Household Investment Technique II: The Personal Pyramid II Plan

What is Hyperinflation?

THIS HUB OFFERS A SLIGHT ADAPTION TO THE BASIC Investment Pyramid in order to provide protection against something that probably will never happen. But, like all insurance policies, you grouse about paying for it but are very happy you need it.

What you are insuring against is hyperinflation, runaway inflation when an economy is collapsing and it's currency is becoming worthless. It really hasn't happened in America, yet, but it has happened in economies of such countries Germany and Argentina. When this happens, people look toward something solid, something that holds it's value over time, that something is Gold.

Gold has been a time-honored form of currency since forever. It sill is today in many countries. It isn't a legal currency in America today, but, I just heard Ron Paul, US Representative from Texas, declare he is determined to get America back on the Gold Standard once again. Nevertheless, whether gold is legal tender in American or not, it has value and can be treated that way.

The reason you would want to add gold to your investment pyramid is because when people get scared about an economy, the value of gold goes up. When the economy crashes, the price of gold goes WAY up.

Why Gold?

BECAUSE when people believe an economy is in trouble, the price of gold goes up. When an economy crashes, the price of gold goes WAY up, relative to the currency of that economy. Besides gold's historic use as a currency, it is more available than more precious materials such as diamonds or platinum.

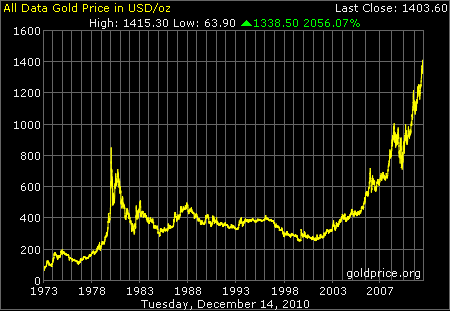

Take a look at the chart to the right. What you see is a 36-year history of the price of gold from 1973 to 2010. The first spike at around 1975 is the result of the 1973-1974 oil embargo and the world-wide economic turmoil that caused. The next major spike in gold prices in 1980 is probably the closest thing we have seen to hyperinflation in a long time. It wasn't because the economy was collapsing but skyrocketing oil prices driven by other external reasons, resulting in inflation of everything make with oil. All of this led to the recession of 1980.

Starting in 2003, we see the beginning of the biggest run-up in gold prices in history and it hasn't stopped yet. It begins with the economic instability driven by:

- First, the aftermath of 9/11,

- Second,the ramp-up of the war in Afghanistan,

- Third, change from budget surplus to deficit brought on by the Bush tax cut

- Fourth, the huge turmoil and uncertainty from start of the Iraq war compounded by the sloppy execution of the war in Iraq and Afghanistan.

That gets us to 2007, where prices flattened out briefly, but only briefly. That was the beginning stages of America's almost fatal economic collapse. You can easily see that as things really started to go to hell-in-a-hand-basket, the price of gold soared; it is still soaring. Can you imagine where the price of gold would be if, first, President Bush hadn't gone against his core ideological principals and agreed to TARP and, then, if President Obama had listened to the ney-sayers and not gone forward with the stimulus? How about, oh I don't know, $3,000 an ounce rather than the current $1,400 or so an ounce; $4,000?

In any case, I think you can see how economic instability is related the price of gold.

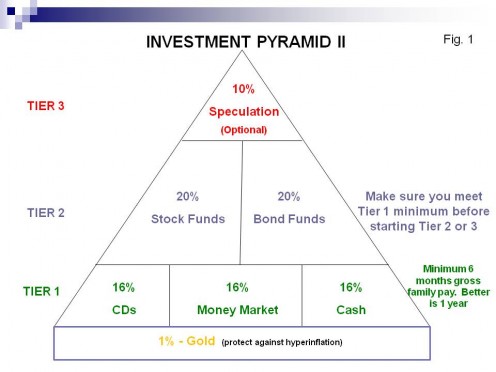

Changing Pyramid I to Pyramid II

THE CHANGE WE WANT TO MAKE TO Pyramid I is to add a block at the bottom for the acquisition of gold. This is shown in Figure 1 below. The recommendation is that you put 1% of your investment in gold. That 1% comes from the Money Market block. All of the rules about when you fund this part are the same as they are in "Household Investment Technique of the Month - Nov: The Pyramid I ": There is only one caveat regarding the acquisition of gold for this purpose, buy real gold, either bullion, coins, or other hard metal. Don't buy bonds or stocks or other paper instruments, buy the real deal. You don't need to personally hold it, although that might be fun. You can have a third party store in for you for a fee. Personally, I don't own any gold beyond a 1oz $50 gold coin from the US Mint, 2 - 0.1 oz gold coins, and a 2 gram "bar" I bought out of a gold dispenser at the Golden Nugget casino because I think they look cool. But, even with that little bit, what if we go into a depression some day and gold hits $10,000/oz? Hmmm.

Investment Pyramid with Protection Against Hyperinflation

Post Script

WHILE I DO OWN a little bit of gold (primarily a $50 gold piece my employees gave me for my 60th birthday), I haven't followed my own advice; but that doesn't mean you shouldn't, therefore. I do not in any way have 1% of my investment assests in gold; and I am much poorer for it! When I knew to do this, gold was $300 an ounce; you know the rest of the story.

I Am Just Wondering

Would You Find Investment Pyramids I or II Useful for Your Investment Plan?

Demographic Survey #1

Are You

Related Hubs

- Take Control of Your Bills

There have been thousands of articles written on this and related financial topics; as there should be for it is hugely important. Not knowing how to manage household finances has ruined countless lives and... - Household Investment Technique of the Month: The Pyr...

YOU need a plan. You need a plan. I say again. you need a plan and you need to stick to it. I bet you have seen that a million times if you have been hubbing through sites that talk about successful investing....