How To Trade Shares – Stochastic Oscillator Parameters - Compute the Stochastic Oscillator Using Excel

Beginner in Trading Shares

If you are a beginner in trading shares for a living then there is one trading indicator called the Stochastic Oscillator that you will need to learn how to use it. The stochastic oscillator is actually a momentum indicator. It is widely used by stock traders in their technical analysis. Stochastic Oscillator was introduced by George Lane in the early years of 1950s. The idea behind the Stochastic Oscillator is simply to compare the closing price of a security to its price range over a given time period.

When the prices of a share are going up, they continue to do so until when they reach the top where the day to day changes start reducing – it’s as if the upward swing is getting tired. The opposite in case of downward movement is also true. The logic of the stochastic indicator is that prices tend to close near their past highs in upward movement, and near their lows in downward movements. Treades are entered or exited when the stochastic oscillator crosses its moving average.

Stochastic Oscillator Parameters

The stochastic indicator is made up of two lines namely:

- %K line which compares the current closing price of stock to the recent trading range.

- %D line which is really the moving average of smoothened %K line.

Stochastic is an oscillator that fluctuates between 0 and 100. From this a trader can define overbought or accumulation and oversold or distribution levels, usually 70 and above for overbought and 30 and below for oversold.

Before computing the stochastic oscillator, you have to decide on the time period you want to use. George Lane used a 5 days for %K and 3 days for %D to trade short cycles, but I use 8 days period for %K and 5 days for %D. The period to use is your discretion based on the sensitivity you want.

To calculate the stochastic oscillator, we use the two formulas below:

1. Calculate CL = Close Price today - Lowest Low in 8 Periods

2. Calculate HL =Highest High in 8 Periods - Lowest Low in 8 Periods

3. Compute %K = (CL / HL) x 100

4. Calculate %D by smoothing %K using the 5 period moving average of %K.

Compute the Stochastic Oscillator using Excel

To compute the stochastic oscillator using Excel, you proceed as follow:

