How to Build Credit and Use It for Real People

Before We Begin...

Before we begin, the first thing you need to do is find out your credit score. The best resources for this are Credit Karma and Nerdwallet. They're both great starting points to figure out where you are and how to move forward. Plus, they both pair you with card recommendations that they think would work for you. They tend to push their partners more than other vendors though, so while they're a great spot to window shop and get an idea of your options, they probably shouldn't be your one stop shop.

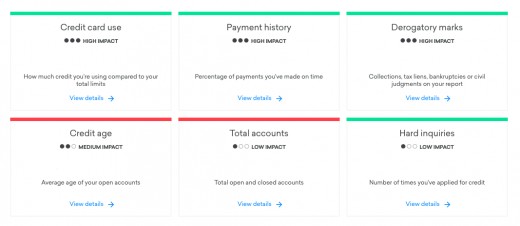

So What Determines Your Score, Anyway?

-

Credit Card Use

This is how much of your total limit you're using. Obviously, you want to keep this as low as possible and it is key to making the most of your credit. Balances mean interest, which mean lost money and lost rewards.

-

Payment History

This is how many of your payments you've made on time. Long story short, don't miss a payment. After a few times, your credit will really take a beating that takes a long time to recover completely. Even if you can't pay off the balance, make sure you pay the minimum.

-

Derogatory Marks

Things like bankruptcy or tax liens fall under this. Try not to let it happen, yeah?

-

Credit Age

Average age of accounts. The more recently you've opened your accounts, (which if you're just starting, is very recently) the lower this is. This and the next three criteria are why you want to begin now, to start that clock ticking!

-

Total Accounts

The number of credit accounts you have, including both credit cards and loans. You want a solid amount of these to look good, but are limited by the final section.

-

Hard Inquiries

Every time you open a new account, you get a pull on your account. They stay for two years so the sooner you make these, the sooner they go away. You want to try and stay under 5, though.

So Now You Understand Your Score - What's Next?

Once you've figured out your score you're ready to work on A) improving it and B) racking up some rewards.

If you're not doing so hot (less than 650, generally), you're going to need to open a secured card. Secured cards basically turn you into your own lender. You put down a refundable deposit and that deposit is your limit. After some time, they return the deposit and give you a real credit limit. Personally, the best option I've seen is the Discover It Secured because it offers decent rewards, which is not super common on this tier of cards. 2% on restaurants and gas, plus 1% on everything else, is not a bad starting point at all.

If you're starting from a bit stronger of a position, (at least 700) you should have a lot more options open to you. For your very first card I recommend a good catch all card that gives a flat rate of at least 1.5% on everything. Start paying your bills on this every month to get used to the idea of credit. Personally, I started with the USAA Preferred Cash Awards Visa Signature, but USAA isn't available to everyone. The Citi Doublecash Card, TD Cash card, and any of Bank of America's cards are all decent starting cards too.

Now You Have Your First Card - Let's Build On That

You want to eventually have one credit card for every purpose to max out your rewards. But remember, you need to pay your balance off each month to take advantage of these. Otherwise, you'll be paying interest that defeats the point of all this. You also want to try and stay within a few rewards ecosystems, if possible, such as Chase Ultimate Rewards.

With that said, there are some categories to make sure you hit. The order you progress on these will depend on your particular needs. If you commute a great distance to work, a gas card might be a higher priority than a travel card. But make sure you take a vacation eventually, ok?

-

Bills

You want a card that you use to pay your bills every month, preferably on auto-pay to save you time, effort, and in some cases, money since some companies give discounts.

-

Travels

Even if you don't travel a lot, it's a good idea to have at least one card you dedicate to your travels. Make sure it has no international transaction fees, but the best options for this category will depend entirely on what companies you like to use. You'll likely end up with multiple eventually, but start with one for now, at least.

-

Supermarket

This is one of the biggest parts of your budget each month, more than likely, and you should get rewards for it. Get a card just for groceries and see those rewards rack up.

-

Gas

The 5% I get back on gas from my USAA AmEx card makes me hate going to the pump a little less. Only a little though.

-

Dining

Another category where your spending can quickly add up. If you double this up with restaurants' rewards programs you can really start to save some money.

-

Debit card

Yes, that's right. Get one credit card to essentially replace your debit card. Forget your debit card exists. Your checking account is only to push payments on your credit cards now (and rent, I guess). I mention this because when something doesn't fall into another category, you won't know where to put it and the whole model becomes harder to follow. This one goes well with shopping in particular, because every store wants you to open their own usually subpar card.

So Those Are The Types of Cards - Now Which Cards Should You Get?

Well, this one will really be up to personal preference. There are a LOT of options. The biggest names you've probably already heard of really are great options though. There are a lot more options than these but keeping one of these in mind is a good starting point for you to figure things out.

-

Chase

Chase is very strong right now because of their full ecosystem. You can combine a lot of cards together to make them stronger, since Chase Ultimate Rewards points are transferrable with the Chase Sapphire Reserve. Consider the Chase Freedom Unlimited (1.5%), Chase Freedom (5% on certain changing categories), either Sapphire card (Travel and Dining), or any of their co-branded cards. (mostly travel)

-

American Express

AmEx has a solid portfolio as well. They have one of the stronger offerings for gas and grocery cards, and are also very competitive on travel with a wide range of options.

-

Discover

Discover is a good place for a beginner. Their portfolio is smaller, but very useful and straightforward for starting out and they're generally a lot more accepting than Chase. Especially works well if you went with them for your secured card.

-

Honorable mentions

These are probably the three biggest, but also worth considering are Capital One, USAA, and Citi Bank.

Get all that?

Hopefully this quick run down gave you a bit more of an idea of where to begin. The idea of credit seems overwhelming to a lot of people but it's really not if you do a little bit of reading. Take the time to compare which cards have the rewards rates and benefits you need. And if you get a card and it's really not the right fit, don't worry. It happens. My first card was one from my local bank, and it's served me well enough, but I didn't know all the options that were out there at the time. Now I do, and soon, you will too!