How To Withdraw Provident Fund In India

How to withdraw PF or Provident Fund: Follow these easy steps

Have you left a job and not yet withdrawn money saved in Employees Provident Fund? If not, take all the money and invest in tax savings schemes immediately.

The reason: the Income Tax Appellate Tribunal in Bangalore ruled in November 2017 that all interest accrued on PF accounts, after an employee has left a job, is taxable.

Earlier, most people did not withdraw their PF money after resigning or being terminated from a company and even upon retirement.

The reason was simple: the money is safe with the Employees Provident Fund Organization (EPFO) and collects interest, regardless of whether the account is active or dormant.

Rules on Provident Fund Withdrawal

Actually, you cannot withdraw PF amount under existing rules. This is because you pay 12 percent of basic salary towards Provident Fund while the employer pays a matching or higher amount.

Since February 2018, the government pays 8.55 percent interest per year.

Amount collected in the PF account ensures you have some income post retirement and do not have to live at mercy of others. This was the deciding factor for the Indian government to make mandatory for all companies hiring 20 or more staff to provide Provident Fund.

Why Withdraw PF?

Generally, people withdraw money collected in their PF accounts for two main reasons.

- If you do not want to continue using the same PF account with a new employer for any reason. These include bad blood with former employers, better investment options with high returns elsewhere or migrating to a foreign country for work.

- You can also withdraw PF money if facing severe financial crises. Generally, this is not permitted, but EPFO has some provisions that allow employees facing financial hardships to prematurely withdraw the money, before retirement.

Remember, withdrawing Provident Fund is not an easy task. EPFO has simplified several processes to withdraw PF over the years.

However, you need to overcome several hurdles and cut miles of red tape before actually getting the money in your hands. Hence, it is advisable to know rules that govern PF withdrawals.

Rules to Withdraw Provident Fund

There are several rules that you need to follow before withdrawing Provident Fund.

Withdrawals Not Permitted

- You cannot withdraw PF unless you are 58 years and have retired.

- Provident Fund cannot be withdrawn if you have to continue working past 58 years of age.

- Withdrawals are also not possible if you seek an extension of service beyond 60 years age.

- It is also not possible to withdraw PF if you have continuous service and contribution for 10 years with the same employer unless permitted under specific clauses of EPFO, as mentioned in exceptions.

- If you are below 58 years and have lost employment for any reason. However, in such cases, it is necessary to prove that you remain unemployed after 60 days since leaving duties.

- In cases where you have left the job by resignation or termination and do not wish to continue the Provident Fund scheme of the former employer.

- Cases of emergency where you have no options other than to withdraw PF.

- Upon retirement at the age of 58 years and above.

Permitted Withdrawals

Exceptions

According to a decision at the 22nd Central Board of Trustees meeting of EPFO held June 2018 employees that resign from their service can now withdraw 75 percent of their total Provident Fund money after 30 from the date of stopping work.

This relaxation is offered to PF subscribers to meet monthly financial needs.

This can be done even if you have not completed 10 years of continuous service with an employer who also contributes to your Provident Fund.

To avail this relaxation, you may have to provide adequate and acceptable proof of unemployment. You also need to show there are no alternative sources of income to support family and self.

Providing false information to withdraw PF is considered fraud and punishable under various sections of the Indian Penal Code.

Withdrawing Provident Fund

There are two procedures to withdraw Provident Fund.

- With Aadhar Card: This is the fastest and involves few hassles

- Without Aadhar Card: Can prove very laborious and tiring.

First, let us look at how you can withdraw PF using Aadhar Card

PF Withdrawal with Aadhar Card

Complete the Composite Claim Form- Aadhar and submit to your nearest EPFO office. Since tis withdrawal of PF is Aadhar based, you do not require an endorsement from the previous employer.

This system is particularly useful in case you have bad relations with the past employer or their authorized signatories for Provident Fund. It does away with the need to beg your previous employer for signatures and stamps to withdraw PF.

To use this facility, you have to ensure your PF account is linked to Aadhar. Secondly, it is also necessary to have the Universal Account Number (UAN) while filing the claim status.

You can find your UAN number and bank details where the PF account is held using your Aadhar card. Simply look up on the EPFO portal for these details.

Generally, employers will have taken your Aadhar details through Form-11, while opening the account. If not, the process can prove a hassle. You will need to get the UAN from the nearest EPFO office and get this number activated. However, such cases where a UAN is not issued or activated are fairly low.

