Gold and Silver -The gold Silver ratio, uses of gold and silver and their abundance in the earth

Gold and Silver

Gold is the first and most obvious choice for many investors who are looking to precious metals as a safe haven and effective hedge against fiat currency devaluation and economic uncertainty. However as I write this hub the price of gold is approaching $1700 per ounce which is threatening to price out the average investor who is worried about inflation and looking for exposure to precious metals and hard assets. Silver is perhaps the next most obvious choice. Silver is both an industrial and precious metal. Like gold, silver has thousands of years history as sound money and a store of value, however unlike gold over 50% of silver produced is currently used in industry.

The Uses of Gold and silver

Let’s take a closer look at the uses of gold and silver.

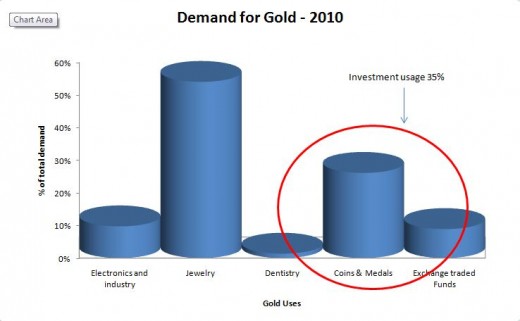

The chart above breaks down the uses of gold. Over half of the demand for gold is for jewellery (54%). Investment use is 35% of the demand for gold. A very small proportion of demand for gold comes from industrial use and dentistry.

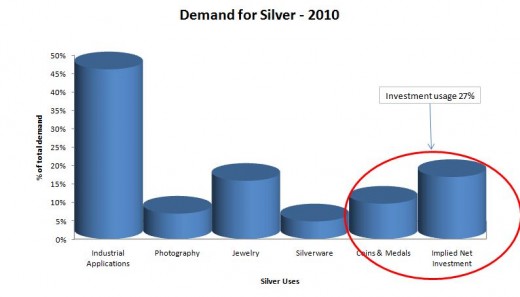

Over half the silver produced is used in industry and photography. Jewellery makes up 16% and Investment demand (including coins and medals) makes up 27% of demand.

It is clear from the above chart that silver has two faces. Historically Silver was and still is a precious metal used in coinage alongside gold, however over the past century industrial demand for silver has become increasingly important.

Gold and Silver prices

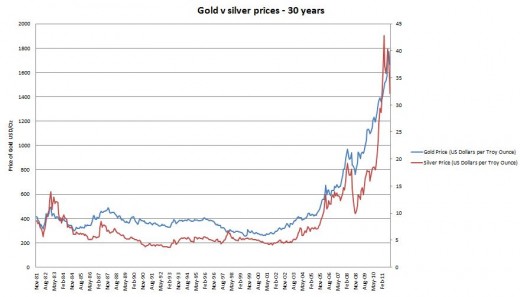

The chart above shows the price of silver has followed the price of gold reasonably closely over the past 30 years. This suggests that silver is primarily priced as a precious metal like gold rather than an industrial metal. It is notable however that the price of silver is much more prone to short term volatility than gold. During the financial crisis of 2008 the price of silver fell from $20 to $9, a drop of 55% in the space of 6 months between March and November. Over the same period gold fell 21%. It is this volatility that gets silver named “the devils metal” as these short term spikes and drops in price make it difficult to trade. Part of the reason for the volatility is due to the small market for silver. In relative terms the market for silver is approximately 18 times smaller than that of gold. The price stability of gold v silver also reflects the status of gold as the number 1 precious metal for investment.

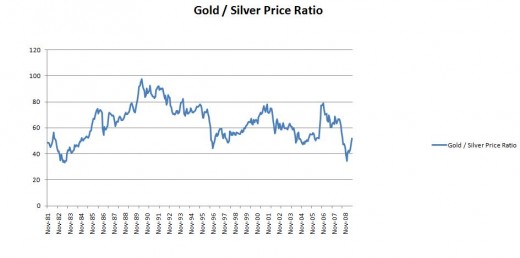

This price relationship between gold and silver is known as the gold/silver ratio. Currently the gold/silver ratio is 54:1 which means that the price of gold is 54 times the price of silver. Historically the gold silver ratio has been as low as 10:1 in the early part of the 20th century and as high 94:1 in the 1990. The following chart shows the gold/silver ratio over the past 30 years

So what does it mean? And what should the gold silver ratio be?

This is an impossible question to answer. If we are just looking at a 30 year time frame the current gold/silver ratio of 54:1 is below the average of 64:1, which might indicate that silver is slightly overvalued compared to gold. However this comparison to average is far too simplistic to gain an understanding of what the ratio should be. During the 30 year time period the gold silver ratio hit a low of 34:1 in 2005 and in 1983. In 1980 the gold silver ratio was as low as 17:1.

One way of trying to gage what the gold/silver ratio should be is if we look at abundance of both gold and silver in the earth’s crust. The abundance of gold in the earth’s crust is quoted in various reports as 4 parts per billion (by weight). The abundance of silver in the earth’s crust is 75 parts per billion. This gives a ratio of 19:1 (i.e. silver is 19 times more abundant than gold). Some Analysts use this point to make the bullish case for silver and argue that in the long term the price of silver must move closer toward gold in order to move to a level which reflects the abundance in the earth. There is much merit to this argument however the problem with it is that it only looks at half of the equation (i.e. the supply side) and ignores the demand factors. If precious metals were priced wholly on their scarcity in the ground then Rhodium and Iridium which are the rarest of all the precious metals would be worth four times as much as gold. It is difficult to predict where the price of silver is going over the short term. Over the longer term as debt continues to weigh heavy on the world economy and negative real interest rates remain the order of the day, silver remains a very attractive investment.

Related Reading

The silver market

The silver market is much smaller than the gold market. It is estimated that there is approximately 1 billion troy ounces of investment grade silver compared to 2 billion troy ounces of gold. Because of the relative small size of the silver market it is much more volitile than that of gold. A single large buyer can influence the silver market, this was evidenced in the 80s when the Hunt Brothers infamously attempted to corner the silver market and nearly did so. Today the price of silver is impacted significantly by the paper market (futures and ETFs). In this interview John Embry and James Turk discuss the silver market and where it is headed.