Investing Money in Your Portfolio

Street Vendor Example

Think of a street vendor who sells a wide variety of unrelated products knowing that a buyer won’t be purchasing many because of the variety. If he is selling sunglasses, they are not going to be sold on a rainy day but umbrellas will sell. This is a great example of diversification and allocation

Diversification and Allocation

There are two principles to remember for diversification of you investment portfolio:

- First principle is to diversify your stocks, such as large-cap, small-cap, international, and so forth.

- Second principle is to allocate across the different asset classes like stocks, bonds and cash.

Investing in only one category is less secure over the long term.

Make you Best Investment

When you are deciding on how to allocate your assets, you should certainly look at the recent returns each category offers. The thing to keep in mind is higher rewards require higher risks.

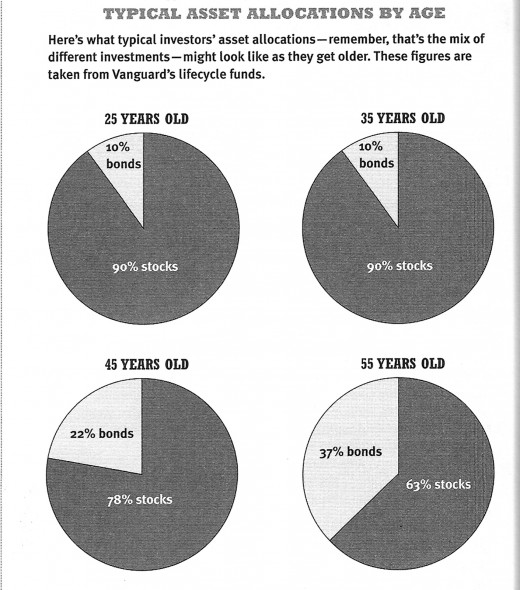

You have to find the mix that is good for you, and as we get older it is wise to move into more conservative investments, because if stocks take a drop quickly you have less time to recover your money.

Many people lost much of their retirement investment in the 2008 stock market drop. Younger people have more time to recover from that loss as compared to those nearing retirement. Even diversification does not always save the day.

It is can also wise to have financial advisors that stay current on what is happening in companies to help you decide on which stocks to purchase. Even the experts can make mistakes. In addition, they charge fees, and it can get expensive. If you have the time or knowledge to study the stock market it may be the best choice to go it alone.

Everyone you know will give you financial advice, but that isn't the safe way to invest. You may be able to stay current with a little time allotted daily for investment research.

Chart from "I Will Teach you to be Rich" by Ramit Sethi

Asset Allocation

In asset allocation you must consider your time horizon, which is the expected number or months, years or decades you will be investing to achieve your particular financial goal.

An investor with a longer time horizon will be more comfortable taking a risk. Risk tolerance is your ability and willingness to lose some or all of your original investment in exchange for greater potential returns. Obviously if you are in your sixties for instance, the bulk of your investment should be in low risk stocks or stable bonds.

There is always that lingering question of risk versus reward. No pain, no gain may fit for you, but for some, they do not want to risk the pain. The other asset allocation is cash and that means money market accounts, certificates of deposits, treasury bills or any type of bank or credit union cash that you could get with a moments notice.

It is prudent to have some cash on hand; some say at least enough to live six months in case you lose your income, but certainly an amount that could handle emergency situations. You don’t necessarily want to have a huge amount of your portfolio in cash at the time since the interest rates are so low.

Bonds act as a counter weight to stocks as they rise when stocks fall, which will reduce the risk of losing much money in your portfolio. Bonds become more necessary for protection as we age. If you are young and perhaps want to invest in a promising biotech stock with great potential, then go for it. You may make a lot of money, and if you don’t youth is on your side to recover. The following chart shows the average amount per age that is a safer diversification.

How To Properly Diversify Your Investments And Lower Risk

Classifications of Stocks and Bonds

As for diversification, there are many types of stock and bonds, and we really want to own a little of all of them as that is what being diversified means.

The stock choices are classified according to their value.

Large-cap:

These are large companies with a market capitalization (market cap, which is defined as outstanding shares times the stock price) over $5 billion.

Mid-cap:

Mid sized companies with a market cap between $1 billion and $5 billion.

Small-cap:

Smaller companies with a market cap less than $1 billion.

International investments:

Stocks from these companies in other countries sometimes can be bought directly but usually they are purchased through an international mutual fund.

Value:

Stock that seem bargain prices (cheaper than they should be)

The types of bonds include:

Government:

These are an ultra safe investment that is backed by the government. In exchange for their low risk they typically have a lower return.

Corporate:

These bonds are issued by corporation. They tend to be a bit riskier than government bonds but safer than stocks.

Short-Term:

Bonds with terms of usually less than three years,

Long-Term:

Thee bonds tend to mature in 20 or more years and therefore offer a higher yield.

Municipal:

These are also known a “minis” and are bonds offered by local governments.

Inflation-Protected:

Treasury Inflation-Protected Securities (TIPS) are ultra-safe investments that protect against inflation.

Index Funds

Another type of fund is the Index funds. Index funds are similar to mutual funds, but these funds work by replace portfolio mangers with computers. The computers aren’t looking for the hottest stocks, but they methodically pick stocks in the same ratio that the NASDAQ index represents.

Most index funds stay close to the market, and they have lower fees as they have are no expensive staff to pay. There are numerous types of index funds available. Since they match the market, if the market goes down, then the index fund will also drop, but over the long term they have consistently paid 8%.

How To Diversify Your Portfolio

Summary

This should give you an idea of the broad categories of stocks and bonds. Good investment strategies are essential to successful savings.

There are so many ways to invest, and we just barely scratched the surface. Investing your money is a big decision. Mutual funds are very popular as they are also rated to let you know which are conservative and which ones have more risk. Diversification of your investment portfolio decreases risk and lets you rest easier at night.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.