PF Withdrawal Without Aadhar card

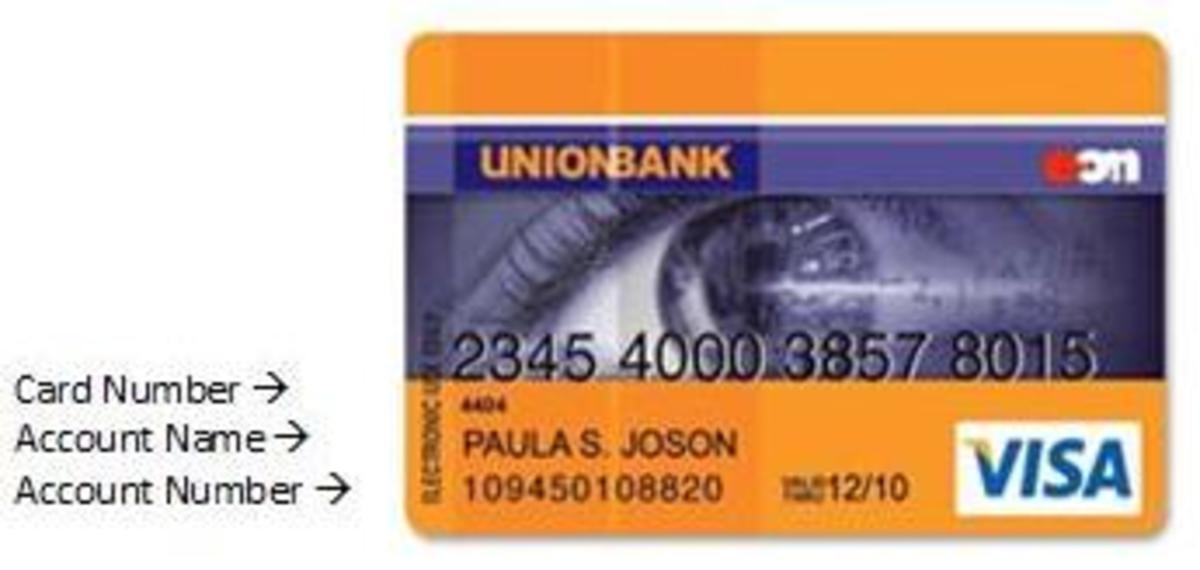

If you do not hold an Aadhar card, the process can be fairly complex. In such cases, you need to provide your Permanent Account Number (PAN) provided by the Income Tax Department as well as account number of the Provident Fund account.

Both these details are to be mentioned in the Composite Claims Form (Non Aadhar) available from EPFO offices.

Both Aadhar and Non-Aadhar based withdrawal of Provident Fund has to be supported by additional forms.

Terms and Conditions (Aadhar and Non Aadhar based PF)

There are four terms and conditions if you want to withdraw PF using Aadhar card or without it. You need to conform to either of these.

i) Withdrawing your PF contribution plus those made by employer and government under Employee Pension Scheme (EPS) if you have less than 10 years of service.

ii) If you have more than 10 years of service and want to withdraw all money in Provident Fund.

iii) Withdrawal of PF balance and part of your pension under EPS. This is permitted only after completing 10 years of service and between 50 to 58 years of age.

iv) Withdrawal of both PF balance and full pension amount under EPS. This facility is permitted only if you are above 58 years old or more and have retired.

Addition Forms to Withdraw PF

The process is similar for Aadhar and non-Aadhar based PF subscribers.

For those below 58 years of age, it is possible to continue with PF by availing the Scheme Certificate by submitting the completed Form 10-C at the EPFO office. Use this facility if you plan to work again and will be entitled to PF from the new employer.

If you are between 50 and 58 years old, it is possible to opt for reduced pension when you withdraw PF. This can be done by submitting the completed Form 10-D along with the Composite Claim Form.

Citizens over 58 years of age can withdraw the full Provident Fund and EPS amount by submitting Form 10-D along with the Composite Claim Form.

Next Steps to Withdraw PF

Once you have submitted the Composite Claims Form and other forms, the process to withdraw PF takes anything from one week to a month depending upon where you stay.

In some cases, PF withdrawals are faster if the money is to be received in an India Post savings bank account. However, this is not a rule.

The best way to withdraw your PF is by continuing the account number for use in future. This ensures you have a longer track record of paying Provident Fund contributions. This comes handy while paying Income Tax.

In Conclusion

If you view the broader picture, it is not advisable to withdraw PF unless you have pressing and genuine need for the money. Instead, allow the money and EPF to mature. These will ensure you are financially secure after retirement. Keeping money in a PF account earns good interest. It more than doubles since your employer also makes a contribution to the fund. Should you need to withdraw PF, follow these simple steps we have described?