Gold as an Investment Top Tips on Market Prices and Value

The purpose of gold as a solid financial investment

The use of gold as an investment relies on the cost of gold as a tangible asset as well as the real monetary value of such a commodity. Unlike currency Gold is able to retain a value that extends beyond a paper value. For example if a currency hits super hyper-inflation and totally devalues it is fair to say that gold will retain a value beyond the worthless currency. Like all markets however gold can and will vary over a period of time.

Currently gold prices have dropped significantly from 2014 prices and now remain a valuable investment. This market can and will possibly recover, although with all investments there’s a risk that it will not. However it is safe to say that gold will always be worth something. Gold therefore remains an excellent way of investing hard currency, although there are certain pitfalls to watch out for!

Being able to invest money in a solid asset has to have many merits to the investor as well as the smaller "private" individual. When you consider the weight and fascination of gold it isn't hard to imagine why it carries such an allure. Also gold is a wonderful way to win over the admiration of a female who you may be trying to impress.

The True Value of Gold as a currency and reserve fiscal entity

Should I purchase real gold or “paper gold”?

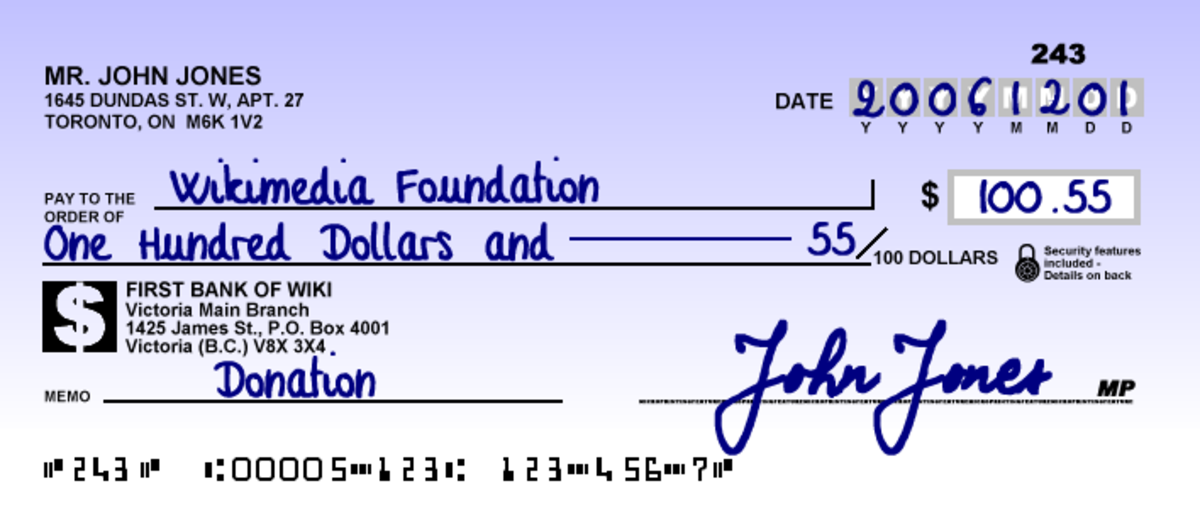

When choosing to purchase gold always use a reliable trader and ensure that they have a solid reputation. Background checks must be comprehensive and complete to ensure the trader meets your expectations. A certificate of purchase, as well as validity, ensures the gold’s from a reliable and guaranteed source. In addition to this look at the current gold prices before deciding to purchase. Like all markets there will be peaks and troughs. These can be short term financial spikes, as well as historic trends. Nobody wants to buy gold when it hits a temporary high. A common trend now is to offer “Paper Gold”. Put simply this is offered by some banks and institutions and consists of a “Paper” bond stating that you have purchased a certain value of gold, however the physical gold itself still resides in a bank. This is potentially problematic as it keeps the gold out of the hands of the purchaser. During a possible global financial meltdown the ability to acquire this “paper gold” is going to be a tough challenge as opposed to actually having the physical gold available.

The Value of Gold has always increased!

How to store your gold investment

The issue of storing gold at home or another safe place relies on ensuring adequate security exists and that no one has access to the storage area. If a currency devalues and money becomes worthless, gold will be both a life-line to moving to a secure area as well as a solid bargaining commodity. Keeping gold safe can cause sleepless nights, and if care’s not taken this highly prized commodity, with a high gold price, can gnaw at the consciousness. Safe storage is essential so ideally you’ll need to invest in a well hidden vault or safe. Gold is extremely heavy so moving larger quantities (especially if on foot) present its own logistical problems.

The Gold Poll

Would you consider Gold as a solid Investment?

