Home loan in India: Is it justified to reduce interest rates for new borrowers alone?

High interest rates hurting margins: SBI

Home loan in India, highest interest rates of all time

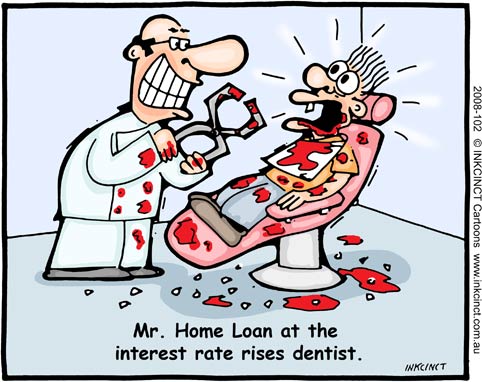

No, it is not at all justified for reducing home loan interest rates just for new borrowers as it is only meant for gaining up new clients and customers from the market by the banks. The banks and money lending services know that if we will not decrease the home loan rates for new buyers, there will be no one to take our home loan product which is a major source of income for around every bank or financial institution in the world.

I can give my own example, I purchased a flat around 3 years back in September 2005 in New Delhi and got my loan santioned from a leading banking institution at a rate of 7.25% reducing balance (floating rate). I tried to take a fixed rate of interest but was not able to take a fixed one because my total income was not matching the equated monthly installment ratio that means my monthly installment was going above 60% to 70% of my monthly income which was not agreeable with the banking authorities and they were unable to provide me with a fixed rate of interest which was 9% at that time.

It is interesting to know that after around 1 year of buying my flat, my monthly installment increased and the interest rate increased up to 9.50%. Then, after 6 or 7 months, it again increased to around 10.75%, then again 11.25%, and now today it is 13%. It is all over the news that banks are going to reduce their interest rates but where??? I have not seen a single reduce in my interest rate for the last three years and right now also it is up.

Believe me dear, I have not recieved a single notification or mail at my house about a decreased rate of interest. In three years, it is almost double.

So now what do you think that it is justified to decrease interest rates for only new buyers????? What about their old loyal customers who are paying their EMIs every month.

Banks need to decrease their interest rates for everyone. I have read in the news that some banking institutions in India are providing interest rate of 11.25% to their new buyers.

I am totally not agreeable with this step taken by the bank or RBI or govenment.

Their should be equality for all, new and old buyers, both of them. After all trusted ones should also get the benefit.

Effects of high interest rates and mortgage and home loan resources

- 6 facts you should know about your home loan

What should you do in such a situation? Here are a few things that every home loan borrower must remember now that home loan rates are expected to increase further. - Home Loan Interest Rates in India, Housing Loan Rates Comparison

Home loans interest rates in India. Fixed, floating rates on home loans. SBI home loan interest rates, ICICI, LIC Housing Finance, HSBC, Citibank, HDFC, Canara Bank, Hudco fixed and floating home loan rates. Compare housing loan interest rates of Ban - Home Loans in India – Housing Loan and Finance News for Indians and NRIs

News on Home Loans in India – Latest news on current home loans rates in India for buying flats, apartment and houses including information on low housing loans for NRI, SBI home loans interest rates, loan rates for commercial and residential propert - http://www.livemint.com/2008/11/07220551/High-interest-rates-global-sl.html?d=1

- http://sify.com/finance/fullstory.php?id=14753378

- \'Will high interest rates kill investment growth?\'

With high investment levels fuelling much of the current GDP growth, the impact of the credit squeeze is more than a matter of academic interest. - High interest rates crippling real estate growth: ICICI - The Financial Express

Due to high interest rates, banks have seen 15 to 20% preclosure of home loan accounts in India

YouTube - Where is Cheapest Home Loan?

- Chidambaram for home loan rate cut, says RBI, banks need to take a call - The Financial Express

- RBI rate cut: Deposits to pay less; loans to cost less

The Reserve Bank of India (RBI), on Wednesday, cut repo and reverse repo rates by 50 basis points. The repo rate now stands at 5 per cent and the reverse repo is at 3.5 per cent. - Reserve Bank of India - India\'s Central Bank

- http://www.livemint.com/2009/03/24234315/HDFC-cuts-floating-interest-ra.html

- http://www.rupeetimes.com/compare/home_loans/home_loan_rates_results.php?bank=&category=Salaried