We Were Scammed

My Money Machine???

Background Information

©joaniebaby 06/09/2012

Since I am not certain about legalities of naming specific scam websites in a Hub, I am going to refer to the one I am discussing as "My Loss." Back in 2005 one of my grandsons introduced me to My Loss as a website on which I could make some money. That type of income source was just what intrigued me, so I thanked him and dove right into the mix. He had been participating approximately five months and had received a payout check. That encouraged me further and I studied the site thoroughly. After reviewing it painstakingly and discussing it with my husband and my grandson again, I signed up. What could I lose, right??

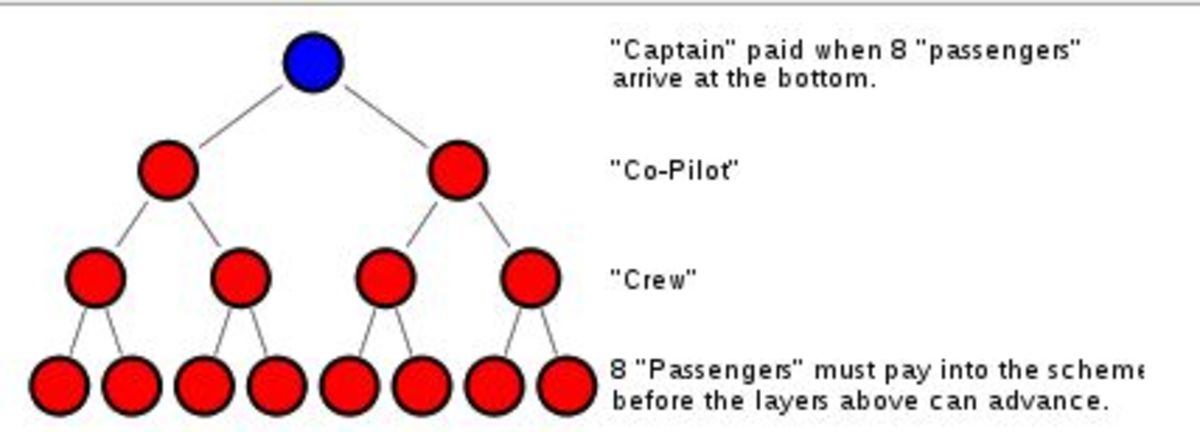

The old adage "If something looks too good to be true, it probably is" really proves accurate in my story. Now that I look back, the website was the time-honored "pyramid scheme." You put in money, they use your money to pay out to other participants, etc., etc. No doubt they never put in any money of their own, except maybe a "starter fund." Since many people, including me, are naive and gullible, they had a "good thing going." With the internet, they were able to reach many people around the world and did not have to concentrate on just one area, which made it all the more profitable.

After all of these years, my memory of just exactly what the program was about is quite fuzzy. There were two different websites, one for registering and participating, and one for sending in your money and receiving payouts. This probably made it more difficult to investigate the scheme. The website that was used for the money transactions I will refer to as "My Loss Pay." To the best of my recollection the only activity we had to do was watch a required number of advertisements per day. Then we would be paid 1% of our account for each day that we watched those ads. The program gave you $10 when you registered and I started out putting in $50. That means if I watched the required ads each day, I would make 60¢ per day, and I could make $18 per month. As you see your account growing, you think about adding more money, which I foolishly did. This I did only after my grandson had received a payout check, thus making me think the "scheme" was for real. My next deposit was $1,000 which allowed me to make $10.60 per day or $318 per month. Pretty good, don't you think? And all I had to do was watch so many ads per day. With all of the extra time I had after retirement, what could be better?? Maybe actually working for my money, right?

It was approximately June of 2005 that I registered with My Loss and deposited money into my account with My Loss Pay. By November of 2005 I had sufficient money in my account that I could request a payout. It took approximately two weeks to receive a check for $350.20 and I was thrilled. The odd amount of the payout is because they charged a fee to transfer funds from My Loss to My Loss Pay. Now I was really hyped, and decided to put in an additional $1900!