Gold prices and the rise and fall of the gold market

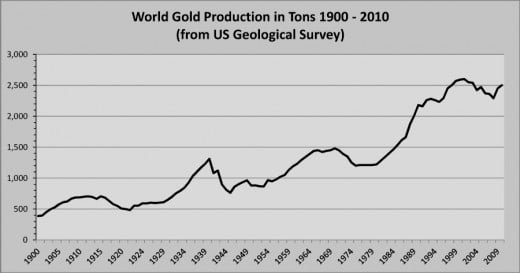

Like all investments the price of gold can deflate as well as inflate. However gold as an solid investment will always be worth something, it will always have an economic value, even if bartering is the key financial mode of operation. This is in stark opposition to a currency that can effectively become worthless overnight. 1 million dollars in one hand and a chunk of gold in the other highlights this point if the dollar collapses. The paper currency essentially becomes fire kindling, whilst the gold ingot has a highly prized value. The beauty of gold relies on the fact that it’s a finite resource; the world’s most malleable metal also has a limited supply. There can only ever be so much of this illustrious metal available and mined on planet earth. Keeping a stable gold supply as an investment means that a prized investment is at hand in times of economic instability.

Forms of gold to purchase as an investment

Various forms of gold exists such as the highly prized Krugerands as well as sovereign coins that offer the small-budget investor ample opportunity to possess gold as an investment. Larger market leaders are also able to purchase solid gold bars from reputable dealers. It also has to be considered that gold jewellery offers a way of securing excess cash as a gold investment, and avoids the necessity of keeping physical (devalued) currency in the bank safes. Having to actual physically wear gold as an investment offers both ease of access as well as a physical display of wealth and status – hence the need for celebrity “bling”. The downside to this is that during times of crisis this has the undesired effect of marking the wearer a target for criminal activity. However it’s also safe to say that a crisis would also force the wearer of the gold items to reconsider the true value of their gold “trinkets”.

Gold Production throughout the World

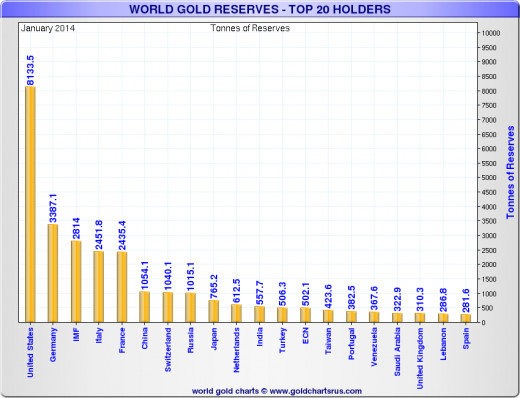

Gold reserves held by countries

Gold investment as an activity suits countries as well as individuals. Currently Russia is holding onto 1130 tonnes of gold (according to the Gold Council). A large physical quantity of gold held by a state or country serves as a safety cushion against internal economic instability, as gold in this instance can be used to shore up a weakening currency. This view of the price of gold as an investment relies on realising when gold prices are favourable to purchase and when the optimal time to sell your gold investment is. Unlike stocks or shares gold retains a “real” value, however it's also possible to lose money whilst trying to invest in gold so caution and a thorough understanding of market prices (both current and historic) should be utilised.

Top 20 Countries with Gold Reserves

The Standard weight of Gold Bars

A standard gold bar held as gold reserves by central banks and traded among bullion dealers is the 400-troy-ounce (12.4 kg or 438.9 ounces. The kilobar, which is 1000 grams in mass (32.15 troy ounces), is the bar that is more manageable and is used extensively for trading and investment.

The highlights of Gold as an investment

- Gold is a highly sought after metal

- It will always retain a “real” value and is protected from hyper-inflation

- Gold’s a universal currency

- Gold is a finite resource

- Gold market prices are subject to internal/external influences and therefore gold offers a good investment

- It has super properties i.e. conductivity

- It can be smelted into coins or jewellery or smaller size bars

Investing in gold can turn out a very healthy profit, however most people find it difficult to sell this fascinating metal once acquired. Individual investors often find smaller “personal “purchases an easier way of hedging their bets against the pricing of the global gold market. Understanding how world events can affect the pricing of gold remains a key to success at investing in gold. Global pressure such as unsecured public debt, wars, governmental sell off of gold reserves, fluctuating oil prices, productivity growth in consumer electronics of developing nations, and space missions all impact the gold price as the market refocuses on the supply/demand aspect of this highly precious metal.

The Pros and Cons of Gold Investment

PROS

| CONS

| |

|---|---|---|

• Market prices are visible and can be interrogated

| • Hard to move large quantities

| |

• Highly precious metal and will always retain a “real” value

| • Difficult to store gold safely without potential loss

| |

• Alternative form of currency if a financial meltdown or deflation occurs

| • Gold prices and the gold market can deflate thereby decreasing the initial investment and effectively losing money

| |

• Gold prices and the gold market can inflate making a substantial financial return on your gold investment

| • “Paper Gold” is essentially unsecured and could become worthless or unguaranteed if banks face financial crisis. Anarchic activity could prevent access.

| |

• Reflects status as a social signal

| • Gold’s very highly sought after by the criminal fraternity

|

Should I invest in Gold?

My other hubs featuring Money

- Garage Sales for Selling Your Items against EBay for Making Money You Will Need to Decide!

Turning your unwanted items into hard cash will be your challenge, but choosing the best place whether it be eBay, Amazon or a simple Garage Sale is the key challenge for gaining extra money.