How To Make a Family Budget

Making a budget is the first step (other than making up your mind) to getting on top of your finances. I think it is almost impossible to live within your means and to stay financially strong without one. I say almost, because there are a few people who are very disciplined and keep their spending to a minimum. For the rest of us who need a little help, we need to make a budget!

First figure out your family take-home pay (after taxes). This is a monthly budget; so add up your take-home pay for yourself and your partner. If you get paid weekly, multiply the weekly pay X 4.33 to get your monthly pay.

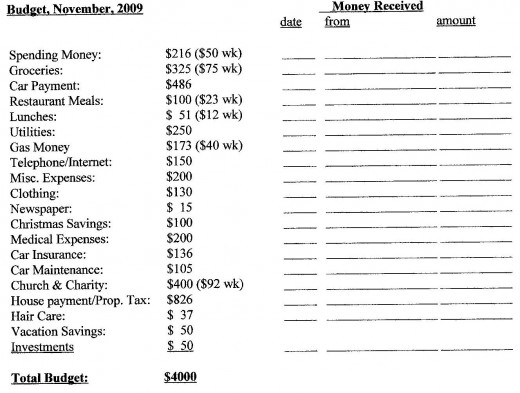

All of your take-home pay for the month becomes your total monthly budget. For purposes of this blog, lets say your monthly take-home pay for your family is $4000. This amount is also your budget and that’s what we have to work with. There is no “deficit spending” in the family’s finances (unlike the government!).

Now figure out the categories of spending you need to include in your monthly expenses. Try to list them in the order of importance or by date order of payment during the month. Following are some suggestions for categories you might use:

Rent or house payment

Groceries

Utilities

Daycare

Telephones/Internet

Church or charity

Car payment

Gas for cars

Car insurance

Car maintenance

Medical expenses

Credit car payments

Spending money (pocket money) for family members

Lunch money for family members

Home and lawn care (repairs & maintenance)