1. Insert the high prices data for your stock in column “A” in Excel Spreadsheet.

2. Insert the low prices data for your stock in column “B” in Excel Spreadsheet.

3. Insert the closing prices data for your stock in column “C” in Excel Spreadsheet.

4. Sort out the lowest closing price for the last 8 days “=Min(C1:C8)” into column “D”

5. Sort out the Lowest Low price for the last 8 days “=Min(B1:B8)” into column “E”

6. Sort out the Highest High price for the last 8 days “=Max(A1:A8)” into column “F”

7. Compute the CL in column “G” by inserting “=(C1-E1)

8. Compute HL in Column “H” by inserting “=(F1-E1)”

9. Compute %K in column “I” by inserting “=(G1/H1) * 100

10. Compute %D in column “H” by inserting “=Average(I1:I5)

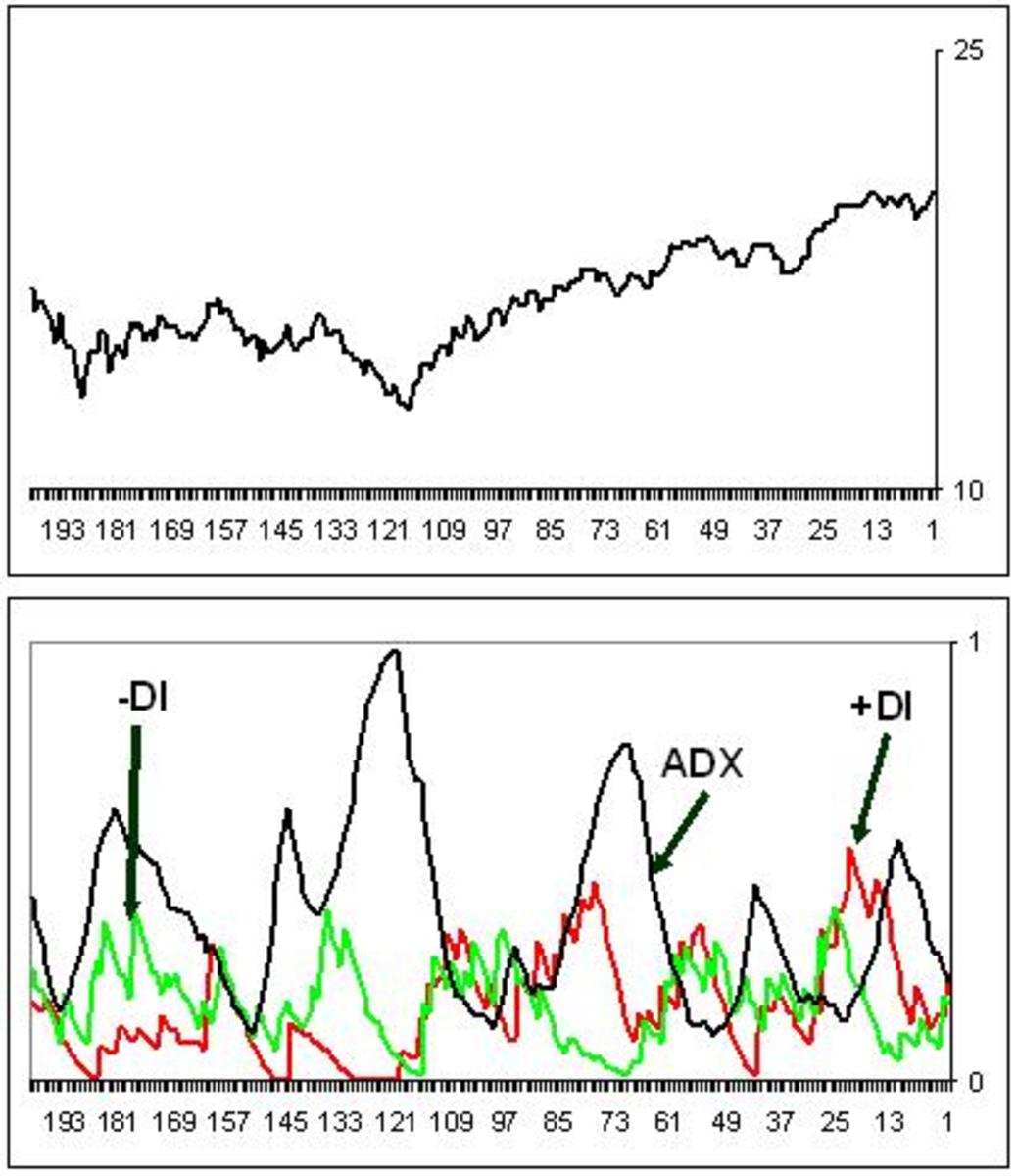

Hold and drag your formulas downward in as much as you would want to go into the past. Now select column “I” and “H” data and draw or insert a chart using Excel. You will now have stochastic oscillators with %K and %D as shown in the image below which you can use for entering and exciting your trades. Once you learn how to use stochastic in excel then you can latter manipulate it to your liking and the sky will be the limit to what you can do.

Before you attempt to trade using stochastic oscillators with %K and %D, you should have the following:

1. You must define the trend. Only trade with stochastic in the direction of your trend.

2. Always use a Stop Loss Order which you will keep on trailing or updating as the market unfolds.

3. Buy shares when stochastic oscillators fall below the 30 level and raises back above it, but only if your trend is upward, or better still when %K line crosses %D line.

4. Short stocks when stochastic oscillators rises above the 70 level and falls back below it, but only if your trend is downward, or better still when %K line crosses %D line.

If you have liked this article, and you would want this page to keep up and improved, you can help by purchasing some great items from Amazon by following Amazon links and widgets on this page. A free way to help would be to link back to this webpage from your web page, blog, or discussion forums.

The Author’s page is designed to help beginners and average readers make some money as an extra income to supplement what they may be earning elsewhere - details of which you can find in My Page, if you will.