After receiving that check, my success made me feel good about the program and I discussed it with another of my grandsons. If you referred someone who later signed up, you received a percentage of what they invested. Yah, more money into my account! Little did I realize I was taking money from my grandson's college fund. When I was considering involving my grandson, I first discussed it with his parents--my son and daughter-in-law. They gave me permission to tell him about the program, and after much thought, he decided to register, too. His parents left him make his own decision. Since he went in "whole hog" with $4000, I received a nice bonus of $400.

Unfortunately, that was the end of a good thing. By the summer of 2006 problems started to show up. The grandson who first got involved was having trouble getting a second payout check that he had requested and so did I. We also were having trouble getting answers to our inquiries from any "administrators" involved with the program. They always had some big excuse for problems. Warning signals started going off, on the internet and in our minds. Many forums were discussing the company and saying it was a "big ponzi scheme." But others were defending it. By the end of 2006, my grandsons and I knew we had been very naive and were out what money we had put in. Quite a difficult pill to swallow, especially since I was the culprit who involved one of my grandsons.

- Being Scammed on the Internet Ended With Restitution Awarded

This Hub continues my story about how my grandsons and I were fleeced by a scam on the internet. Now I will tell you what happened as the case went to trial and a judgment was eventually filed.

How I Took Action

But now comes the good part--or hopefully so. The scheme made me so unhappy that I looked up how to file a complaint to the federal court system. Which I did. That was probably during 2009 sometime (why I waited so long I don't know). I found a form on the internet to fill out and filed it over the internet. After several months and having heard nothing, I decided that my complaint was useless. But, in April of 2010, the phone rang and my husband answered it. He called to me and said, "Joan, it's the FBI. What have you done now?" Was I flabbergasted? To say the least. Have you ever had a call from the FBI? Me neither, and I was shaking, even though I was pretty sure I had done nothing illegal. Anyway it was an Assistant District Attorney from the Northern District of New York on the phone.

She explained what she was calling about and asked me lots of questions about the My Loss program. After talking for a while, she asked if I had any records of my transactions and could I explain how the program worked. As I explained to her, it had been five years and my memory wasn't the best. But, as anyone knows about me, I do keep complete records and I had a boxful about My Loss and My Loss Pay. These records included my registration information, the terms and conditions of the program, records of my payments to My Loss Pay, emails from the company answering questions, a copy of the check I had received and the actual envelope the check came in, etc. When she requested that I send information to her, I decided I had better find out if she was definitely with the FBI. So I asked her to verify that in someway. She agreed I had a legitimate question. It so happened there was a gentleman on the phone who was her superior, and he assured me it was a legitimate call. But I was still suspicious, so they gave me a phone number to call and check on them. I can just hear the skeptics out there thinking, "Well, sure they have a phone number for you to call, but that was just part of the setup, too." They gave me a name of their superior and a phone number.

My first action was to look on the internet under the Northern District of New York for the name they gave me and lo and behold it was right there. Next I called the number listed for this gentleman (which was the same number the FBI lady on the phone had given me) and he verified everything they told me. They were on the up and up and they were probably going to be indicting a lady in New York who was handling the money for people in the United States who had invested in this program. The actual "home office" of the scam was in Canada. They told me that I might have to come to New York and testify if the case went to trial as my complaint was one of the more complete ones they had received about My Loss. That excited me, but also made me nervous to even think about.

This Hub is getting quite long so I am going to end here and continue in another Hub telling all about the continuation of the FBI case.

- What Is A Ponzi Scheme? How To Avoid Being A Victim!

Basically a Ponzi scheme is a form of Investment fraud. What occurs is the perpetrator of the Fraud promises the victims a high return on their investment or dividends that cannot be acquired through legal and honest investments - How Ponzi Schemes are disguised: through secrecy, fake product, and consistently high returns

How do Ponzi schemes even now manage to lure in people despite its invention almost 100 years ago? Learn the three disguises of a Ponzi scheme and avoid being a victim of one.