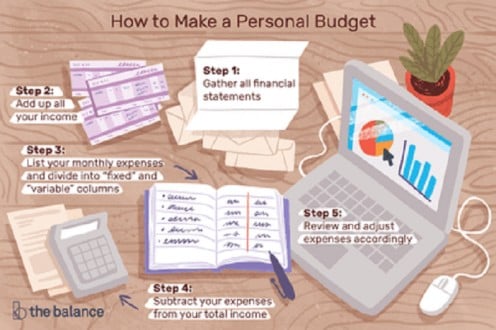

It appears challenging to saving money, mainly since it not that simple of a task. Yet you have to be organized with your spending habits. So, while thinking of opting for budgeting, you need to gather all the financial statements you possess. These include bank statements, loan expenses, mortgage bills, recent electricity bills, and any information regarding a source of income or expense.

Your primary intention for doing this is to use your expenses and income as your starting point to create a budget. It will assist you to know your monthly amount spends averagely. So, the more information you avail, the more it is best for you. Finally, these details will let you figure out where you are getting the money. You save how much and where you are spending your money.

You will get certain degrees of idea and responsibility instant as you gain knowledge how to salvage money. Know that it doesn’t matter how much more you make if you’re spending more than you earn.

When you’re not taking control of where your money goes on a daily, it’s like you failing to plan, and it’s the same as intending to disappoint. But, with your finance on track, you will be in the essence of significant power. Your money is a tool that enables you to protect yourself, to establish yourself and your family. Why not use it wisely to make sure it’s available for you?

The next step will be essential in listing your monthly expenses. It will include the rent or mortgage amount, auto payment, and insurance, supermarkets expense, utilities, laundry or dry-cleaning expenses, gas bill, clothing expenses, cable bill, telephone bill, and anything you spend your money on.

Also, you can get a free budgeting tool online that will assist you with your budget. All you get to do is input your income, expenses, and budgeting needs. It will show you what’s coming in and what’s going out.

Side by side, you can keep track of the principal source of your income. If you get your salary as a monthly paycheck from which your taxes get automatically deducted, keep a note of the net income or the take-home amount. If you a self-employed person. Perhaps you have a source of income that you forget to add as income to the list.

These total incomes, from various sources, should be the periodic amount. Lastly, you need to add all your monthly earnings and expenses. If you figure out that your income is much more than your expenses, then you are on the right track. If not, you need to take steps from next month onwards.

Now, once you are moving in the exact path, also involve your kids. It is never hasty to teach children about savings. Children will get certain degrees of responsibility and will get knowledgeable on how to save money. We intend the fundamental mode of gains for one age group.

Everybody should agree. Children will start gaining some maturity in money handling if they get such training from their tender years.

Remember, if you don’t teach your kids how to save and manage money, life will, and that’s not a hazard you want to happen. Teach your children about saving money to start with a strategy that will be easy to teach kindergartens to teens about money.

Begin by first setting an example where you will show them that toys, candy, or anything of the interest cost money. Give them four quarters or a one-dollar bill. Let that being a starting point. Talk to them and help them understand the importance of saving it. Use an empty jar or a piggy bank as a way of saving money.

An empty jar probably is better because they can see the money through it. It would allow visually. Seeing the money can motivate the children to do odd jobs to create ways to make wages to be added to the container.

You can also teach them how to save and conserve energy: they should always be particular about such minor aspects as switching off the light. When no one is in the room, stop allowing the water to excessively run while brushing their teeth, and stop leaving on the television when no one is watching it.

Set boundaries for you and the entire family; everybody should also know how to save on water at home by installing a low-flow showerhead. It should make them cautious about the use of fluorescent light bulbs, as those are more reasonable compared to ordinary bulbs.

Thus, teach your children about such small things: stop standing right in front of the refrigerator, holding it open to look a long time for what they want to snack on. Fridge doors should not be kept open for long, unnecessarily. Let them be aware of the facts that turn the water off and drippy faucets are wasteful, turn the water knobs so that water does not drip, etc.

They should know that while electronic appliances are not in use, they should be unplugged. While each of us takes small measures to save, you can save a good amount of money without putting in much effort.

When it is time for grocery shopping, put a lot of your attention around saying NO to higher price items, not in the sale. There will be times when you have to tell the children junk food is not in the budget. At first, it will take some getting used to, and it sometimes will seem cruel. It will be a challenge, but it is well worth it.

Sometimes the family might not remember the household is on a budget. Therefore, it is up to the head of the house to be committed to making sure it enforces your budget and makes it a priority over the next few months. Just by consolidating different bills, creating a budget, changing my spending habit and the family's many minor changes toward saving, our life changed tremendously.

When the family desired to use less energy at home to lower the energy bills, it became easier. We cut back on family nights, stop all the unnecessary shopping, searching for deals, downgrading the cable and phone bill, and the entire family was involved. In as little over three years, I paid off $87,000 in auto, credit card, and old debt. If I can do it, anybody else over their head in debt can do it too.

Get Back On Track By Adjusting Your Finance; Initiate a Budget, and Teaching the Children the Importance of Saving!

What are your thoughts and opinion of, "Get Back On Track By Adjusting Your Finance; Initiate a Budget, and Teaching the Children the Importance of Saving?"

Money Management Rap - Smart Songs

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2019 Pam Morris