Clothing expense

Hair care

Gifts

Vacation savings

Christmas savings

Investment savings

Newspaper

Miscellaneous expenses

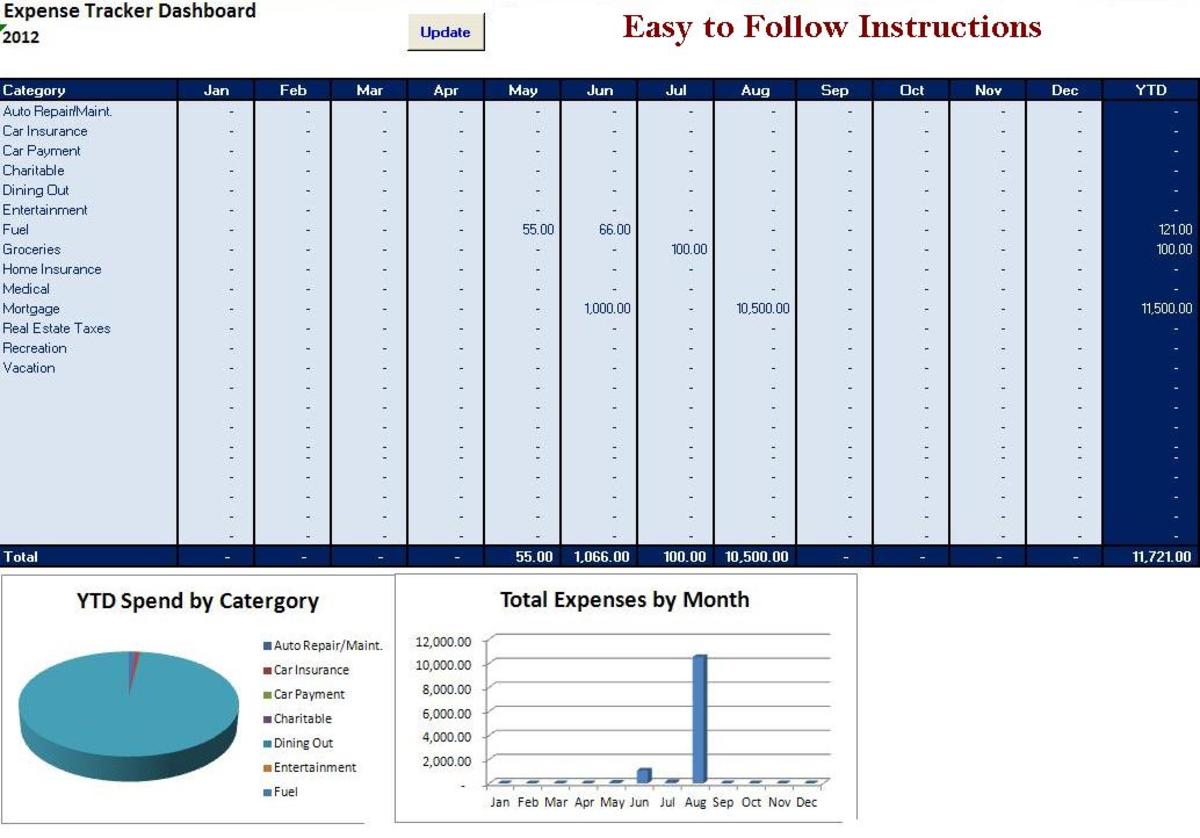

These can be modified, combined, eliminated or changed as needed. After you have made your list of monthly expense categories, try to estimate the amount needed for each category, each month. Then add up your amounts to compare to your total monthly budget. If you come up less, you can add more categories (to make your budget more detailed), or increase the amounts on some of the items. Try to get it close to your monthly budget, or slightly less, so you can allow something for unforeseen expenditures. Once you get this done, you need a simple form that looks something like the one in the picture above to the right.

Each time you get a paycheck or other money during the month, log it into the lines on the right. During the month as you spend or pay bills, keep track of expenses according to category on a separate page in a notebook.

At the end of the month, add up the totals of all the pages (all the categories) and see how you did. Did your total expenditures equal your total income? Did each category equal the amount budgeted for the month? If not, change your budget to bring it in line with your actual spending. Remember, your total expenses cannot be more than your monthly income. The goal is to make a realistic budget, which tracks your actual spending on a monthly basis. If your actual expenses are way more than your income, you are not living on what you make. You are going into the hole a little further each month.

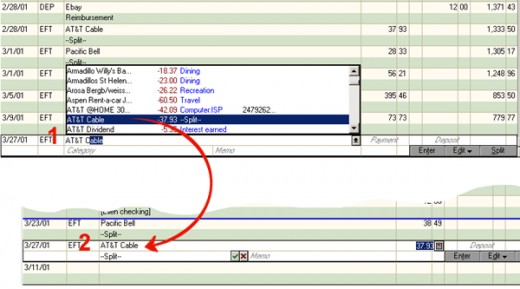

This system is a lot easier to do on a long-term basis if you use a checkbook program like Quicken. Then you can set up your categories as in your budget and each time, you take any money out of the account (cash, debit, or check), you can post the expense to that category. It keeps track of your spending for you according to the categories you choose and will give you quick totals at the end of the month, or at any time you just want to look at it. It’s about 100 times faster than keeping track manually and infinitely more accurate. The great thing, is it also gives you quick and easy totals at the end of the year when you are doing your taxes. I really can't tell you how great it is, you have to try it. If you are committed to budgeting, Quicken is the way to go!

Getting good at budgeting is a process. It takes many months of “tweaking” to get it right. Learning to live on a budget can be even harder, but I believe it is the only way to learn to live on what you make. Why should we do that, you ask? Because it is the only way to get ahead on a long-term basis (short of some kind of windfall profit). You should do it because it is responsible and it will enable you to “get on top of your finances” once and for all. This is the first step, which will enable you to plan your financial future and set goals. More blogs to come!

![Quicken Deluxe 2010 [OLD VERSION]](https://m.media-amazon.com/images/I/41uEaGxpH0L._SL500_.jpg)