How Your Insurance Company Computes Your Household Insurance Premium

Household Insurance Premium Quotation

When applying for household insurance from your insurer, you will normally be required to provide some information, usually in the form of an application form. If the insurer is satisfied with the answers you provide, they will calculate your household insurance premium. Rates for buildings will usually be based on the rebuilding costs and these rates usually vary according to the location.

Where household insurance is required for contents and personal possessions, the rates will be based on the sum insured. Again, the location will be taken into consideration.

Location/Zip Code/Post Code Rating

To minimize their risk exposure, insurers could base their household insurance rates on either:

- sector coding

- on the full zip/postcode

There are disadvantages to a 'more specific' approach. Although consumers living in areas where the risk of being burgled is perceived as low could benefit from lower premiums, this would be at the expense of those people living in higher risk areas who would have to bear higher premium rates. This approach could result in household insurance becoming inaccessible to people living in high-risk areas. Further, calculating accurate premium rates for each area would be complex and need constant monitoring.

However, in recent years a major preoccupation for insurers and many householders has been the availability of flood damage cover and storm damage for homes. This has resulted in full Zip codes/postcodes being used to determine which properties are situated in flood or storm-prone areas plain to enable underwriters to assess whether they want to cover that risk.

Where flood defences protect properties, premiums will differ dependent on the risk involved.

Claims Frequency and Costs

Within each zip/postcode, insurers will analyze their own household insurance claims frequency so that they can obtain, over a period of time, statistical data on which to calculate their risk premiums. The company will use information collected on all insured perils, paying particular attention to the frequency of theft, subsidence, storm, flood, fire, burst pipes and accidental damage claims.

Other Household Insurance Rating Factors

Other information that might be used by the insurer in calculating the premium payable includes the:

- Type of property, e.g. a detached house, semi-detached etc

- Year of construction of the property

- Nature of the construction

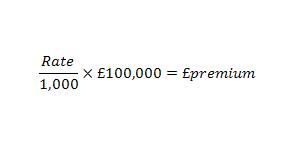

Premium Calculation for Standard Risks

Once the insurer has calculated the risk or pure premium, they will need to consider a number of factors so that they can calculate the final household insurance premium chargeable to the customer. For example:

- The contingency loading - The amount needed to cover the risk that the actual cost will exceed the expected cost.

- The expenses loading - The administration costs required to issue and service the policy.

- The commission loading - This will only be a consideration if the insurers pay commission as a means of selling their products.

- The profit loading - The amount needed to provide the required rate of return (profit).

Non-Standard Risks

Where the applicant wants to insure a non-standard household insurance risk, the underwriters will need to consider whether it is viable. To an extent, the insurer's willingness to take on that household insurance risk will depend on the company's risk appetite.