How I Invest Part Four: Dividend Investing

Dividends=CASH

Dividends? Look for the return

I love dividends. I rarely invest in stocks which do not return any dividend.

Many large companies have reduced or stopped dividend payments over the last couple of years. Now however companies are talking the D word again. Walmart is talking of boosting dividends and Bank of America is talking of returning investor patience by a return to paying dividends.

In the long term I have held Bank of America (BAC) throughout the downturn and bought all the way down to almost its lows of $5.00 per share. I am glad of the return to talk of dividends and am a long term hold for the stock.

Walmart has not been part of my portfolio but with the talk of higher dividends I'll be watching it.

Dividends for me are a reward for owning the stock for the long term. I invariably opt for dividend reinvestment programs (DRIP's) when I can, they are cost effective ways of increasing ones holding, one can stop a DRIP at anytime to opt for cash if ones mood towards a stock changes, but for long hold stocks DRIP's are my favorite method of receiving dividends.

I also like stocks and Exchange Traded Fund's (ETF's) which pay regular monthly dividends. One of my favorite stocks is ING Prime Rate Fund (PPR) it is not an expensive stock around $6.04 but it pays a dividend each month of about two cents per share. It is a risky stock, the business is short term loans to business. During the credit crunch the price fell but it has maintained it's dividend at or above two cents for about a year.

I also like the Bond ETF's for their regular monthly dividends, but these are a little on the pricey side at the moment, as the economic cycle comes around though their prices should comeback to more value limits and be a better bet, I would guess by the end of 2012. Also about that time Corporate Bonds may well be better value, again they rose as returns from cash declined and investors looked to bonds.

Don't Forget the Dividend.

It is possible to receive quite a good stream of income by looking at dividends. If one selects carefully one can use the quarterly dividend or semi-annual system to have some dividend income every month. Dividends are a regular return on your cash. Careful planning can save ones money for more investing if one doesn't choose to use DRIP's; setting dividend income aside in a cash account can be a method to support cash savings for further investments.

One way to make more money is to increase the amount of time one earns money, if one can make multiple strams of income work, making money even as one sleeps one can increase ones earning potential considerably. Dividends are one way to make money as one sleeps.

Low Interest Rates? Look to Dividend Paying Stocks for Income

When interest rates fall on your cash investments, as they have during the past few years (2009-12) This article is updated late in 2012. Cash investments often return little benefit.

Example a standard interest rate on a cash CD with Union Bank of California is today paying 0.3% so with inflation at about 1% cash is losing value in real terms and will do so for the foreseeable future.

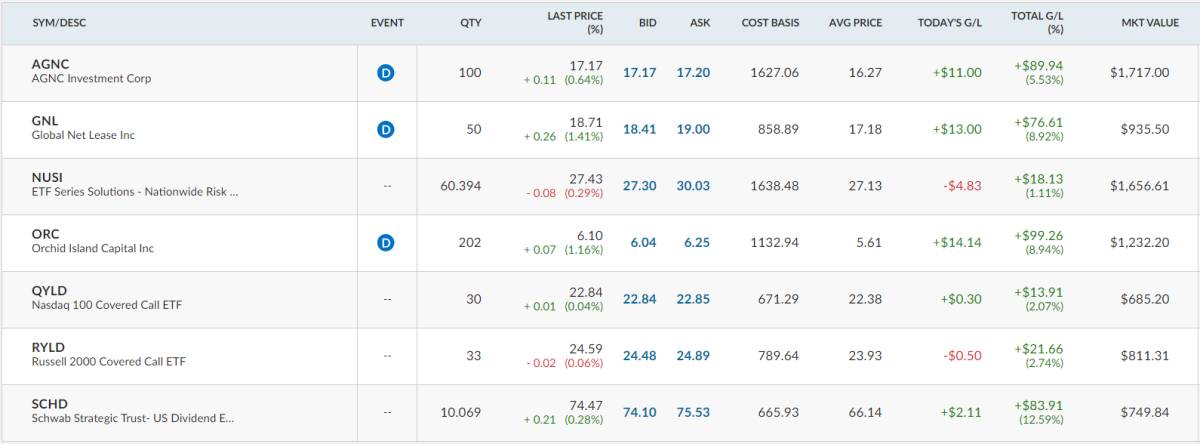

I have several stocks paying me dividends at over 5% per year.

My largest stock is ING Prime Rate Trust (PPR) at present it is selling around the $6.20-6.30 price point, and is returning me 0.8% dividend per month APR at about 5.6%

A nice monthly return for a small investment.

Do not put too much store on a large dividend amount. ING is a well known company and has a good track record of dividend increases.

Some companies may use large dividends to lure unwary investors. Always check other fundermentals such as price to earnings ratios, company liquidity, cash flow, the main business of the company you are investing in.

ALWAYS look the dividend gift horse in the mouth. You will be sure to get a nasty surprise if you don't.

Other Hubs which may be of interest

- Make Money at the Library - Associated Content from Yahoo! - associatedcontent.com

Do you like to earn cash? Do you know your local public library may be an excellent source of extra cash for you. Everyday libraries discard books. You can rapidly build a small high cash generating business using your libraries discarded bookss. - Increase Your Wealth

Most of us would like to have more money. It is our nature to want to see ourselves as comfortable and without the worry of the monthly paycheck lasting only three weeks or less. A basic method of...