How to Achieve and Maintain Healthy Credit

Be aware! Consumer reporting companies know all about you. Your credit report consists of every time you've been sued, arrested, filed for bankruptcy, your bank account information-yes-even those times when you've overdrawn your account, made a late payment, where you sleep and more!

What the scores really mean

Each credit report has a score. To have what is considered "good credit," you need to be in the 600 to 700 range. Scores start out at 300 and can be as high as 800. It is imperative that one has good credit- so when you need a loan, a car, a home-you will be thanking yourself for building a good credit history. You will earn lower interest rates when purchasing higher ticket items.

Now, you are probably wondering-where can I get a copy of my report? Well, it's fairly simple. You can obtain a copy through one of the following CRC's: Equifax, Experian, or Trans Union. All you have to do is fill out a form, with general information, names, numbers, and a few questions about payments you make-such as mortgage payments. You can obtain a free copy of your credit report once a year. There is a fee for more times.

Why do I have different scores?

All credit reporting agencies may have you at a different, but similar score. This depends on if they only have part or all of your reports from companies you owe money to. Based on the information they have, this is how they assess it. Understanding your report is the next step. The different CRC's have similar but different ways of presenting information on you, but they should all include similar information such as your address, banking accounts, etc. and any inquiries you have made on an account. When reading through your report, if you see an error, write a letter to the CRC, noting the error and include your supporting documentation.

The CRC has up to 30 days to investigate your claim. If they can resolve the issue, they can re-submit your credit report to anyone that obtained it in the last six months and you may obtain a new copy. Keep in mind-arrests, lawsuits and other harmful information can stay on the report for up to seven years and cannot be removed-even if your brother-in-law is a powerful attorney.

Always know what's going on with your credit

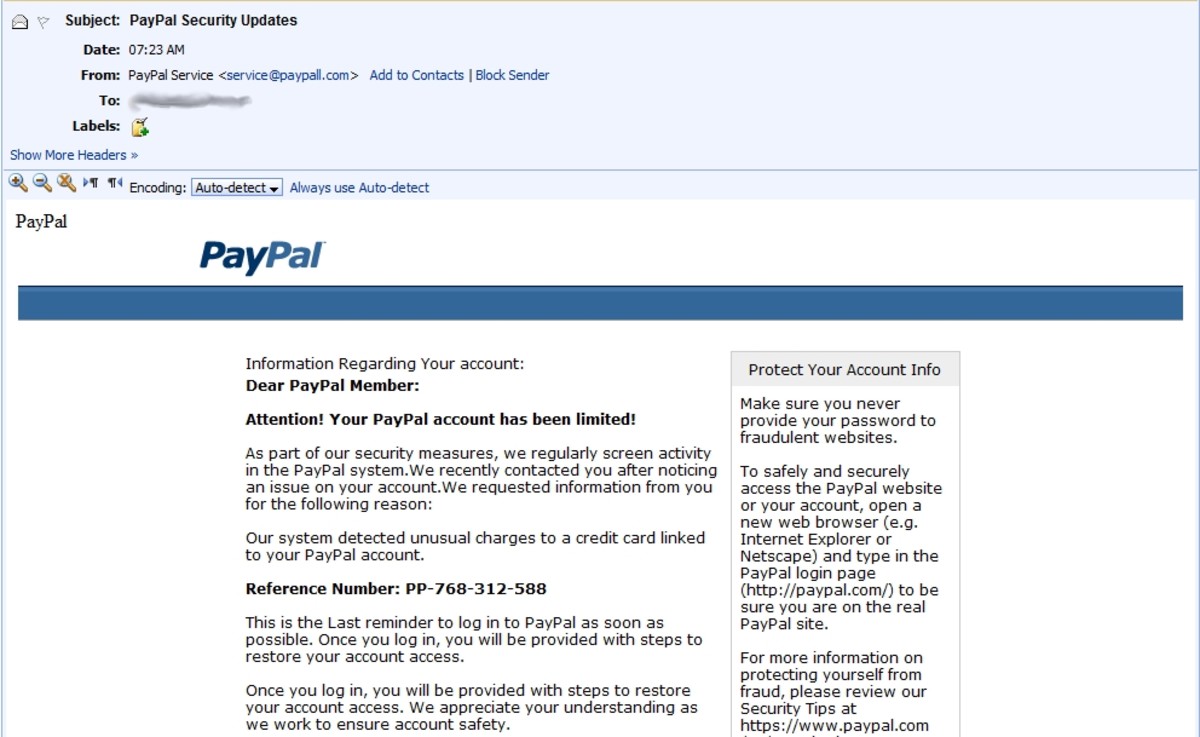

Monitoring your credit is a way to help ensure that you are in good status. There are however companies that can do this for you. Due to the increase of identity theft, this might be something to consider. Essentially, the company will send you updated reports on the activity of your account (Example is, If someone tries to get a credit card, under your name). If you are aware that your identity has been stolen you can call a CRC and ask to speak with someone in their fraud department.

Protecting your personal information is a key to maintaining good credit and help deter identity theft. You should shred all old financial information and be assertive when you give information over the telephone.

How can I improve my credit score?

To improve your credit score, pay bills on time and have fewer accounts, and make fewer inquiries regarding your credit status. Be smart and savvy about your credit report concerns and you'll be in business!

SITES TO ULTILIZE:

http://www.annualcreditreport.com/, 1-800-322-8228

Annual Credit Report Service, PO Box 105281, Atlanta Georgia 30348-5281

Equifax: http://www.equifax.com/, 800-865-1111

Experian: http://www.experian.com/, 888-397-3742

Trans Union, http://www.transunion.com/, 800-916-8800