How To Read a Stock Option Chain and Quote

Before we learn how to accurately read and interpret a stock option chain, or brush up on certain components which you may find slightly confusing or just simply do not understand, please read on to find an initial introduction that outlines the basic concept of what this complex and highly diverse financial instrument called an option is, and a brief description of the two most common types traded on the CBOE (Chicago Board Options Exchange).

At first glance, the stock option can be relatively difficult to understand in theory and even more so in actual practice. For many beginners, the moderately steep learning curve typically requires a considerable amount of study and research hours dedicated to the subject to gain a comprehensive understanding of exactly what a call and put are, and how they work. However, with this in mind, I'm highly confident this goal is achievable and well within reach even for the inexperienced novice provided of course the desire, commitment, and time allocation necessary to absorb all basic fundamental aspects is present. Conversely, some of the ultra complex and exceedingly risky options strategies utilized by experienced professionals in every day practice, may take many more additional hours of intense study before adequate working knowledge is attained. A retrospective review of my personal experiences detailing intimate involvement in regard to options research and trading, leads me to the following logical conclusion - Attaining expertise which enables the consistent production of positive results and attractive ROI in this highly speculative derivative trading area, is subjective and a fleeting attribute at best.

In the future, I will publish additional follow up articles which will primarily focus on the actual mechanics and market dynamics that can be significantly influenced and or impacted by this common stock derivative security, but for now, let's take a look at the unique format in which they are quoted called the "Chain".

Call Option Overview

The "Call" option is a contract that contains a provision which gives the owner or "Holder" an exclusive right to "BUY" 100 shares of the underlying stock for a specific price (Called the Strike or Exercise Price), for a specific period of time. The option holder does not own the actual stock or equity position in the company, just a financial contract or "OPTION" to buy the underlying shares sometime in the future if the right or provision is exercised. This right can be exercised at any time prior to the options expiration date. Once an option expires, it's worthless.

Put Option Overview

Essentially, the exact opposite of a Call Option. The owner of a contract representing 100 shares of the underlying stock has a right to "SELL" the shares at a specific price for a specific period of time. Just like the Call Option, it becomes worthless after the expiration date.

- Note: All 100 shares must be bought or sold if the right is exercised. You cannot buy or sell less than the designated 100 shares in any given contract, it must be all or none, no "partial execution").

- Due to the volatile nature, inherent risk factors, and complexity of this derivative security, a brokerage firm or financial institution such as a bank which acts in duel capacity as a "Broker / Dealer", typically requires a higher level of approval from a prospective client. The criteria threshold which must be met is above and beyond the basic stock and bond trading account application. If you're an accredited or experienced investor with a substantial net worth, the process should be relatively swift and easy. If not, there is a possibility that your options trading application will be denied until an appropriate experience threshold is achieved or other acceptable criteria is met. Even though the novice investor may be disappointed in the denial, the financial institution is merely looking out for its own best interest -

Options Quick Reference Table:

TERM / PHRASE

| DEFINITION / EXPLANATION

|

|---|---|

Stock Option Contract (Puts & Calls)

| The right to Buy or Sell 100 Shares of the underlying stock at a specific price for a specific period of time until expiration

|

Call Option Contract

| A financial instrument which gives the owner a right to BUY 100 shares

|

Put Option Contract

| A financial instrument which gives the owner a right to SELL 100 shares

|

Exercise/Strike Price

| Price designated in the option contract at which the underlying stock can be purchased (The price is non negotiable and never fluctuates or changes)

|

Expiration Date

| Pre-Determined date at which the option contract expires (Becomes Worthless) Options are only valid for the period of time designated in the contract. The time frame cannot be extended

|

Bid & Ask Price

| Same as Stock

|

Exchange

| CBOE (Chicago Board Options Exchange)

|

Options Chain/Quote

| Options "Chains" (Industry term for "Chart"), can usually be found in the same location as standard stock quotes & charts. i.e Online Discount Brokerage Web Sites, Independant Financial Services Web Sites, etc.

|

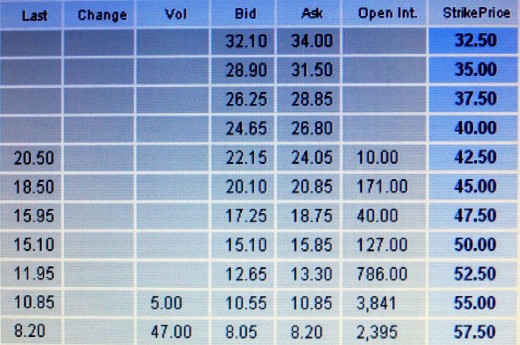

HOW TO READ A STOCK OPTION CHAIN & QUOTE

- Calls on Left & Puts on Right

Call Option Contracts are typically listed on the left side of a chain if the format is designed in a vertical separation with the partition in the center, or they may be located on top in a horizontal style chain. In either case, both the "Put" and "Call" section will be clearly listed. If you have any questions or doubts about which type of option you are viewing, contact the host for additional information.

- Exercise/Strike Price

Typically found in the middle of the options chain, this is the price at which the underlying stock can be purchased or sold. It's a set price and will not fluctuate in value.

- Ticker Symbol

Options just like the underlying security or stock they represent, are assigned and trade under a unique ticker symbol for identification purposes. A series of letters used to distinguish the various option contracts for practical purposes. This symbol can usually be found in the same options chain as pricing info etc. and is used when placing a trade (Buying or Selling the option). Once again, if you have questions, contact the web site host.

- Bid & Ask Price

Bid and Ask prices for all options contracts work essentially under the same concept or principle as stock prices. The "Bid" is the current highest recorded price a buyer is willing to pay for the derivative, and the "Ask" is the current lowest price a seller is willing to sell the contract(s), hence, a standoff ensues unless a meeting of the minds can be achieved via a price adjustment, or the communication of a third party order materializes which accommodates the current price on either side of the spread.

Note: The "Bid" or "Ask" price is always multiplied by 100. ( Per the options contract which is for 100 shares of underlying stock ).

- Open Interest

This indicates the current total number of option contracts that are still "In Play" or on the open market. They have not been exercised or "Closed Out" (The underlying stock has not yet been bought or sold).

- Volume

Options volume is calculated in the same way as the underlying stock however, in most cases it's a fraction of what the total daily stock volume is.

- Last (Price)

The last or most recent price at which a transaction between a buyer and seller was consummated. Last sale price.

- Change

The change in price between the most recent sale transaction and the one immediately preceding it. Price increase +, decrease -, or unchanged. the extent of price fluctuation or volatility, percentage change, and short term technical trends can usually be determined by monitoring this indicator.

Reminder: The "Call" and "Put" Option is a financial instrument that contains the "RIGHT" to "BUY" or "SELL" the underlying stock. You don't actually own it unless and until the right is exercised,

That's your "OPTION" -

- About the Author-

- Alternative Prime is a former Personal Finance Professional - Broker - Life Agent - Series 7& 63 Registered Representative & NASD Member Licensed in 5 States - Stock & Options Researcher/Consultant/Trader/Investor - Contract Quality Check Supervisor - Regional Manager/Trainer and Educated in Business Law Aspects -

<> "Read & Experience" more literary and creative visual works by this highly acclaimed publisher - Click "Alternative Prime" located next to avatar at top of page <>

|

|---|